- Ripple has continued to press against key support levels since the drop from June highs.

- A break above $0.32 is likely to open the door to gains heading to $0.4.

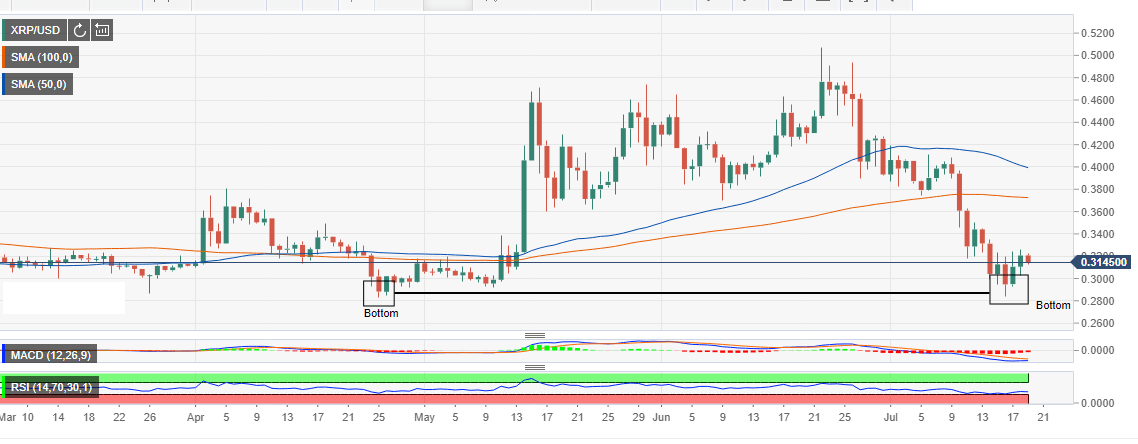

Ripple has dived massively from the recent highs. The breakout above both the 50 Simple Moving Average (SMA) 1-D and the 100 SMA 1-D propelled XRP past critical hurdles. For the first in 2019, the price exchanged hands above $0.5. A high was, however, formed at $0.50 before the bears took over.

Following the rejection from June highs, Ripple has continued to press against key support levels. Moreover, the declines could not find support at $0.4 and $0.38 key levels while the drop below moving averages encouraged the sellers to increase their grip on the price.

The bear wave this week saw Ripple dive under $0.30 before forming support at $0.28 (April) lows). The support completed the formation of a double-bottom pattern whose reaction could give XRP a push towards $0.40.

Also Read: Bitcoin market update: BTC/USD losing ground under $10,500

At the time of writing Ripple is trading at $0.31 after failing to sustain gains above $0.32. A bear correction is likely to test $0.30 giving way for a bounce back up. Indicators on the daily chart show the price having an inclination to sideways trading. The Relative Strength Index (RSI) is horizontal at 40 after recovery from the oversold.

The Moving Average Convergence Divergence (MACD) is still losing ground in the negative zone as an indicator of prevailing selling pressure. On the positive side, a break above $0.32 is likely to open the door for correction heading to $0.4.