Better-than-expected US growth: 3% annualized according to the first read. This is significantly above 2.5% expected and at the magical 3% level. Personal consumption is up 2.4%, also above predictions.

The US dollar is extending its gains. The moves are not huge but they could continue. The Fed could raise rates with more confidence and hint about it in next week’s meeting.

The price index is strong at 2.2% against 1.7$ predicted, yet the core PCE is stable at 1.3%. Inventories did have their contribution: 0.73% and this may turn negative in Q3. Business investment is up 3.9%, equipment investment 8.6% and there is no clear-cut assessment about the effect of the hurricanes. This may wait for the revisions.

Currency reaction (updated)

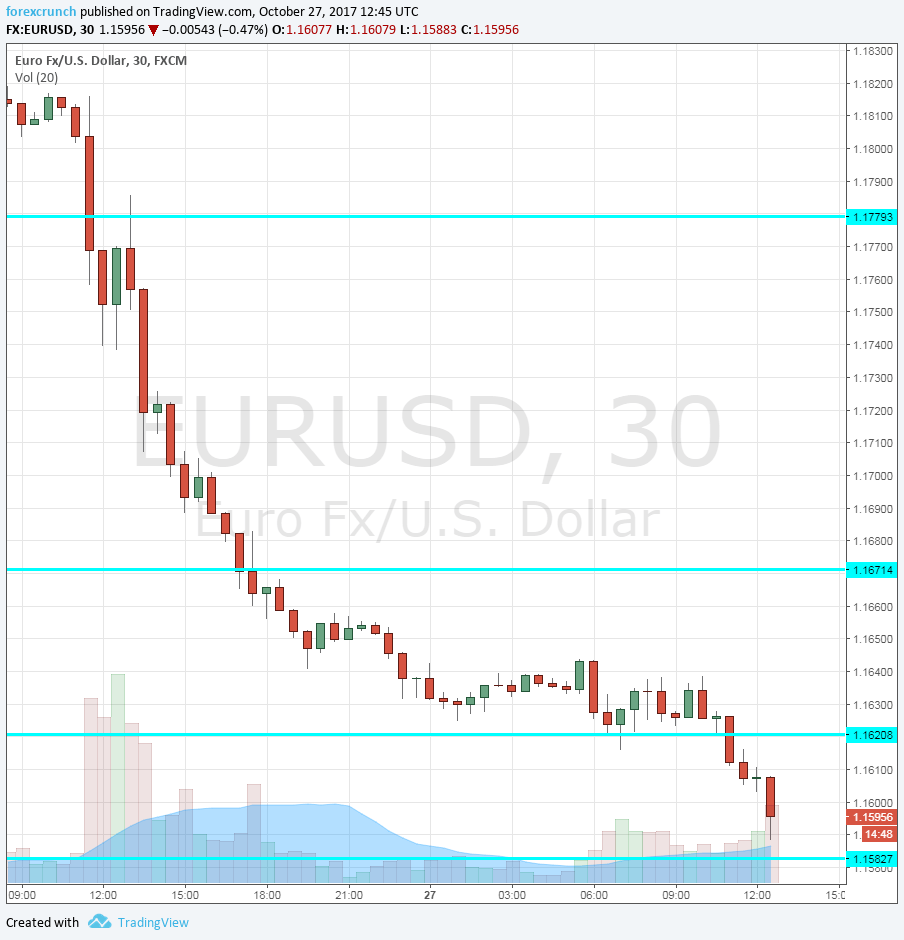

- EUR/USD was struggling to hold onto 1.16, below resistance at 1.1620 and above support at 1.1580, due to Draghi’s open door to bond buying beyond September 2018. The pair now slips under 1.16 and reaches a new low of 1.1583.

- GBP/USD dropped to 1.3090 despite an upbeat GDP report from the UK. Cable slips to 1.3080. Support awaits at 1.3030.

- USD/JPY was feeling comfortable above 114. Dollar/yen moves up to 114.30. Tough resistance is at 114.50.

- AUD/USD was down under at around 0.7640 and reacts with a minor slip.

- USD/CAD flirted with the 1.29 level and edges closer to it.

Here is the EUR/USD chart:

GDP Background

The first read of US GDP for Q3 2017 was expected to show an annualized growth rate of 2.5%, within the “new normal”. In Q2, the economy grew at a robust rate of 3.1% according to the final read while a sluggish rate of 1.4% was seen in Q1.

The US dollar was on a roll ahead of the publication. The expected ousting of Fed Chair Janet Yellen and the potential appointment of John Taylor as Fed Chair sent the greenback higher. Taylor is a hawk.

This is the Advance release: the first out of three and the one with the biggest potential for a surprise on the headline and usually the biggest impact. Nevertheless, the components of growth still matter. Rises in investment, exports and consumption are seen as “good growth”. Increase government spending and inventory building are seen as “bad growth”.

More: How low can EUR/USD go after the ECB decision? 3 views