Markets did not remain sleepy for too long: two poor US figures ended the new love markets had for the greenback against the majors, and the euro is taking advantage.

US industrial output dropped by 0.6%, worse than 0.1% expected. This is the hard data – not the survey data such as the Empire State Manufacturing Index. The accompanying Capacity Utilization Rate followed suit with a slide from 76.7% to 74.8%, also worse than expected.

And after retail sales disappointed earlier this week, also the forward looking consumer confidence is on the slide: the score of 89.7 is significantly below 91.9 points expected and 91 seen last time in the UoM survey. This is the weakest since September and does not bode well for the US economy in Q2, even though the actual correlation between sentiment and sales is questionable. Current conditions stand at 105.4 and expectations dropped from 81.5 to 79.6 points.

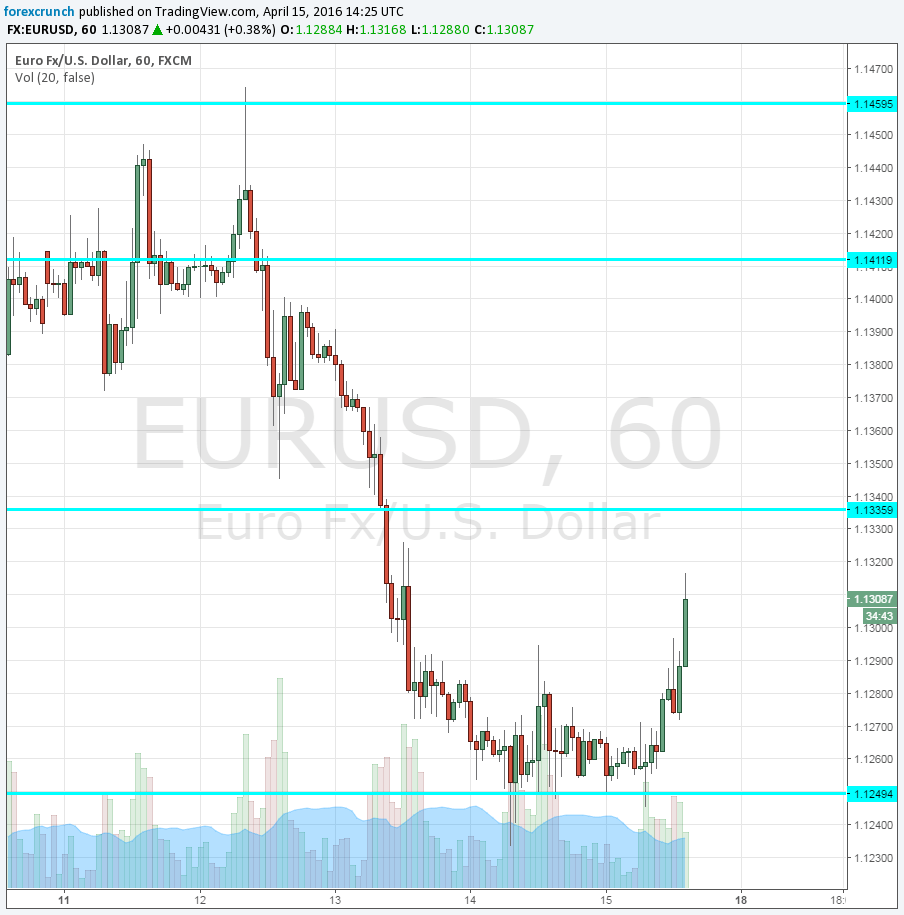

Here is how this move looks on the EUR/USD chart. Resistance awaits at 1.1335, which was the bottom of the previous 1.1335 to 1.1460 range the pair was stuck in for quite some time.

Support awaits at 1.1250, which cushioned the pair now and also in the past.

The US dollar is also losing ground against the Japanese yen, with Dollar/yen sliding below 113. The next big event is the Doha summit: will OPEC and Non-OPEC members reach a Doha Deal? A fall in oil prices could boost the Japanese yen against the Canadian dollar.