The US jobs report beat on the headline, 209K and on wages y/y: 2.5%, even though it does not represent any real improvement. The economy continues gaining jobs but the elusive “full employment” stamp still seems far. Employers are not raising wages. Without wage growth, it is hard to see inflation rising and the Fed hiking rates.

Nevertheless, this allowed the dollar some room for recovery after a long period of falls that were the result of political turmoil, uncertainty about the Fed and also mixed data.

Update: the dollar strength is also related to Gary Cohn talking about tax reform, something markets want to hear.

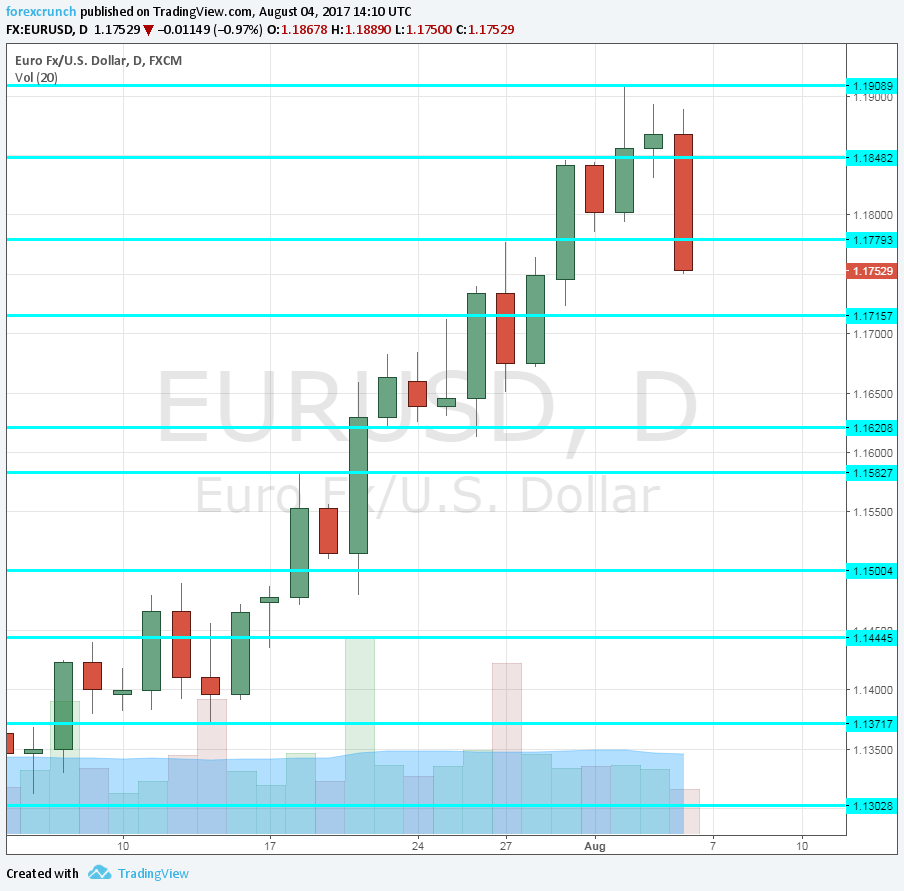

EUR/USD initially dropped from 1.1870 to 1.1825 but recovered. However, the Bears gathered and now the drop is worth over 100 pips. Finally, the pair is correcting.

EUR/USD drops to a low of 1.1750. This is still above the 2015 high of 1.1712, which serves as the next level of support. This is followed by 1.1620 and 1.1580. Resistance awaits at 1.1840, which was a temporary top. The pair struggled with the 1.19 level, which it managed to top only temporarily.

Here are reasons to buy and sell the euro:

Here is how it looks on the daily chart. Note that the pair has been on the up and up and this is the largest daily drop in quite a while: