- Ethereum recovers to assault $220 resistance twice but a bearish bias still exists.

- Ethereum still has a ‘buy’ rating following the breakdown from the highs above $300.

Ethereum has in the past few days come under heavy selling pressure. The crypto plunged from levels above $300 and explored how deep the rabbit hole goes under $200. Support established at $190 allowed the bulls to take over control and push for gains above $200.

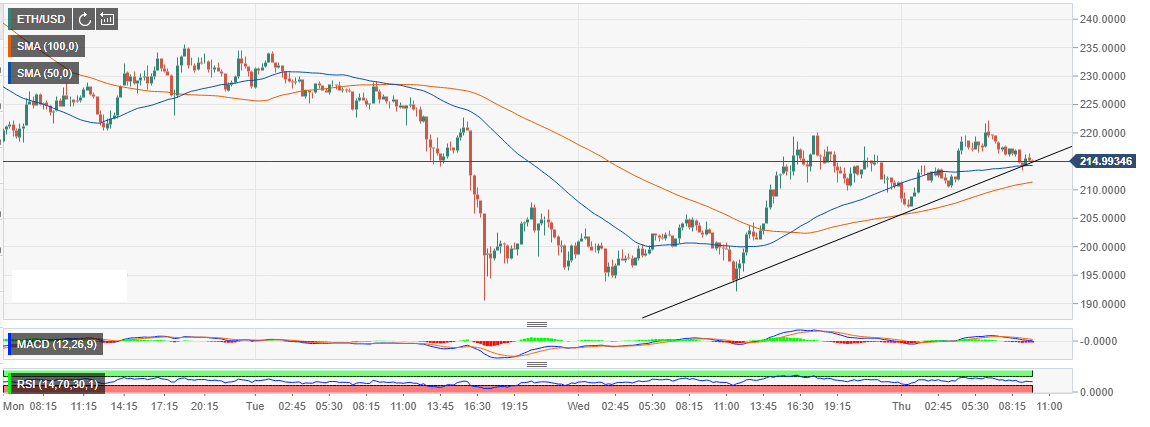

The second-largest crypto touched $220 hurdle yesterday but dwindling buying pressure resulted in a correction that found balance above the rising trendline aided by the 100 Simple Moving Average (SMA) 15-mins. Meanwhile, the bulls not ready to give up control pushed ETH/USD above $220 on Thursday during the European session.

Also read: Coinshares: Bitcoin and Libra are primarily different

At press time, Ethereum is valued at $215 with its immediate downside protected by the 50 SMA 15-mins as well as the ascending trendline. Technically, ETH/USD has a bearish bias in the near-term. The Moving Average Convergence Divergence (MACD) grinding towards the mean line after the rejection at +2.19. Crossing into the negative zone could encourage the sellers to increase their positions further pulling the price towards $200.

Ethereum still has a ‘buy’ rating following the breakdown from the highs above $300. Besides, Ethereum demonstrated the ability to reverse the bear moment in 2018 by trading above $360. Therefore, investors still believe the potential for growth is still immense.

ETH/USD 15-mins chart