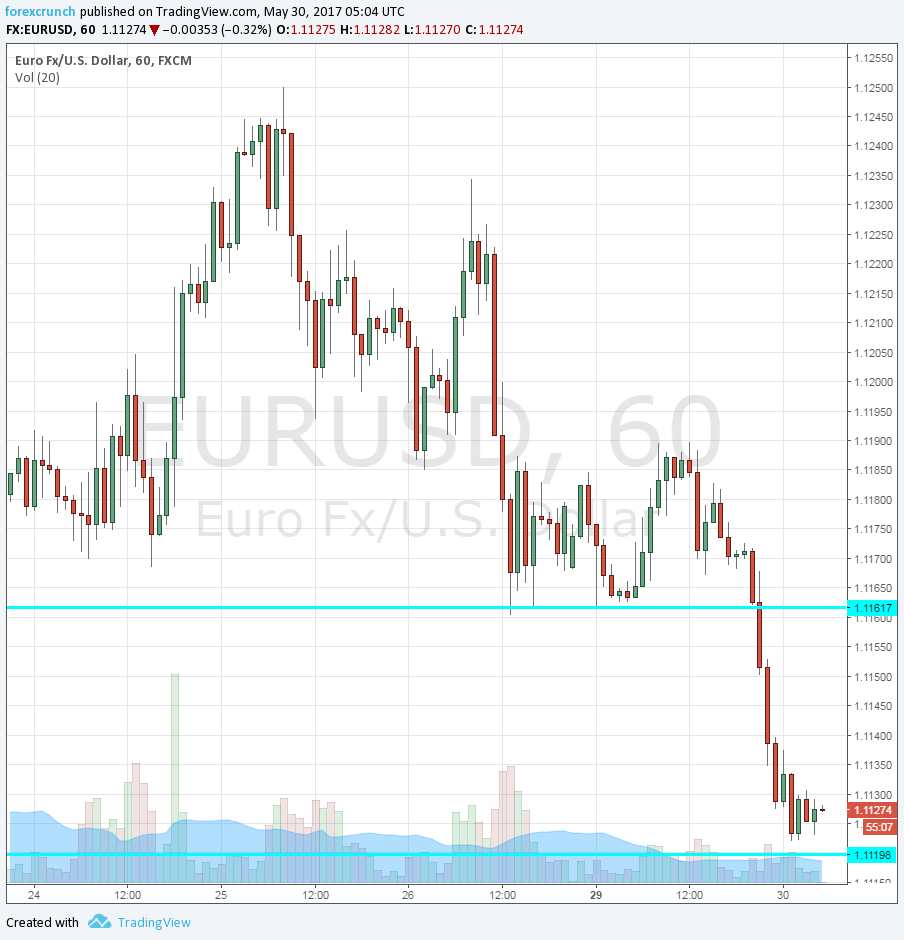

EUR/USD is clinging to support at 1.1120, but only just. This is one leg lower from the previous support line of 1.1160 and almost 150 lows from the cycle of 1.1266.

1.1120 worked as support back in October 2016 and returns to its old role. Further support awaits at 1.1050, followed by 1.0950, which was the initial post-French elections high.

Draghi drag

The President of the ECB initially provided optimistic words. He saw the glass half-full by saying that downside risks have diminished and said that gorwth has become more broad-based.

However, the tone was already different in the Q&A session. The Italian central banker said that extraordinary support from monetary policy is still needed. This is not really new but the emphasis contrasted the optimism about growth.

In addition, Draghi reiterated that inflation is still subdued and also mentioned wage growth. So far, wages did not seem to be on the radar of the ECB, but they now feature as an important talking point.

Is Greece back?

The debt-stricken country has been far from the headlines. Long gone are the days when Greece was left, right and center. Away from the limelight, Greece has fulfilled the demands from the creditors, passing yet another round of austerity in the parliament.

However, the current problems stem from the creditors. The IMF demands debt relief for Greece and the EU, led by Germany, refuses. From the outset of the third bailout signed back in the summer of 2015, there were doubts about the participation of the Fund.

The latest news comes from Greece, among the tussling of the creditors. The German tabloid Bild reports that the Greek government may just say no to the next tranche of the bailout funds. Without debt relief, Greece will not accept the bailout money to pay back the debt.

More: EUR/USD: Running Ahead Of Yields; M/T Buy, S/T Buy-On-Dips – SocGen

EUR/USD chart – click to enlarge: