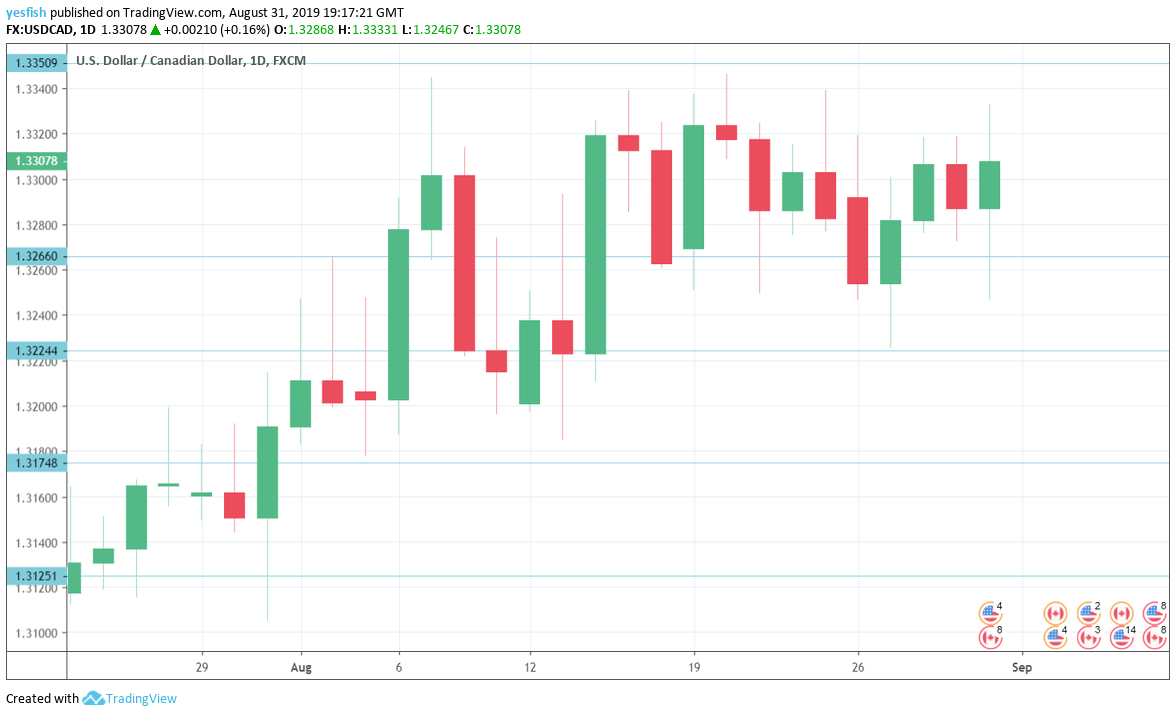

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Manufacturing PMI: Tuesday, 13:30. Markit’s purchasing managers’ index for the manufacturing sector improved slightly to 50.2 in July, after three successive contractions. Will we see another expansion in August?

- Trade Balance: Wednesday, 12:30. Canada posted a small surplus in June of C$0.1 billion, above the forecast of C$-0.3 billion. Another small surplus is expected in July, with a forecast of C$0.2 billion.

- BoC Rate Decision: Wednesday, 14:00. The BoC last raised rates back in October, and no change is expected to the current rate of 1.75%. Investors will be keeping a close eye on the rate statement – a dovish statement could send the Canadian dollar lower.

- Employment Data: Friday, 12:30. Employment change declined by 24.2 thousand in July, surprising the markets, which had forecast a gain of 15.2 thousand. Will we see a rebound in the August release? The unemployment rate jumped to 5.7% in July, up from 5.5% a month earlier. We will now receive data for August.

* All times are GMT

USD/CAD Technical Analysis

Technical lines from top to bottom:

1.3665 was the high for 2018. 1.3565 is the next resistance line.

1.3445 has held in resistance since the first week of June. This is followed by 1.3385.

1.3350 has held steady since mid-June. It was under some pressure during the week.

1.3265 remained relevant this week. It starts the new trading week as a weak support level.

1.3175 is the next line of support.

1.3125 (mentioned last week) has held in support since the end of August. 1.3048 follows.

1.2916 is the final support level for now.

I remain bullish on USD/CAD

The Canadian dollar continues to lose ground, as the currency has registered seven successive losing weeks. Fears of a recession in the U.S. have dampened risk appetite, and the ongoing U.S-China trade war will not help matters. The Bank of Canada is widely expected to hold rates, and if the rate statement or follow-up comments from BoC Governor Stephen Poloz are dovish, the pair’s upward movement could continue.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!