AUD/USD was almost unchanged this week, as the pair closed just above the 0.76 line. There are eight events this week. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

The Australian dollar gained ground after the RBA cut rates to 1.50% in a widely-expected move. AUD/USD ended the week with losses, as US Nonfarm Payrolls gained 255K jobs and wage growth also improved.

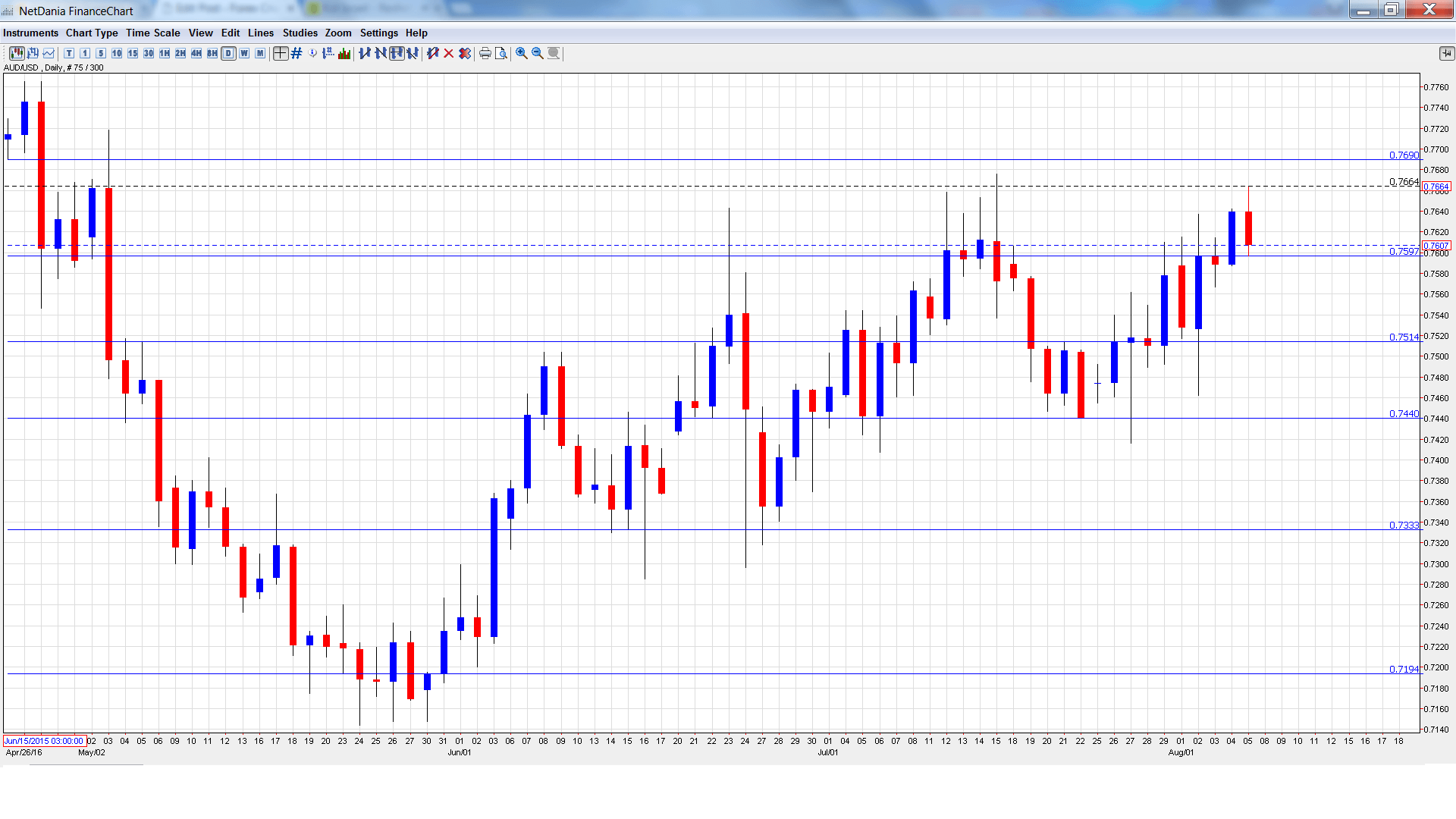

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD graph with support and resistance lines on it. Click to enlarge:

- ANZ Job Advertisements: Monday, 1:30. This indicator is an important gauge of the strength of the Australian labor market. In June, the indicator climbed 0.5%, a much softer reading than the 2.4% gain a month earlier. Will the indicator remain in positive territory in the upcoming release?

- Chinese Trade Balance: Monday, Tentative. Chinese key indicators can have a significant impact on AUD/USD, as China is Australia’s largest trading partner. The trade surplus dropped to 311 billion dollars in June, shy of the forecast of 320 billion dollars. The estimate for the July release stands at 313 billion dollars.

- NAB Business Confidence: Tuesday, 1:30. The indicator improved to plus 6 points in June, up from plus 3 a month earlier. This marked the strongest reading in 3 months.

- Westpac Consumer Sentiment: Wednesday, 00:30. Consumer confidence is closely linked to consumer spending, which is a key driver of economic growth. The indicator has struggled, posting only two gains in 2016. In July, the indicator posted a sharp decline of 3.0%? Will we see a rebound in the August release?

- Home Loans: Wednesday, 1:30. Home Loans dropped 1.0% in June, but this was better than the estimate of -1.9%. The markets are expecting a strong turnaround in the July release, with the estimate standing at +2.4%.

- RBA Governor Glenn Stevens Speaks: Wednesday, 3:05. Stevens will speak at an event in Sydney. The markets will be listening carefully, looking for clues about another rate cut.

- MI Inflation Expectations: Thursday, 1:00. This indicator, released monthly, helps analysts track CPI, which is released each quarter.

- Chinese Industrial Production: Friday, 2:00. Industrial Production improved to 6.2% in June, beating the forecast of 5.9%. Another reading of 6.2% is anticipated in the July report.

* All times are GMT

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7587 and dropped to a low of 0.7462. The pair then reversed directions and climbed to a high of 0.7664, breaking above resistance at 0.7597 (discussed last week). AUD/USD closed the week at 0.7607.

Live chart of AUD/USD: [do action=”tradingviews” pair=”AUDUSD” interval=”60″/]

Technical lines from top to bottom:

We start with resistance at 0.7938.

0.7835 has provided resistance since April.

0.7692 is protecting the 0.77 line.

0.7597 continues to be busy and has switched a support role. It is a weak line.

0.7513 was a cap in May and June.

0.7438 is providing support.

0.7334 was a cap in December 2015.

0.7192 is the final support level for now.

I am bearish on AUD/USD

The RBA cut rates last week and more easing could be in the pipeline if inflation levels don’t move higher. With the Fed moving in the opposite direction and considering a rate hike, monetary divergence favors the US dollar.

Our latest podcast is titled Carney King of Governors, Small in Japan

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.