The New Zealand dollar kept on struggling. Milk prices stand out this week. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

Terms of trade in New Zealand fell by 2.1%, worse than expected, but that did not hurt the currency too much. The kiwi remained under pressure from the strength of the US dollar, which enjoyed the echoes from Jackson Hole in the previous week. NZD/USD eventually took advantage of the poor US NFP to end the week higher.

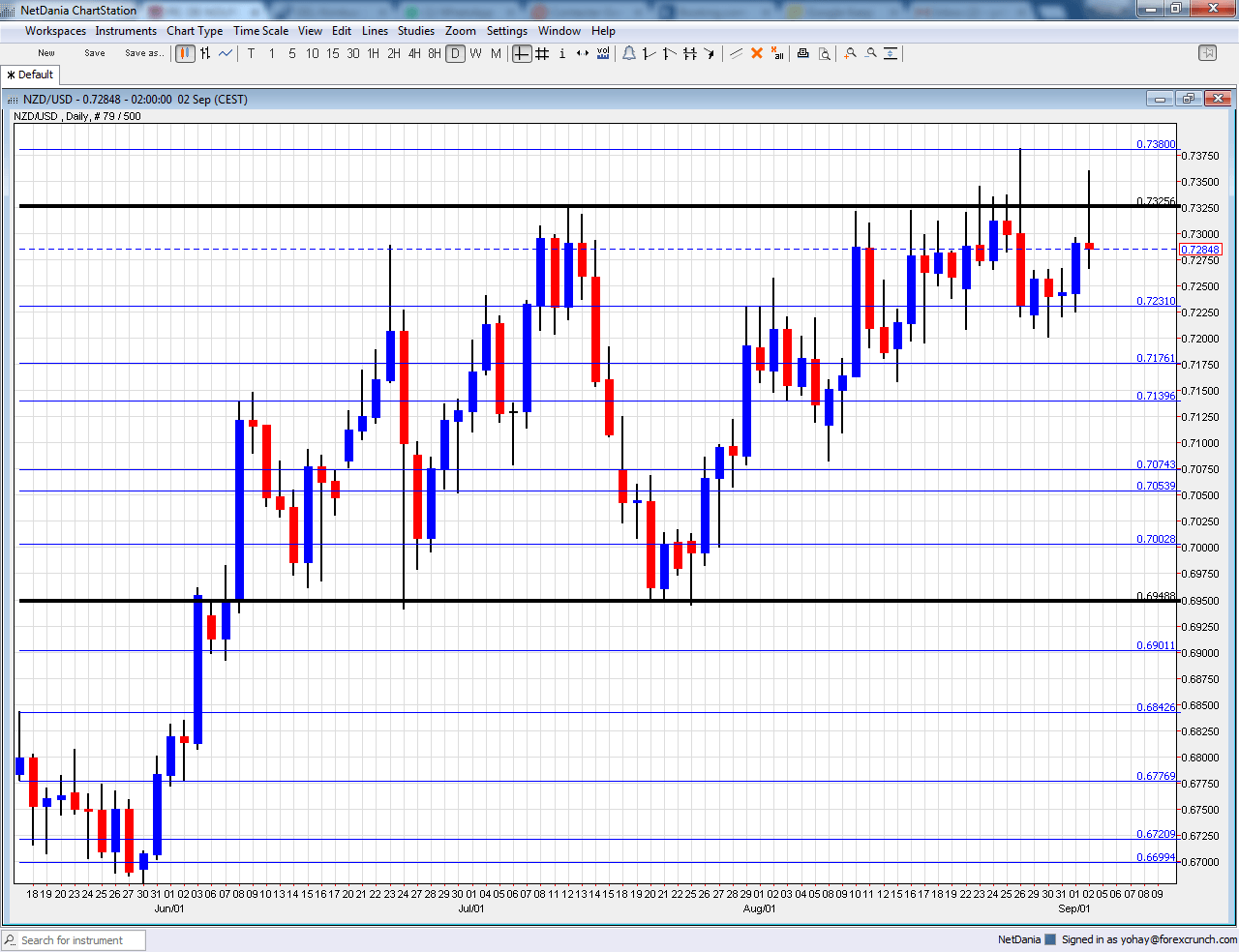

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- ANZ Commodity Prices: Monday, 1:00. Commodity prices are key to New Zealand, which exports agricultural soft commodities. According to this measure of commodities by ANZ, prices advanced by 2% in July. We now get the prices for August.

- GDT Price Index: Tuesday, during the European afternoon. The Global Dairy Trade is currently the dominant publication of commodity prices, at least in terms of NZD movement. The bi-weekly release leaped by 12.7%, well above the shallow changes seen beforehand. Will we now see a slide?

- Manufacturing Sales: Tuesday, 22:45. This quarterly measure by the government has dropped in both Q1 2016 and Q4 2015. It shows that the manufacturing sector is not at its best. A rise could be seen now.

NZD/USD Technical Analysis

Kiwi/dollar made an attempt to rise above resistance at 0.7330 mentioned last week but fell back down.

Technical lines, from top to bottom:

The round number of 0.74 served as resistance and support back in 2015. 0.7330 is the high of 2016 so far.

0.7290 was the pre-Brexit peak and serves as high resistance. The next line is 0.7240 which capped the pair in July 2016.

0.7160 worked as support when the kiwi was trading on the much higher ground in 2014. 0.7050 was the peak in April 2015.

The round level of 0.70 is still important because of its roundness but it isn’t really strong. The low of 0.6940 allowed for a temporary bounce.

The round 0.69 level has switched positions to resistance. 0.6840 capped the pair during May 2016 and tops the range. 0.6720 is the low seen in May 2016 more than once providing the lower bound.

The round level of 0.67 that works nicely as support. Another line worth noting is 0.6640, which capped the pair in November.

I am neutral on NZD/USD

While there are reasons to like the New Zealand economy, the pair struggles to rise and could remain balanced once again.

Our latest podcast is titled Time to inflate inflation targeting and the suspicious oil rally