- BTC/USD failed to settle above the key barrier due to the lack of momentum.

- A sustainable move below $3,600 will unleash bearish potential.

BTC/USD humbled under $3,800 after a failed attempt to break above $4,000 handle. Bulls were celebrating victory on Sunday, as the price of the first digital coin surpassed $4,000 and refreshed the highest level of the year. However, their joy was premature, as the currency dropped back below $3,800 handle in a matter of hours.

While the cryptocurrency market experts believe that the sell-off was caused by triggered stops located on the approach to $4,200, the inability to gain upside momentum even after a critical breakthrough bodes ill for short-term bulls.

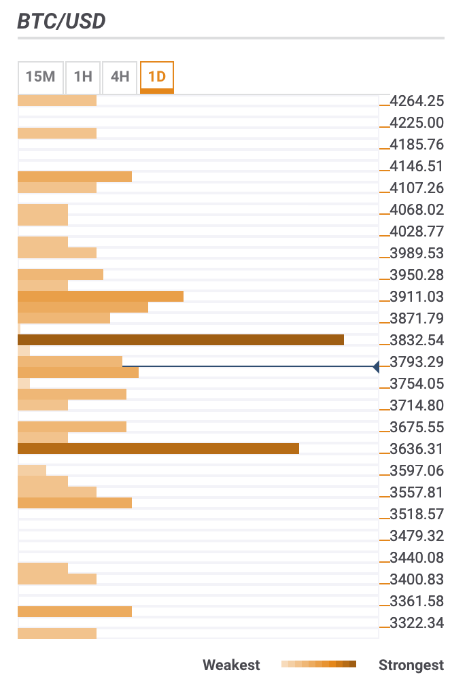

BTC/USD the daily confluence detector

Above the current price, strong resistance is located on the approach to $3,850. It is strengthened by a cluster of Fibonacci retracement levels, including 23.6% Fibo retracement daily, 38.2$ weekly and 61.8% monthly. Once it is out of the way, the recovery may be extended towards $3,900 (Fibo retracement 38.2% daily) and back to $4,000.

On the downside, the most notable support is located on the approach to $3,600 with DMA50 located on approach. A sustainable move below this barrier will bring $3,500 (23.6% Fibo retracement monthly) back into focus. The next support comes at $3,341, which is the lowest level of January.

BTC/USD, 1D