- Global payments amount to $600 billion per annum, while $30 billion of these go straight to transaction costs.

- Indicators are showing short-term bullish signals, a break above $0.54 could pave the way for Ripple price to attack $0.58 level.

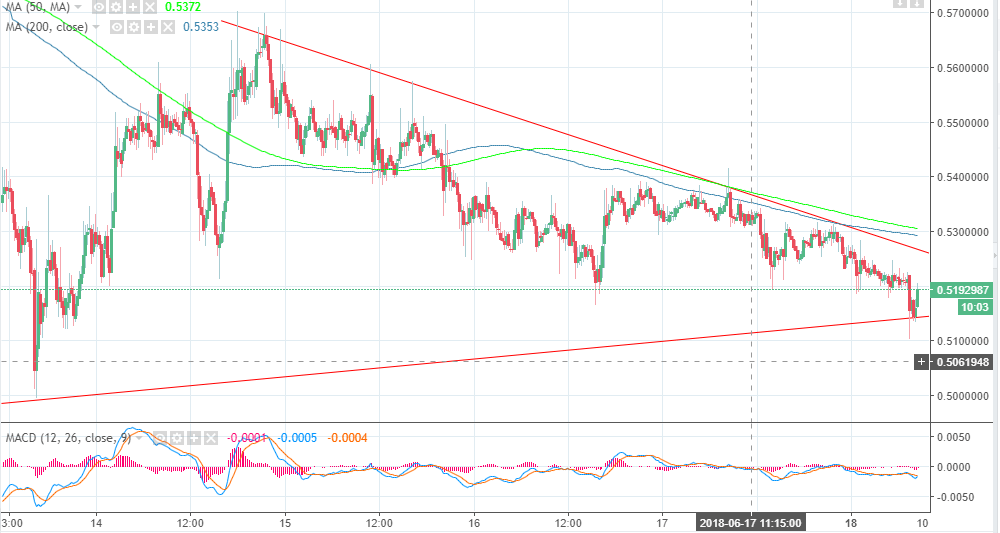

Ripple price is backed to a tight corner below $0.52 but weakly supported above $0.51. Over the weekend the crypto utilized the support created at $0.50 to retrace marginally above $0.56. However, XRP/USD has been trading lower highs and lower lows towards the narrowing end of a contracting triangle pattern.

Ripple is more than just a digital asset, it is a company that is striving to revolutionize the way global payments are done. The payment solutions from Ripple; xRapid and xCurrent are constantly being updated to achieve fast transaction at minimal costs. Ripple says that global payments amount to $600 billion per annum, while $30 billion of these go straight to transaction costs.

The World Bank, on the other hand, records that the majority of these payments are small and average around $500. While piloting xRapid as a global payment solution, Ripple has found that it can save individual across the world $16.5 billion which in turn could mean that $3.17 billion saved for food and $263.07 million could be saved in terms of bills. This also factors in rent for at least 49.9 million individuals at an average cost of $273.34 per month.

Ripple price technical picture

Ripple price is currently battling to break above $0.52 while the buyers have their eyes locked at $0.53 (moving averages). Indicators are showing short-term bullish signals, for example, the MACD is pointing upwards from, but still in the negative area while the moving averages gap is reducing. The region at $0.54 could open the door for Ripple to recoil towards the critical resistance at $0.58. On the downside, $0.50 will continue supporting the price in case another trend reversal occurs.

XRP/USD 15′ chart