The Australian dollar had another down week but managed to recover after reaching new lows since December. Is it ready to turn up? Australian retail sales and the annual budget are eyed. Here are the highlights of the week and an updated technical analysis for AUD/USD.

The US dollar continued raging on as the Fed remains on course to raise interest rates in June. A marginally dovish FOMC statement was unable to derail the greenback, nor did the unimpressive NFP report, which showed a slowdown in wage growth to 2.6%. However, the Australian dollar was able to fight back. The RBA did not rock the boat in its statement but is Monetary Policy Statement already included upgrades to various forecasts. In addition, the trade balance, building approvals and private sector credit all beat expectations. Chinese data was also slightly better the forecasts, supporting the pair in its recovery.

[do action=”autoupdate” tag=”AUDUSDUpdate”/]

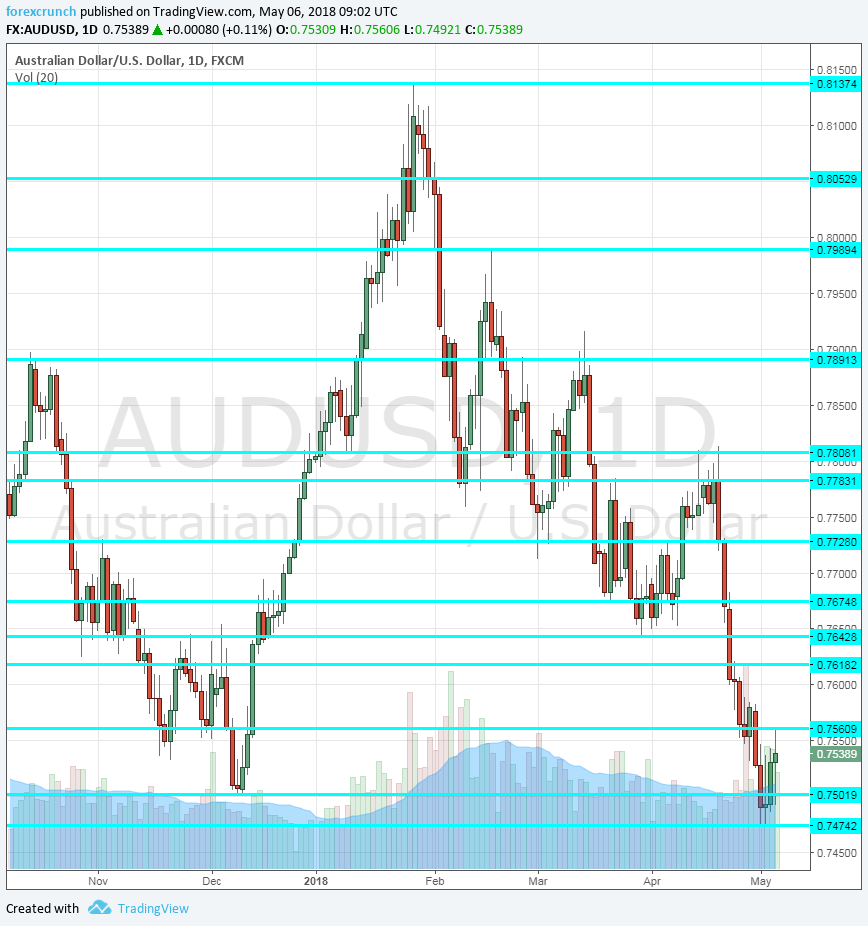

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- AIG Construction Index: Sunday, 23:30. The Australian Industry Group’s forward-looking survey for the construction sector stood at 57.2 points in March, pointing to robust growth in the sector. We may see a small dip now.

- NAB Business Confidence: Monday, 1:30. The National Australia Bank’s 350-strong survey of businesses extended its drops in March and reached 7 points. The positive number shows that conditions keep on improving. A similar number is likely now.

- ANZ Job Advertisements: Monday, 1:30. Job ads remained flat in March according to the measure by the Australia New Zealand Bank. This is an early gauge of jobs, coming out before the official labor market report.

- Retail Sales: Tuesday, 1:30. After two disappointing months, Australian retail sales beat expectations with a rise of 0.6% in February. This important part of the economy is now projected to show slower growth of 0.2% in March.

- Chinese Trade Balance: Tuesday, 2:00. Australia’s No. 1 trade partner publishes its monthly trade balance report for April, which is already expected to be clean of seasonal effects: the Chinese New Year. A surprsing deficit of 5 billion USD was recorded in March and a surplus of 27.5 billion is on the cards now. For Australia, the level of Chinese imports, some of them Australian commodities, is on the cards.

- Annual Budget Release: Tuesday, 9:30 GMT. The Australian government publishes its annual budget and the important parts of it are the forecasts for growth, employment, and inflation. After the recent upgrade of the economic outlook by the RBA, the government may follow suit. If they leave forecasts unchanged, the A$ could suffer.

- Westpac Consumer Sentiment: Wednesday, 00:20. The Westpac Banking Corporation showed a decline of 0.6% in consumer sentiment in April, following a gain beforehand. The 1200-strong survey will likely bounce back as the see-saw continues.

- MI Inflation Expectations: Thursday, 1:00. The Melbourne Institute’s Inflation Expectations measure fills the gap for the government which releases official CPI data only once per quarter. Expectations for inflation decelerated in March to 3.6%. A similar figure is likely for April.

- Home Loans: Friday, 1:30. Home loans fell in the past three months, with a drop of 0.2% in February. The month of March is unlikely to provide any respite as another drop of 2% is on the cards. Households are indebted and this weighs on the mortgage market.

*All times are GMT

AUD/USD Technical Analysis

Aussie/USD extended its falls, losing the important 0.75 level (mentioned last week) before recovering and closing at 0.7538.

Technical lines from top to bottom:

0.7890 worked as support in February and resistance in October. 0.7810 was a swing high in mid-April.

0.7730 capped the pair in early April. 0.7675 provides some support in March and is another stepping stone.

Further below, 0.7640 was a stubborn cushion in March and April. The fall below this line proved its strength. 0.7615 capped a recovery attempt in late April.

0.7560 is the next level to watch after it was the recovery level in early May. The round number of 0.7500 remains important despite the recent breach.

Even lower, 0.7475 was the low point in early May and it is followed by 0.7410, an old line from 2017.

I turn from bearish to bullish on AUD/USD

After further falls, there may be light at the end of the tunnel for Aussie bulls. The upbeat comments from the RBA and a tired US Dollar may be enough to see a week of recovery for the pair.

Our latest podcast is titled Is inflation rearing its ugly head? Oil is on fire

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!