China, the world’s largest economy and Australia’s No. 1 trade partner reported GDP growth of 6.7%, exactly as expected. The other figures already beat expectations and this is encouraging.

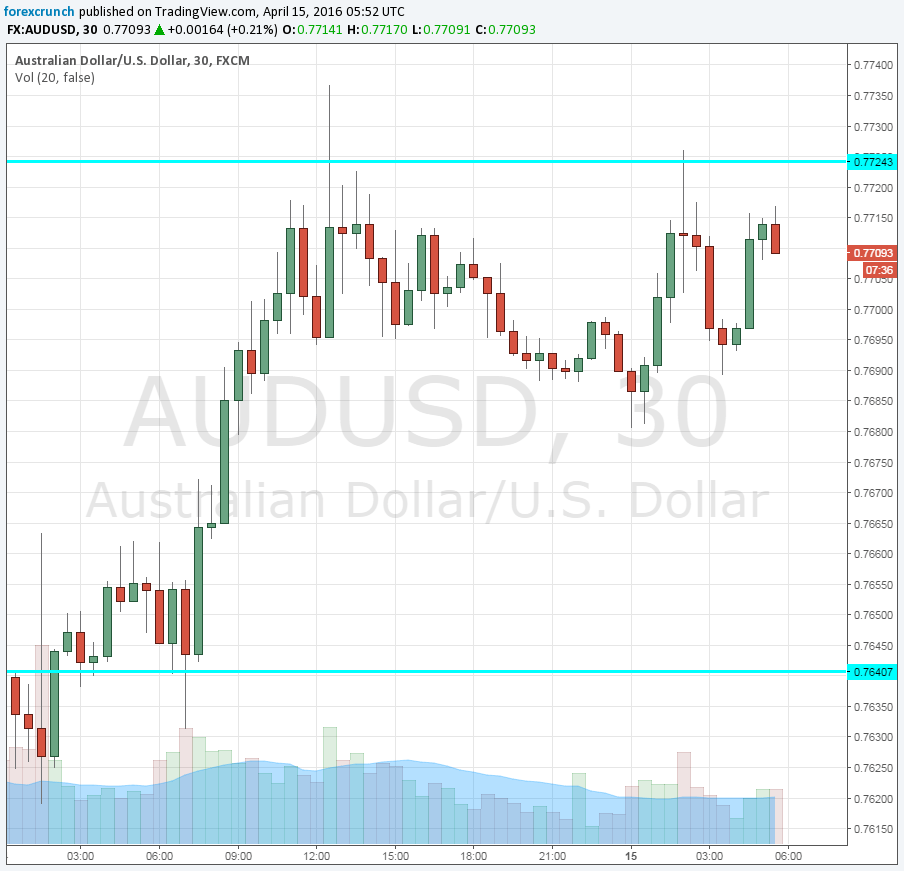

AUD/USD continues holding up above 0.77 and at the peak it climbed around the previous high of 0.7725. However, it was unable to break to even higher ground.

Industrial output advanced 6.8% y/y instead of 5.9% expected and 5.4% last time. Fixed Asset Investment is rising at a fast clip of 10.7% against 10.4% expected and 10.2% previously. And if China is re-balancing its economy towards consumption instead of manufacturing, one could be encouraged by a slightly better than expected retail sales advance of 10.5% instead of 10.4% expected and 10.2% seen previously.

The doubts comes from worries that the outcome is a result of excessive fiscal stimulus in addition to monetary stimulus, and that the Chinese economy cannot accelerate the growth on its own. Another worry comes from the impact of positive data: if things look good, there is no incentive to add more stimulus, and that could be negative.

Is this growth coming from the old engines such as easier credit and government stimulus? This remains an open question. There is some fear that the current lending is unsustainable. Expenses rose 20.1% in March against an income which is up 7.1% in the same month.

Here is the AUD/USD 30 minute chart. A rise to 0.7725 was the maximum the Australian dollar could do during the Asian session. Will European traders see the Chinese data with rosier glasses? Yesterday, the Aussie was more upbeat on its positive domestic jobs report.