- Housing Starts: Monday, 12:15. This indicator provides a gauge of the health of the housing sector. In February, the indicator edged higher to 210 thousand, above the forecast of 205 thousand. The upward trend is expected to continue, with an estimate of 212 thousand.

- BoC Monetary Policy Report: Wednesday, 14:00. The BoC releases this report each quarter. The report details the central bank’s view of economic conditions and inflation and could provide hints as to future monetary policy. A press conference hosted by BoC Governor Stephen Poloz will follow.

- BoC Overnight Rate: Wednesday, 14:00. The BoC benchmark rate has been pegged at 0.50% since July 2015 and no change is expected this week, when the BoC releases its rate statement.

- Manufacturing Sales: Thursday, 12:30. This key indicator softened in January to 0.6%, within expectations. The markets are braced for a decline in February, with an estimate of -0.4%.

- NHPI: Thursday, 12:30. This important housing indicator has posted small gains in recent months. It gained 0.1% in January, matching the forecast. The February report stands at 0.2%.

* All times are GMT

USD/CAD Technical Analysis

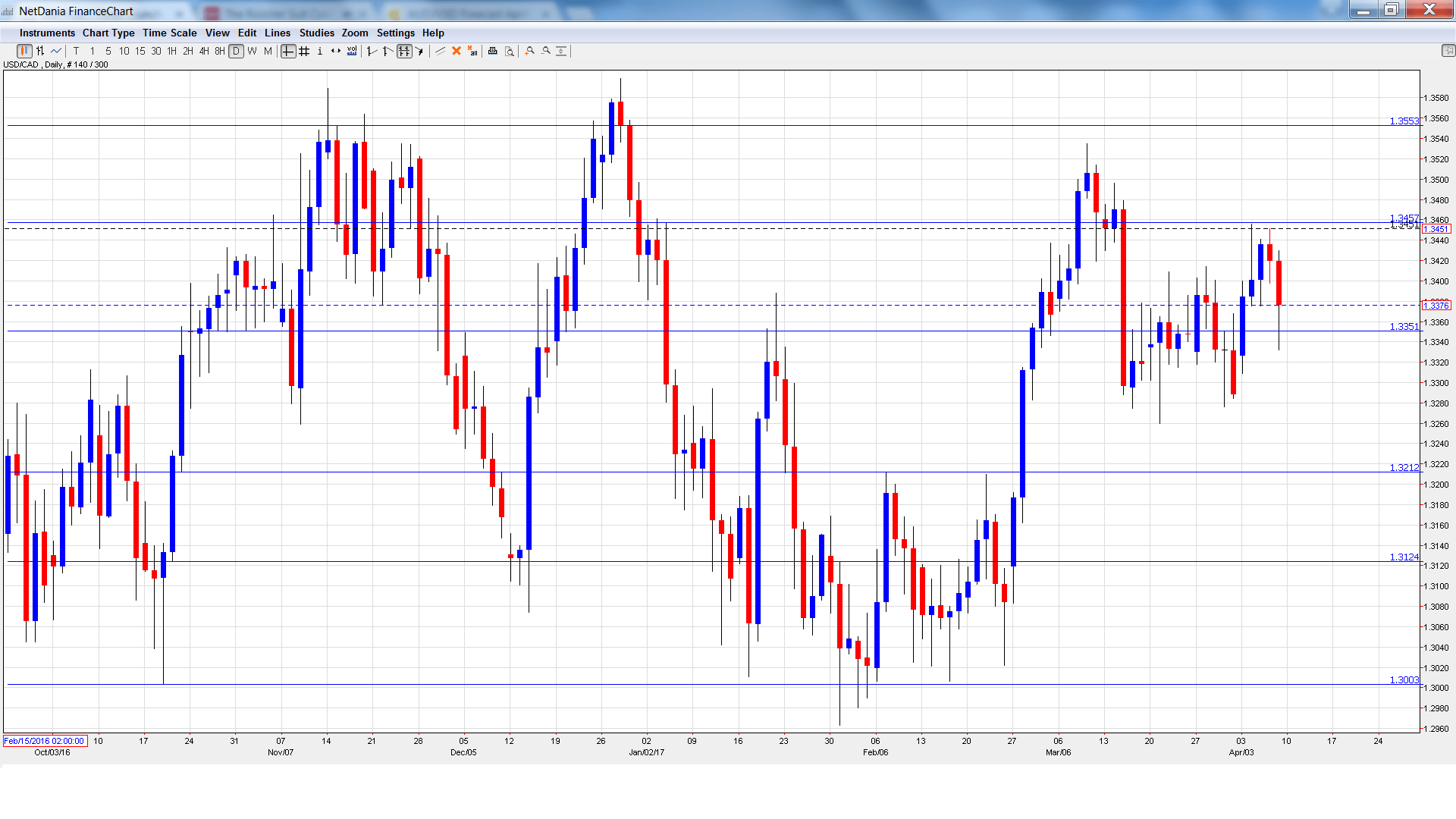

USD/CAD opened the week at 1.3326 and dropped to a low of 1.3309. The pair then reversed directions and climbed to a high of 1.3456 late in the week, as resistance held at 1.3457 (discussed last week). USD/CAD could not consolidate at these levels and closed the week at 1.3376.

Technical lines, from top to bottom

We start with resistance at 1.3757.

1.3648 was an important support level in February.

1.3551 is the next line of resistance.

1.3457 was a high point in September 2015.

1.3351 has switched to a support role. It is a weak line and could see more action early in the week.

1.3212 is providing support. It was a cap in the second quarter of 2016.

1.3124 is the next support level.

1.3003 is protecting the symbolic 1.30 level.

1.2908 is the final support level for now.

I am bullish on USD/CAD

The US economy continues to expand and the Federal Reserve is likely to raise rates another quarter-point in June. Despite the unpredictability of Donald Trump, sentiment continues to favor the US dollar.

Our latest podcast is titled Brexit Bad and “Clean Coal”

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.