Disappointing US inflation figures: CPI and core CPI both miss expectations and monthly and yearly figures. Core CPI y/y failed to rise and remains stuck at 1.7%. Will the Fed reconsider the planned December hike? Retail sales data were not too bad, but not inspiring enough to mitigate the big thing: weak inflation.

We wrote that weak inflation could hit the dollar and indeed: the US dollar is falling across the board.

Here are the currency reactions, followed by the full data.

Currency reaction

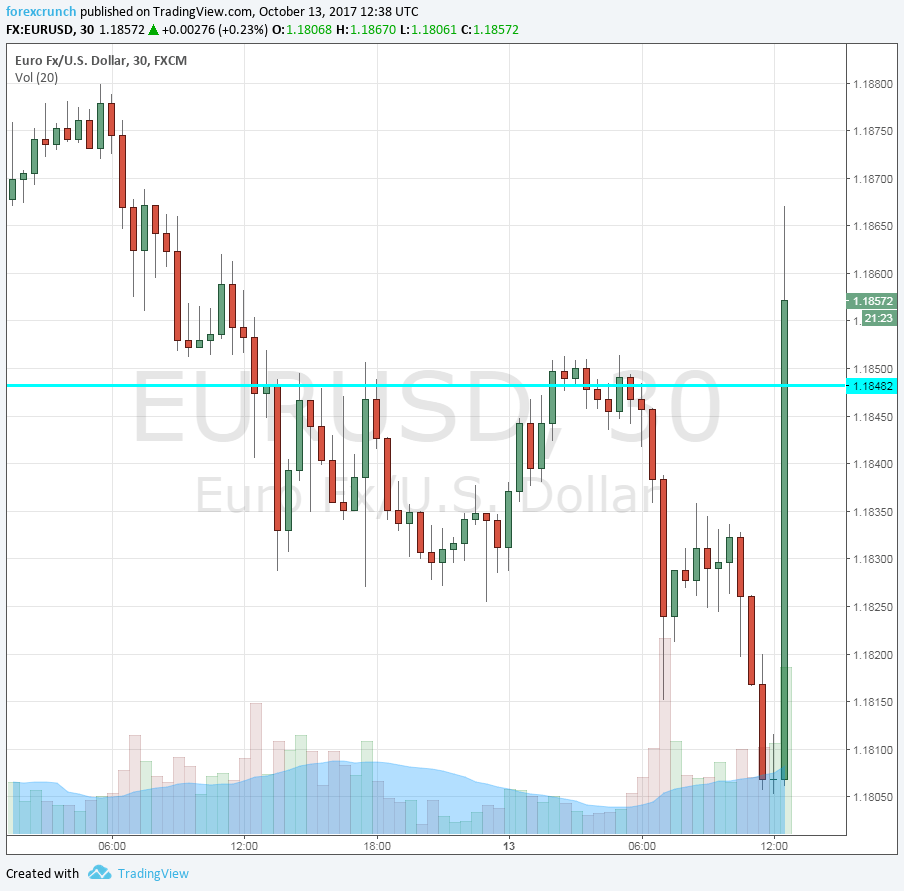

- EUR/USD traded around 1.1805 and is now surging to 1.1860.

- GBP/USD was at support around 1.3265 and tops 1.33 once again

- USD/JPY was at 112.25 and has fallen to 111.75

- USD/CAD traded above 1.25 and is now down to 1.2470.

- AUD/USD bounces from 0.7825 to 0.7870.

Here is the reaction on the euro/dollar chart. There is no doubt about the direction:

September retail sales and inflation

- CPI m/m: previous 0.4%, exp. 0.4%, actual: 0.4%

- Core CPI: prev. 0.2%, exp. +0.2%, actual: 0.1%

- Core CPI y/y: prev. 1.7%, exp. 1.8%, actual: 1.7%

- CPI y/y: prev. 1.9%, exp. 2.3%, actual: 2.2%

- Retail sales m/m: prev. -0.2%, exp. 1.7% 1.6%

- Core sales m/m: prev. 0.2%, exp. +0.3%, actual: 1%

- Retail control group: prev. -0.2%, exp. +0.4%, 0.4%.

In addition, the data on real average earning has also dropped: 0.6% y/y against 1% last time.

Background

The US was expected to report a rise in core inflation from 1.7% to 1.8% in September, boosting the case for a rate hike by the Fed. Retail sales carried expectations for a rise of 1.7% m/m.

The US dollar was stable ahead of the big bulk of data.