- BTC/USD has resumed the recovery after a consolidation period.

- The critical resistance is seen on approach to $10,000.

Bitcoin (BTC) is attempting to clear $9,800 during European hours on Monday. The first digital asset touched the intraday high at $9,838 and retreated to $9,800 by the time of writing. BTC/USD short-term upside trend is gaining traction amid foreign currency crisis in Argentina.

Read also: Foreign currency crisis in Argentina might have triggered Bitcoin growth

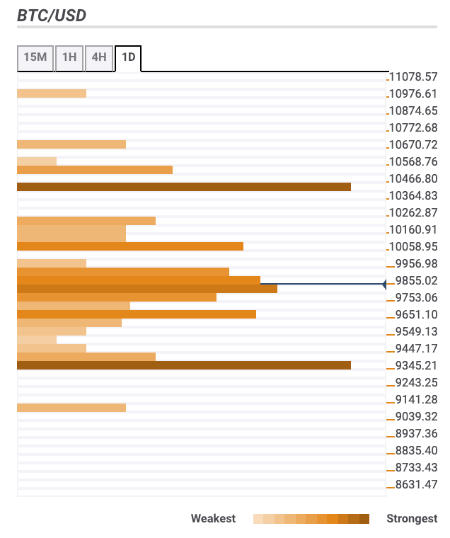

Bitcoin confluence levels

Now that BTC/USD cleared $9,600 barrier, the further upside looks highly likely. While the critical resistance is located on approach to psychological $10,000, the coin retains bullish bias as long as the price stays above $9,600. A way to the South is packed with strong technical barriers that may limit the downside correction.

Let’s have a closer look at the barriers that might influence Bitcoin’s movements in the short run.

Resistance levels

$9,900 – SMA50 (Simple Moving Average) 4-hour and SMA200 1-hour, the upper line of 1-hour Bollinger Band

$10,000 – Pivot Point 1-day Resistance 1, 23.6% Fibo retracement monthly.

$10,400 – Pivot Point 1-week Resistance 1, SMA50 daily.

Support levels

$9,600 – the middle line of 4-hour Bollinger Band, 23.6% Fibo retracement weekly, SMA50 1-hour;

$9,350 – the lowest level of the previous month and the lowest level of the previous week, Pivot Point 1-day Support 3.

$9,000 – Pivot Point 1-month Support 1.