- Ripple records losses in the wake of a uniquely triggered bullish trend.

- The support at the 61.8% Fib level is strong enough to hold to the next session.

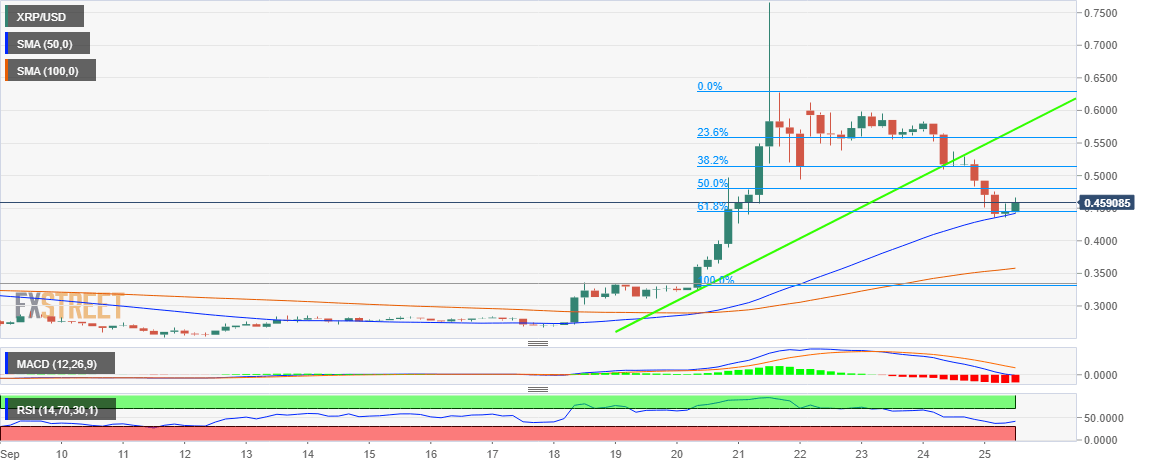

Ripple’s legs are currently being cut from right under it following the overarching declines on Monday and Tuesday. Last week, Ripple made an incredible recovery from the levels around $0.28 all the way to testing the critical resistance at $0.7. Significantly, it briefly claimed the third position in the market by market capitalization. The trading volume was also blowing off the roof. In fact, Ripple kick started the widespread recovery experienced on Thursday and Friday.

However, the gains are now followed by huge declines that have shuttered the support levels at $0.55 and $0.50. XRP/USD also smashed the through the trendline support which coincided with the 38.2% Fib retracement level of the previous swing high of $0.62 and a swing low of $0.33.

In the meantime, Ripple price is supported by both the 61.8% Fib level and the 4-hour 50SMA. There is a slight pullback from the support above $0.45, although the journey towards $0.50 is going to be tough for the bulls. On the flipside, the 100SMA currently at $0.358 is positioned to act like as an anchor in the event $0.40 support fails to hold ground.

Significantly, the cryptocurrency market has wiped off $13 billion in total market capitalization. The cap is currently at $207 after dropping from yesterday’s $220 billion.