The New Zealand dollar suffered the might of the USD following the hawkish hike from the FED but managed to weather some of the storms. The week leading to Christmas is packed with events from New Zealand. GDP and the milk auction stand out. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

The Federal Reserve not only raised rates but hinted at a more aggressive path for hikes in 2017. This sent the US dollar soaring. The kiwi fell to 0.70 before bouncing. In New Zealand, visitor arrivals rose by 2.2% in October, but the Business NZ Manufacturing Index slipped to 54.4 points.

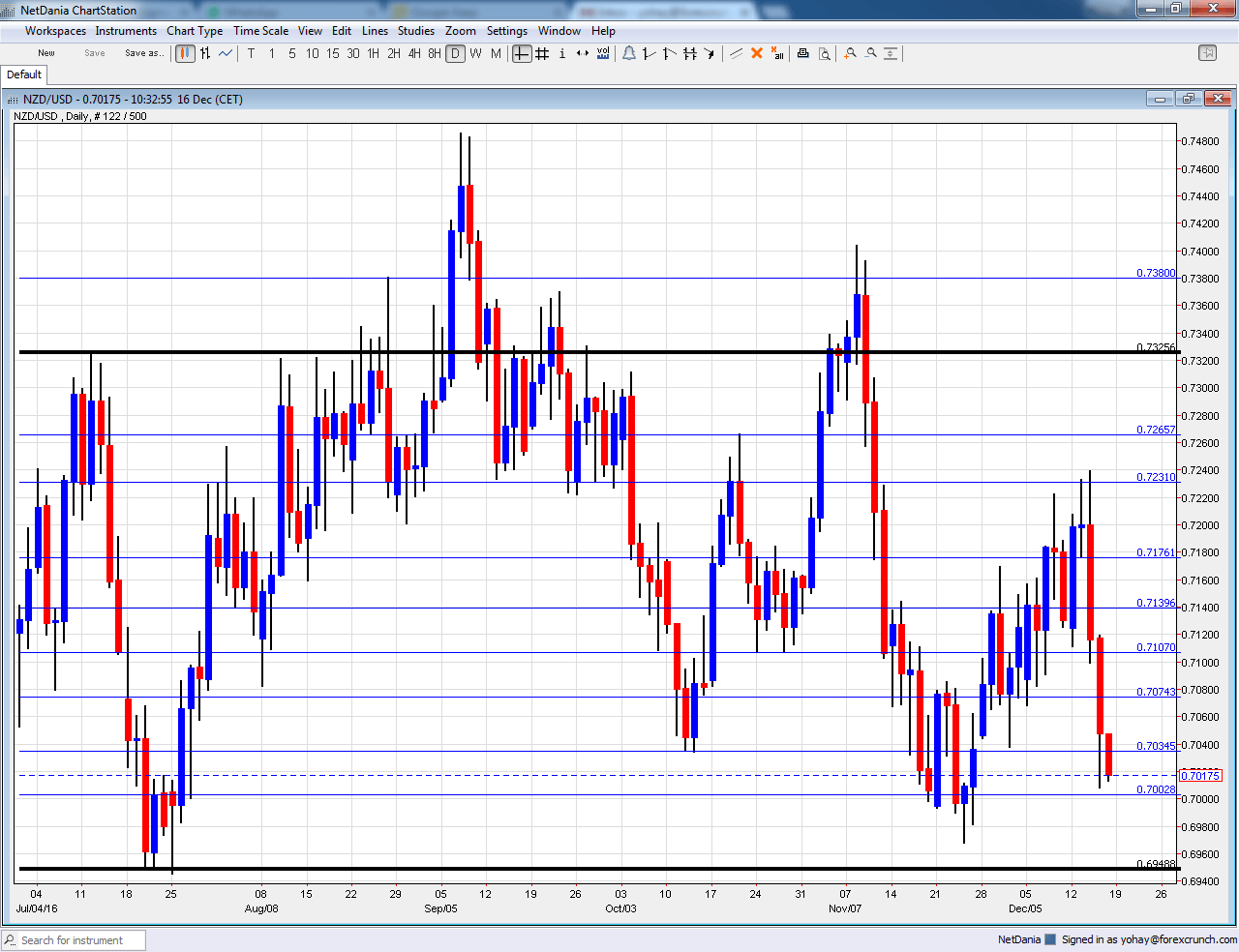

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Westpac Consumer Sentiment: Sunday, 21:00. This survey of 1500 consumers stood on 108 points in Q3, an increase from Q2. A similar figure is on the cards now.

- Building Consents: Sunday, 21:45. This gauge of the housing sector was remarkably stable previously, rising by only 0.2%. This usually volatile indicator could show a bigger move this time.

- ANZ Business Confidence: Monday, 00:00. This indicator of business confidence slipped in the past two months, hitting 20.5 points.

- FPI: Monday, 21:45. The Food Price Index dropped by 0.8% last time, causing some worries. A bounce could be seen now. New Zealand relies on exports of food produce, most notably dairy products.

- GDT Price Index: Tuesday, during the European afternoon. The bi-weekly Global Dairy Trade enjoyed four consecutive rises, keeping the NZD bid. Will it rise for the fifth time? A slide will not be surprising at this point.

- Trade Balance: Tuesday, 21:45. After its deficit ballooned earlier in the year, the much-needed squeeze to a deficit of 846 million NZD was good news for the kiwi. We now get data for November.

- Visitor Arrivals: Tuesday, 21:45. For the second week in a row, we get visitor arrival data, this time for November. Another rise could follow the 2.2% advance seen in October and reported late.

- Credit Card Spending; Wednesday, 2:00. With retail sales figures officially released only once per quarter, this measure of plastic card usage serves a snapshot gauge of consumer activity. A year over year leap of 10.2% was seen beforehand, and some form of cooling down could be seen now.

- GDP: Wednesday, 21:45. New Zealand releases only one and final GDP read, coming a bit late. The economy advanced by 0.9% in Q2, a very robust rate of growth. Somewhat slower growth could be reported now.

- Current Account: Wednesday, 21:45. Similar to the narrower trade balance figure, New Zealand’s current account suffered a deficit in Q2, of 950 million NZD. Another deficit is predicted.

NZD/USD Technical Analysis

Kiwi/dollar made an initial attempt to move higher but stalled around the 0.7230 level (discussed last week). It then turned south, finding some support around 0.70.

Technical lines, from top to bottom:

The round number of 0.74 served as resistance and support back in 2015. 0.7330 was an initial high in 2016.

0.7265 was a swing high in October 2016 and works as resistance. 0.7230 served as support in September 2016.

0.7160 is a pivotal line within the range. 0.7140 worked in both directions in the past months.

0.71, a round number, was a double bottom in October. 0.7075 was a swing low in August and had a role afterward as well. It is followed by 0.7035, the low seen in October 2016.

The round level of 0.70 is still important because of its roundness but it isn’t really strong. The low of 0.6940 allowed for a temporary bounce.

I am neutral on NZD/USD

The FED raised rated and went hawkish, but the kiwi did not collapse like the euro and the yen. Moving into Christmas, the pair could be well balanced.

Our latest podcast is titled The FED and the Road Ahead

Follow us on Sticher or iTunes

Safe trading!