- Americans are not interested in cryptocurrencies.

- BTC/USD stays unchanged on a daily basis.

Bitcoin, the leading digital currency with total market value $140B and average daily trading volume $4.3B is nowhere close to mass adoption, at least in the US.

According to a Wells Fargo/Gallup poll, only 2% of investors confessed that they own Bitcoins, while less than 1% have intendtion to buy it in the near future. The overwhelming majority of the respondents said they had no interest in buying bitcoin, while about 26% were interested in the technology, but did’t want to purchase coins any time soon.

“Limiting bitcoin’s popularity as an investment, only about three in 10 investors (29%) say they know something about digital currencies. Most of the rest — 67% — say they have heard of these currencies but don’t know much about them, while 5% have not heard of them,” the report says.

“The bigger constraint on bitcoin sales is likely the widespread perception that trading in the currency is not safe. While risk is central to how investing works, three in four investors who have heard of online currencies consider bitcoin a “very risky” investment.”

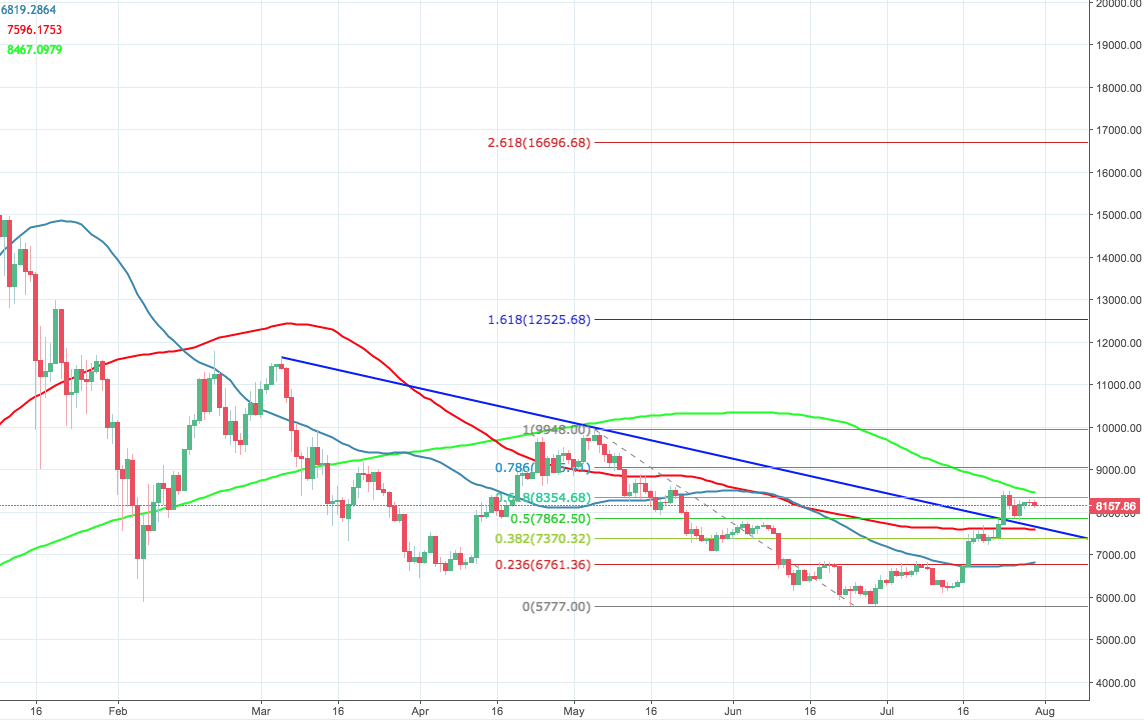

Bitcoin’s technical picture

From the longer-term perspective, BTC/USD stays in a tight range, limited by $8,000 on the downside and $8,300 on the upside. If the support is broken, the sell-off may be extended 50.0% Fibo retracement at $7,862. The ultimate resistance is $8,591 (200-DMA).