If more proof was needed, Draghi got it. Headline inflation remains unchanged at 0.1% and core inflation drops from 1.1% to 0.9%. Draghi’s words about the “weakening in the strengthening of core inflation” are now reflected in the numbers.

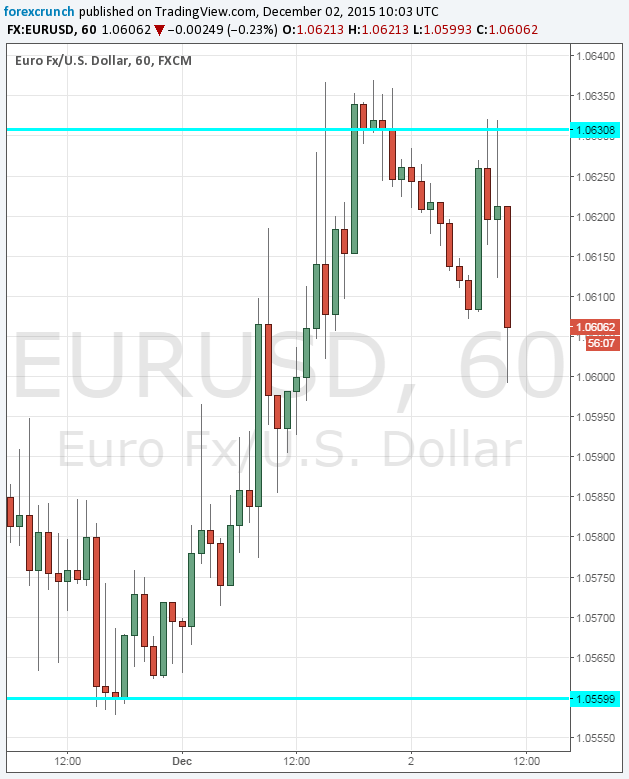

EUR/USD is falling to 1.06.

Producer prices dropped by 0.3%, exactly like last month and better than -0.4% expected. This is a monthly figure and does not provide the necessary silver lining. The data is weak.

All the updates for the ECB

Headline inflation in the euro-zone was expected to rise from 0.1% in October to 0.2% in the preliminary read for November. Core CPI carried expectations for a slide to 1% from 1.1% beforehand.

EUR/USD traded at 1.0620 towards the release, at the high end of the 1.0560 to 1.0630 range.

This is the last important release before tomorrow’s huge ECB decision. According to the recent data from the central bank, they are ready to act, and only a huge change could set them back.

The focus is on the deposit rate, the size of the QE program and forward guidance.

In this week’s podcast we guide you through the upcoming storm: ECB, NFP, OPEC and more