The New Zealand dollar had a mixed week. Three events are scheduled for the last week of March. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

Building consents leaped by 14%, a jump that is extreme even for this volatile indicator. However, the ANZ Business Confidence slipped to 11.3 points. The US dollar struggled after Trump’s health-care failure and as the Federal Reserve remained dovish.

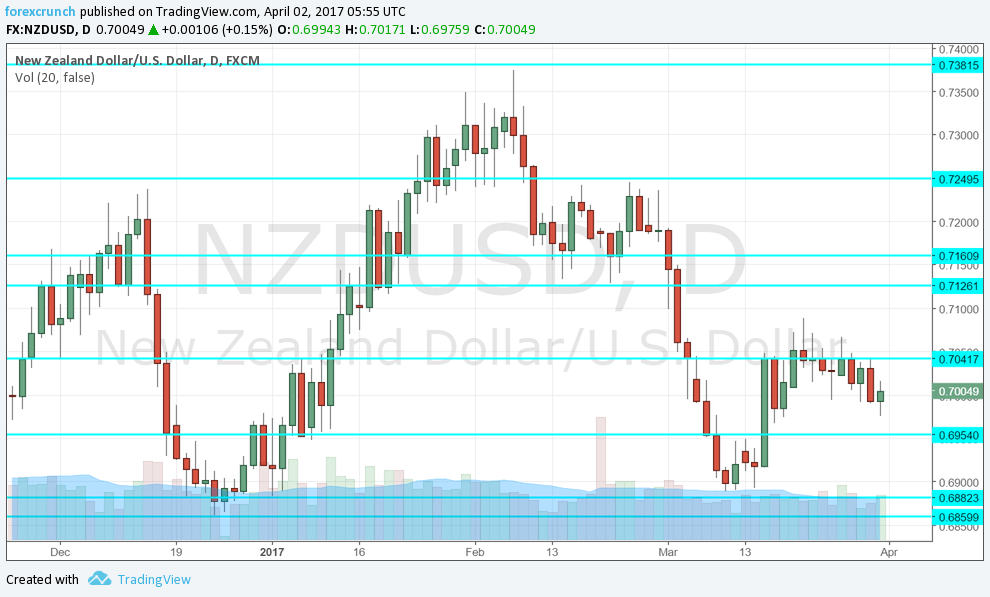

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- NZIER Business Confidence: Monday, 22:00. This survey of 2500 businesses has shown another advance in confidence among kiwi businessmen, with a score of 28 in Q4 2016. We now get the fresh figures for Q1 2017.

- GDT Price Index: Tuesday, during the European afternoon. The Global Dairy Trade reflects prices in New Zealand’s most important export: milk. After a series of falls, prices bounced back and rose by 1.7% in the previous bi-weekly auction.

- ANZ Commodity Prices: Wednesday, 1:00. This measure of commodity prices advanced by a solid 2% back in February. A more modest growth rate is on the cards now.

* All times are GMT

NZD/USD Technical Analysis

Kiwi/dollar hugged the 0.70 level (mentioned last week).

Technical lines, from top to bottom:

0.7380 was the high recorded back in February and is our top line for now. Below, we find 0.7250, which capped the pair back twice in mid-February and serves as a double top.

0.7160, which capped the pair back in November is a pivotal line within the range. 0.7125 worked as a double bottom before it collapsed in early March.

0.7050 served as resistance during the month of March. The very round number of 0.70 is a battle zone. Further below, 0.6960 worked as support in November and then in January once again.

Further below, 0.6960 worked as support in November and then in January once again. The round number of 0.69 is weak support and it is followed by 0.6865.

I am bullish on NZD/USD

The worst for the kiwi may be behind us, with the price already reflecting the weaker growth rate. Yet for the US dollar, we could see further falls.

Our latest podcast is titled Brexit Bad and “Clean Coal”

Follow us on Sticher or iTunes

Safe trading!