The Fed said its word: on one hand it did acknowledge some improvement in the global economy but without any hints of hikes, the dollar fell. What’s next for the greenback especially in comparison to the common currency?

Here is their view, courtesy of eFXnews:

The FOMC made only incremental changes to its policy statement on Wednesday, leaving forward guidance unchanged. The statement signalled a reduction in concerns relating to the external environment, with language about global economic and financial risks dropped.

However, the statement also acknowledged that, while labour market conditions and household real income have improved further, overall activity and household spending appear to have moderated. Overall, the mixed message has done little to shift the market towards increased pricing for a near-term resumption of Fed hikes.

The Fed’s continued willingness to signal steady policy even as the risk environment and inflation expectations improve leaves the USD vulnerable, particularly vs. the current account surplus currencies.

We continue to think that near-term momentum in economic activity and uncertainty will keep the Fed on hold for some time. In our view, the Fed is likely to keep rates on hold throughout 2016 and 2017.

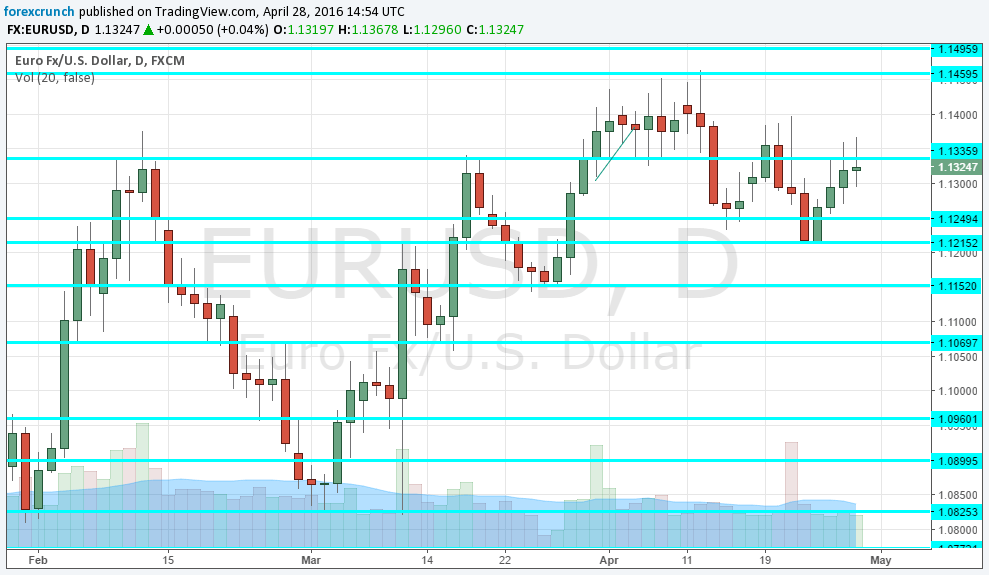

We remain long EURUSD.

*BNPP maintains a long EUR/USD from 1.1290 targeting a move to 1.16, with a stop at 1.1140.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.