The Australian dollar fell to new 5-month lows but turned a corner and ended the week where it started it. What’s next? Australia’s jobs report is the key event. Here are the highlights of the week and an updated technical analysis for AUD/USD.

Australian retail sales disappointed by remaining flat and home loans fell more than expected. However, the NAB Business Confidence increase from 8 to 10 points. The bigger driver was the US Dollar, which initially raged on, but eventually dropped after weak US inflation was the last straw in the camel’s back. This pulled the Aussie out of the abyss.

[do action=”autoupdate” tag=”AUDUSDUpdate”/]

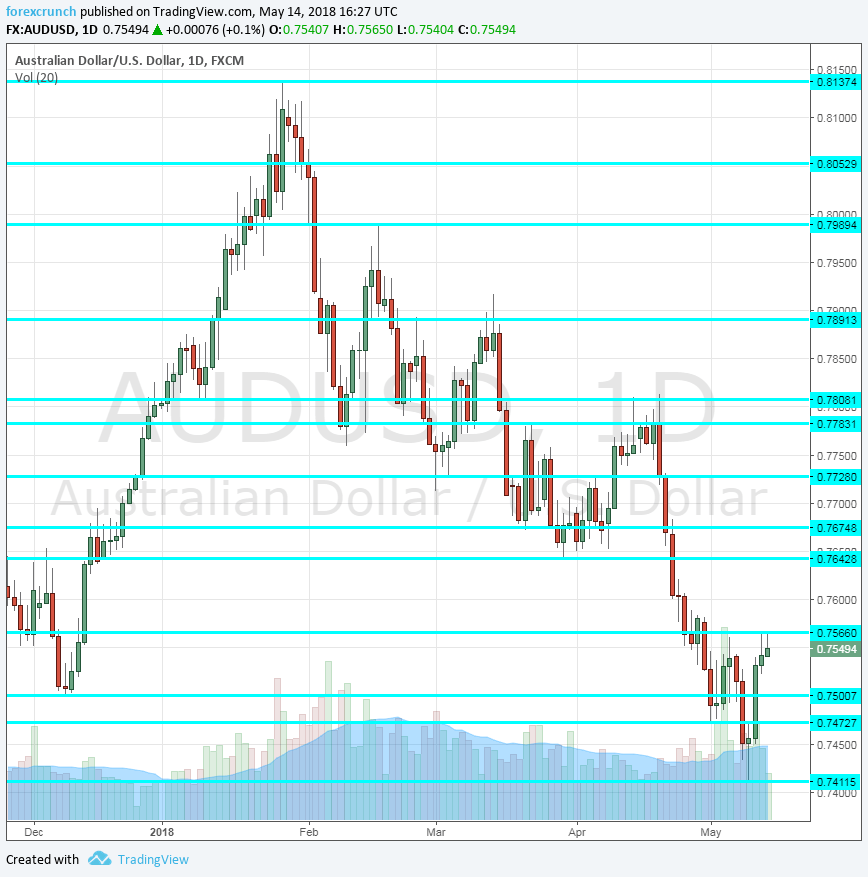

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Guy Debelle talks: Monday, 23:10 and Tuesday, 1:40. The Assistant Governor for Financial Markets will speak about the Australian Economy in Sydney and will later talk about reforms in setting benchmark interest rates in a speech broadcast to Hong Kong. Both topics are market moving. Debelle may sound optimistic like the recent upgrade of the Bank’s forecasts, or express worries on the regular subjects such as household debt.

- RBA Meeting Minutes: Tuesday, 1:30. The Reserve Bank of Australia left interest rates unchanged once again in May and left the forecast upgrade to the quarterly Statement of Monetary Policy. The minutes from the meeting may reveal more details than the bland statement.

- Chinese Industrial Production: Tuesday, 2:00. Australia’s No. 1 trading partner and a consumer of commodities saw its industrial output rise by 6% y/y in March. An acceleration to 6.4% is forecast for May.

- Westpac Consumer Sentiment: Wednesday, 00:30. One week later than originally scheduled, the Westpac Corporation will publish its 1200 strong measure of consumer confidence. After a drop of 0.6% in April, an increase may be seen in May.

- Wage Price Index: Tuesday, 1:30. Jobs are plentiful but salaries are somewhat stuck. This is a phenomenon in many developed economies. Wages increased by 0.6% in Q4 2017 and are forecast to rise by the same quarterly scale in the first quarter of 2018.

- MI Inflation Expectations: Thursday, 1:00. The Melbourne Institute fills in the gap for the government that publishes CPI data only once per quarter. MI showed a rise of 3.6% in March and a similar increase is likely now.

- Jobs report: Thursday, 1:30.Australia’s job report for March disappointed with a minor increase of only 4.9K positions. The unemployment rate remained at 5.5%. The wider picture is positive for Australia and the RBA expects growth to accelerate. April’s jobs report could provide some answers. A return to robust growth is expected with a gain of 20.3K jobs. The unemployment rate is forecast to remain unchanged at 5.5%.

*All times are GMT

AUD/USD Technical Analysis

Aussie/USD fell to new lows around 0.7410 (mentioned last week).

Technical lines from top to bottom:

0.7890 worked as support in February and resistance in October. 0.7810 was a swing high in mid-April.

0.7730 capped the pair in early April. 0.7675 provides some support in March and is another stepping stone.

Further below, 0.7640 was a stubborn cushion in March and April. The fall below this line proved its strength. 0.7615 capped a recovery attempt in late April.

0.7560 is the next level to watch after it was the recovery level in early May. The round number of 0.7500 remains important despite the recent breach.

0.7430 was an initial low in late April and it is followed by 0.7410, an old line from 2017.

I remain bullish on AUD/USD

The US Dollar could continue struggling for another week and Australian jobs probably bounced back to allow for an extension of the recovery.

Our latest podcast is titled Stormy times ahead or just a moderation?

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!