We have seen the US dollar advancing across the board, but this isn’t always really even.

What do the technicals say? The team at JP Morgan examines:

Here is their view, courtesy of eFXnews:

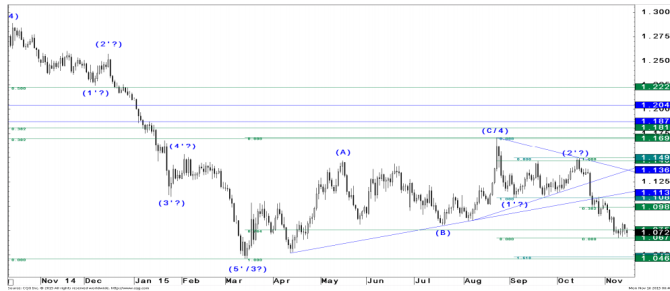

While risk markets are becoming increasingly vulnerable to a deeper setback we also saw the Euro coming under increased pressure last week, so that key supports are now at great risk of being broken in favor of a much deeper setback or the resumption of the long-term downtrend as being the case in EUR/USD, notes JP Morgan.

“The sell-off from the October high at 1.1496 in EUR/USD is clearly showing the characteristics of an internal 3rd wave decline so that the risk of having resumed the longterm downtrend to 1.0485/62 (wave 3 projection/2015 low) and possibly to 1.0072 (76.4 % of the 2000-2008 rally) remains high,” JPM projects.

“The idea of only performing a countertrend decline however persists as long as the 1.5 % tolerance zone of key-support at 1.0757 (int. 76.4 %) at 1.0596 is not broken on daily or weekly close. Above this support zone, we see good chances of at least performing an internal 4th wave recovery to 1.0989 (minor 38.2 %), but in order to support a broader recovery to 1.1811 (int. 76.4 %) it would take additional breaks above 1.1087 (pivot) and above 1.1133 (daily breakout line),” JPM argues.

Turning to GBP/USD, JPM notes that the market is making an attempt to escape the firm grip of the bears which however requires a decisive break and hourly close above the daily breakout line, cutting in a 1.5248 today.

“Below the latter, the risk of extending the downtrend towards the main support zone between 1.4951 and 1.4887 (pivot/int. 76.4 %) remains high.

Only above 1.5248 we’d see room for a stronger recovery to 1.5433 (daily trend), to 1.5534 (weekly trend) and possibly to the upper T-junctions at 1.5631 and at 1.5717 (int. 76.4 % on 2 scales),” JPM projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.