The US Non-Farm Payrolls report for July is eyed: will it follow the firm report of June or the terrible one seen in May? Here are previews from Barclays, Deutsche Bank and Bank of America Merrill Lynch:

Here is their view, courtesy of eFXnews:

Expect USD Gains Across The Board On A 200K NFP – Barclays

Despite the headline disappointment in GDP last week, we think that the breakdown was not as bad as the figure would suggest. Although the investment picture was worse than expected, inventories tend to be very volatile, while consumers are continuing showing a robust demand.

The NFP report should take centre stage because if labor markets confirm that job creation pace continues to be around 175k, a September hike would be likely again. Currently, the fed funds market only prices a 22% probability of a hike in September and 36% for December.

In this regard, we expect a job creation of 200k, which should support the USD across the board.

Elsewhere in the report, we expect the unemployment rate to decline by one-tenth to 4.8%, for average hourly earnings to rise by 0.3% m/m (2.6% y/y), and for average weekly hours to hold steady at 34.4.

USD Into NFP – BofA Merrill

Nonfarm payroll growth likely slowed to a still healthy 165,000 for the month of July, down from the robust 287,000 clip in June. Our forecast would leave the 3-mo moving average at 154,000, indicating progress in the labor market, albeit at a slower pace. Recent low readings for initial jobless claims and the improvement in the conference board labor differential (jobs plentiful – hard to get) are supportive. Looking at the various goods sectors, we expect a rebound in construction jobs, supported by momentum in the housing market, while mining and manufacturing should remain soft. Services sector hiring likely remained solid. The recent volatility in the nonfarm payrolls data has been unusual. Part of the big swing from May to June owed to the end of the Verizon strike. There was also a 5-week gap between survey periods, which is perceived to create an upward bias. In a prior analysis, we found a small difference supporting the claim, but it was not statistically significant. In our view, the strong June reading was primarily a positive payback after abysmal job growth in May, and we should see a return to a more sustainable clip this month.

We anticipate no change in the unemployment rate at 4.9%. The risk is that we see further recovery in labor force participation, which increased to 62.7% from 62.6% in the last report, thereby putting upward pressure on the unemployment rate. We also think we are due for stronger growth in household jobs given the last few months of weak readings. Average hourly earnings should rise 0.3% mom in July, accelerating from 0.1% in June. Yoy wage growth would be unchanged at 2.6%.

FX: Fed cautious optimism USD-supportive, helped by overseas easing

The Fed’s incremental confidence in the July FOMC statement will contribute to protect but not extend dollar gains since the June meeting, in our view. The diminished risks the Committee sees and improved commentary on the economic outlook suggests September remains a live meeting in contrast to market pricing. While the USD sold off in the wake of the statement, we think the USD will continue to be supported with the market underpricing the risk of a September hike, assuming global financial conditions remain subdued. The coming two employment reports will be crucial in this regard.

The healthy 165,000 print we see in this week’s report will leave the 3mma at a still robust 154,000. Combined with a stable unemployment rate and robust 0.3% average hourly earnings, the report will confirm the Fed’s view that continued labor market tightening supports gradual policy normalization. The USD will respond positively with the market currently pricing a 20% chance of a September hike.

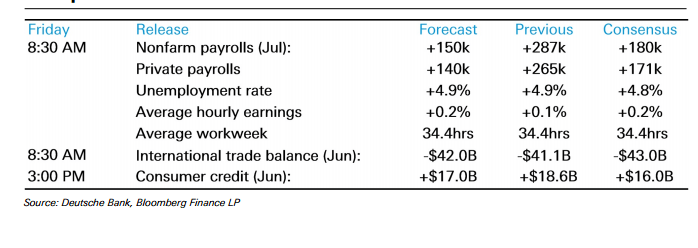

Preview: US: July NFP – Deutsche Bank

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.