Dovish Draghi dragged down the euro, but what does it mean for the next move? Danske has a not-so-dovish scenario:

Here is their view, courtesy of eFXnews:

We expect the ECB to cut the deposit rate by an additional 10bp at the meeting in March while continuing with today’s reintroduction of its forward guidance that key policy rates will “remain at present or lower levels for an extended period of time”.

Over the next 6 months we look for a continued dovish ECB as headline inflation will head lower due to the base effects from the oil price decline. Hence, we expect for an additional extension of the QE programme on a 6-12m horizon.

The meeting today showed, the very low oil price and the risk of second-round effects are much more important to the ECB compared to the outlook for a tightening labour market, which eventually should put upward pressure on wages.

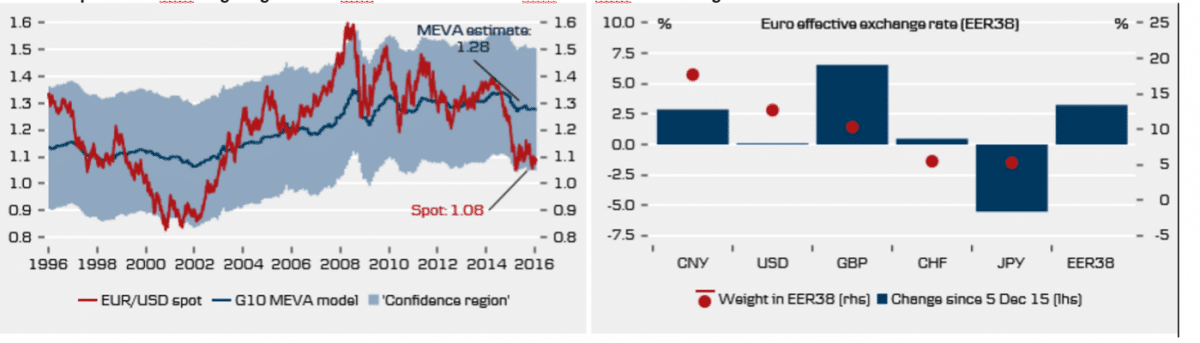

FX implications: EUR/USD still projected to go higher. With Draghi clearly hinting that the ECB could be first to ease among the major central banks following the latest market turmoil EUR/USD fell below 1.08. While we were surprised by Draghi’s rather dovish stance, we maintain that EUR/USD is caught in the 1.05-1.10 range near term and still project the cross at 1.06 in 1-3M: another 10bp cut is already priced, and a QE extension further out should not prove a major drag on EUR crosses given still stretched positioning short the single currency.

Notably, Fed has also been repriced recently in a more dovish direction (only one cut now priced this year) but without much effect on EUR/USD as a range of counteracting forces are keeping the cross afloat at present. Rather than ECB easing we stress that a key risk to our call for limited EUR/USD downside is that Fed will continue with rate hikes with a reference to the continued strength in US job creation while ECB stays in easing mode beyond H1. We still expect EUR/USD to go higher on 6-12m horizon A weaker CNY and USD will be negative to euro inflation.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.