The Australian dollar was under pressure after inflation figures disappointed dropping to the lowest levels in three months. Trade balance and retail sales stand out as we turn the page into November. Here are the highlights of the week and an updated technical analysis for AUD/USD.

Australian inflation failed to meet expectations in Q3, rising by only 0.6% q/q. This sent AUD/USD to the lowest levels in three months. In the US, the dollar enjoyed speculation about the next Chair of the Fed: it will not be Yellen, and this supported the greenback. US data was positive as well.

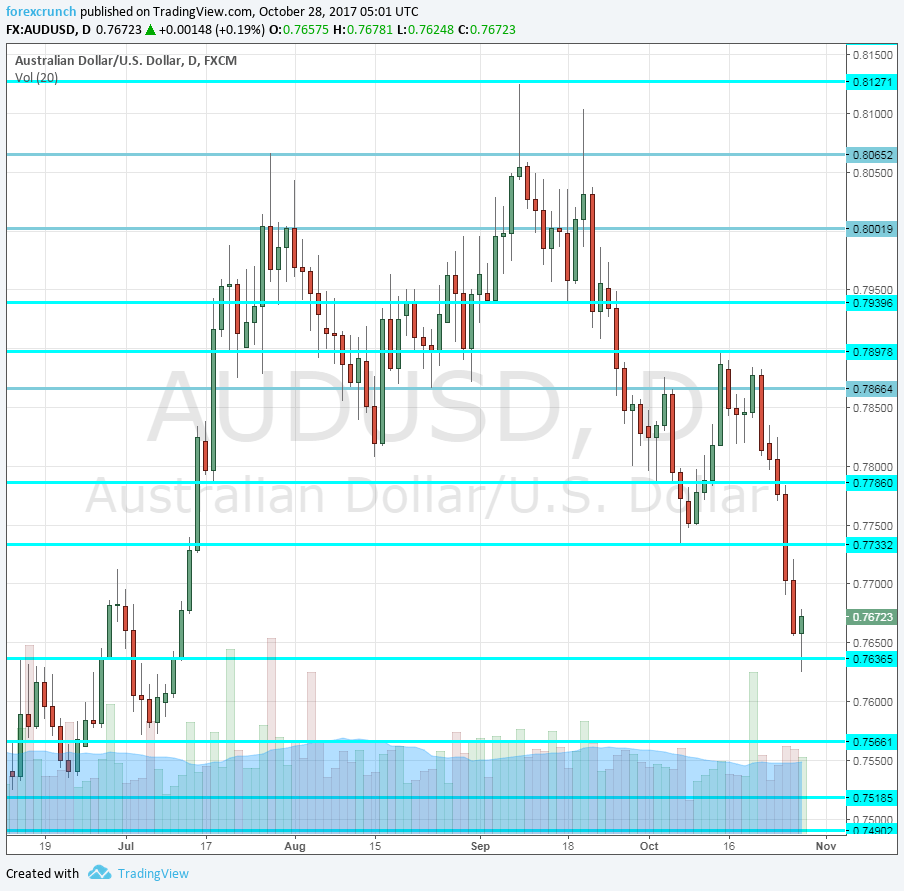

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- HIA New Home Sales: Tuesday, 00:00. The Housing Industry Association’s measure of new home sales is quite volatile, to say the least. It jumped by 9.1% in August and may now experience a drop. This has been the pattern for quite a few months.

- Private Sector Credit: Monday, 00:30. The RBA showed that credit is expanding at a stable rate for quite a few months, advancing by 0.5% in September, the same as in August. A repeat is probably coming now as well: 0.5% is expected.

- Chinese Manufacturing PMI: Tuesday, 1:00. This is China’s official purchasing manufacturing PMI. While the independent measure carries more weight, also this publication moves the needle. In September, the authorities showed a small improvement, with a rise to 52.4 points, above the 50-point threshold that separates expansion from contraction. Growing manufacturing in China is good news for Australia, as the economic giant consumes Australian commodities. A small drop to 52.2 is predicted.

- AIG Manufacturing Index: Tuesday, 22:30. The Australian Industry Group showed a drop in the manufacturing sector, but it is still expanding with a score of 54.2 in September.

- Chinese Caixin Manufacturing PMI: Wednesday, 1:45. This independent measure of the manufacturing sector dropped in September, contrary to the official figure and stood at 51 points. Nevertheless, this was the fourth consecutive month of expansion: above 50 points. A score of 51.1 is projected.

- Commodity Prices: Wednesday, 5:30. Prices of commodities were up 18.3% y/y in September, a slower pace than beforehand. There is a correlation between prices of copper and iron and the A$.

- Trade Balance: Thursday, 12:30. Australia enjoyed a surplus of 0.99 billion in September, beating expectations. This hasn’t always been the case with this measure. A surplus in trade means the Aussie is bid when there is no speculation. A wider surplus of 1.2 billion is predicted.

- Building Approvals: Thursday, 12:30. After dropping for three consecutive months, the level of building approvals ticked up by 0.4% in August. This gauge of the housing sector is volatile but certainly, matters to markets. A drop of 0.9% is forecast.

- AIG Services Index: Thursday, 22:30. The services sector has been growing at a slower pace in September in comparison to previous months according to AIG. The score stood at 52.1 points, representing modest growth.

- Retail Sales: Friday, 00:30. Consumers disappointed markets in the past two months, spending fewer dollars. In the latest publication for August, retail sales dropped by 0.6% and this weighed on the Aussie. An increase of 0.5% is estimated.

AUD/USD Technical Analysis

The Australian dollar continued falling, dipping under 0.7740 (mentioned last week).

Technical lines from top to bottom:

The high of 2017 at 0.8125 is the top level. 0.8065 is the previous 2017 high.

It is followed by the psychological round level of 0.80. Below, we find 0.7940, which capped the pair in August.

0.7860 served as support during September and is another line to watch. 0.7785 was a stepping stone on the way up.

Below, we find 0.7740, that was a high point in June 2017 and also beforehand. 0.7635 was a stepping-stone on the way up, also in June.

Even lower, we find 0.7565 was a low point before the pair shot higher in July. The last line, for now, is 0.7515.

I remain bearish on AUD/USD

The latest inflation figures put more pressure on the Aussie and this isn’t expected to go away anytime soon. The next releases are unlikely to provide any support for the Aussie.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!