AUD/USD was almost unchanged this week, as the pair closed at 0.7637. This week’s highlight is Employment Change. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

Australian business and consumer confidence numbers were solid. However, the Aussie lost ground late in the week as soft retail sales and wholesale prices in the US reduced the appetite for risk.

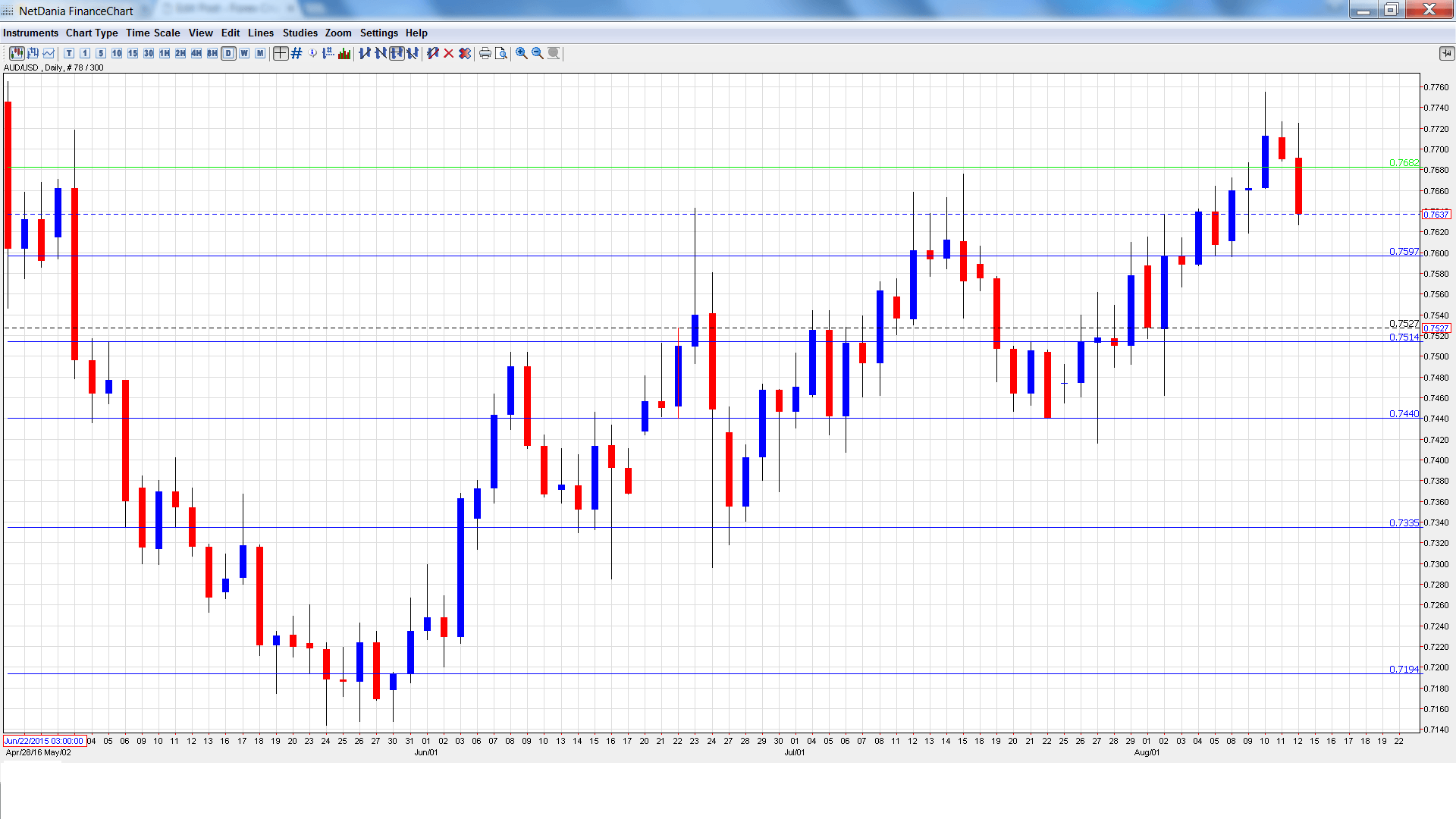

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD graph with support and resistance lines on it. Click to enlarge:

- RBA Monetary Policy Meeting Minutes: Monday, 1:30. The minutes provide details of the RBA’s policy meeting earlier this month. The markets will be looking for any hints of plans to further reduce interest rates.

- MI Leading Index: Wednesday, 00:30. This index is based on 9 economic indicators, but is of minor significance, as most of the data has been previously released. The indicator declined by 0.2% in July, marking a 4-month low. Will the August reading climb into positive territory?

- Wage Price Index: Wednesday, 1:30. This indicator, released each quarter, is a leading indicator of consumer inflation. In the second quarter, the index dipped to 0.4%, down from 0.5% in Q1. Little change is expected in the Q2 report.

- Employment Change: Thursday, 1:30. The June report dropped to 7.9 thousand, short of expectations. This was the weakest reading in 4 months. The indicator is expected to improve in July, with an estimate of 10.2 thousand. The unemployment rate edged higher to 5.8% in June, matching the forecast. No change is expected in the July release.

* All times are GMT

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7611 and quickly dropped to a low of 0.7596, testing support at 0.7797 (discussed last week). The pair then reversed directions and climbed to a high of 0.7755. AUD/USD closed the week at 0.7637.

Live chart of AUD/USD: [do action=”tradingviews” pair=”AUDUSD” interval=”60″/]

Technical lines from top to bottom:

We start with resistance at 0.8025.

0.7938 is next.

0.7835 has provided resistance since April.

0.7682 is an immediate resistance line.

0.7597 continues to be busy and is a weak support line. It could see further action early in the week.

0.7513 was a cap in May and June.

0.7438 is the next support line.

0.7334 was a cap in December 2015.

0.7192 is the final support level for now.

I am bearish on AUD/USD

A September rate hike in the US is likely off the table. However, with the RBA in an easing stance, even after the recent rate cut, monetary divergence continues to favor the greenback. As well, the US economy is stronger than Australia’s, despite the US retail sales hiccup late last week.

Our latest podcast is titled Carney King of Governors, Small in Japan

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.