Dollar/CAD was stable during most of the week but eventually moved a bit higher. The upcoming week begins with Canada’s Thanksgiving holiday and then the focus is on housing data. Here are the highlights and an updated technical analysis for USD/CAD.

Canada gained slightly fewer jobs than expected, but the unemployment rate remained stable and the rise of full-time jobs served as a silver lining. Oil prices reversed their previous gains and put some pressure on the loonie. In the US, the economy looks good but perhaps harder to determine as the hurricanes skewed the jobs report. he loonie seemed to have already consolidated its losses.

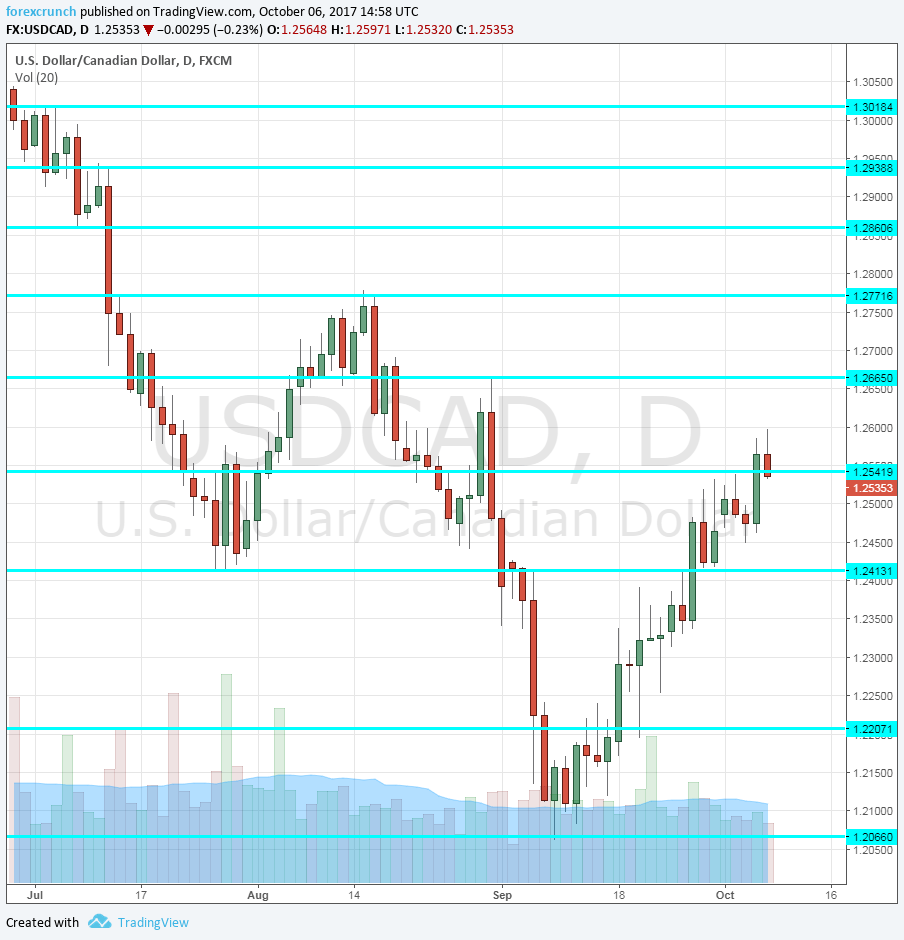

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Housing Starts: Tuesday, 12:15. The Canadian housing market has been turbulent, especially in Toronto and Vancouver. Nevertheless, housing starts beat expectations in August, rising to 223K instead of an expected fall. We now get the figures for September.

- Building Permits: Tuesday, 12:30. The number of building permits dropped by 3.5% in July, but it came after three months of gains. The number of approvals is quite volatile in Canada.

- Carolyn Wilkins talks: Tuesday, 18:00 and Thursday, 19:15. The senior deputy governor of the Bank of Canada was the first official to hint about rate hikes a few months ago. She will be speaking at the IMF conference and could provide hints about the next moves in markets.

- NHPI: Thursday, 12:30. The New Housing Price Index surprised with a rise of 0.4% in July. All in all, house prices continue rising in Canada despite the moves from the regional governments of British Columbia and Ontario. An increase of 0.3% is on the cards now.

* All times are GMT

USD/CAD Technical Analysis

Dollar/CAD traded above the 1.2410 level (discussed last week) and stuck to a narrow range.

Technical lines from top to bottom:

1.2770 capped a recovery attempt in August and is our top line for now. 1.2665 was a swing high of a move higher in early September.

1.2540 capped the pair in early October when it traded in a narrow range. 1.2410 held the pair cushioned for some time but was eventually broken. 1.22 is a round number and also worked as support a few years ago.

1.22 is a round number and also worked as support a few years ago. 1.2065 is the (current) swing low of September 2017. It is followed by the obvious level of 1.20.

I am neutral on USD/CAD

The jobs reports from the US and Canada left something for everyone. In addition, the holidays early in the week could serve to keep things balanced.

Our latest podcast is titled Good, bad and ugly NFP, Catalan crisis update

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!