- AIG Construction Index: Sunday, 21:30. The index continues to point to contraction in the construction sector. However, the indicator improved to 44.6 in September, its strongest reading in 5 months.

- NAB Business Confidence: Tuesday, 0:30. The National Australia Bank indicator dropped sharply to 1 point in September, down from 4 a month earlier. The business sector remains very concerned about the economy, despite the RBA slashing interest rates over the past several months. Will we see a turnaround in the upcoming release?

- Westpac Consumer Sentiment: Tuesday, 23:30. Consumer confidence sagged in September, as the indicator declined by 1.7%. This marked the second decline in the past three months. Another decline could dampen sentiment towards the Aussie.

- MI Inflation Expectations: Thursday, 0:00. The Melbourne Institute indicator is useful for tracking actual inflation levels. Inflation expectations fell to 3.1% in August, its lowest level since 2014.

- Chinese New Loans: Thursday, 10th-14th. In August, Chinese banks provided loans worth 1.21 billion yuan ($170 million) in August, which was higher than in July. The upward trend is expected to continue in September, with an estimate of 1.35 billion yuan ($189 million).

*All times are GMT

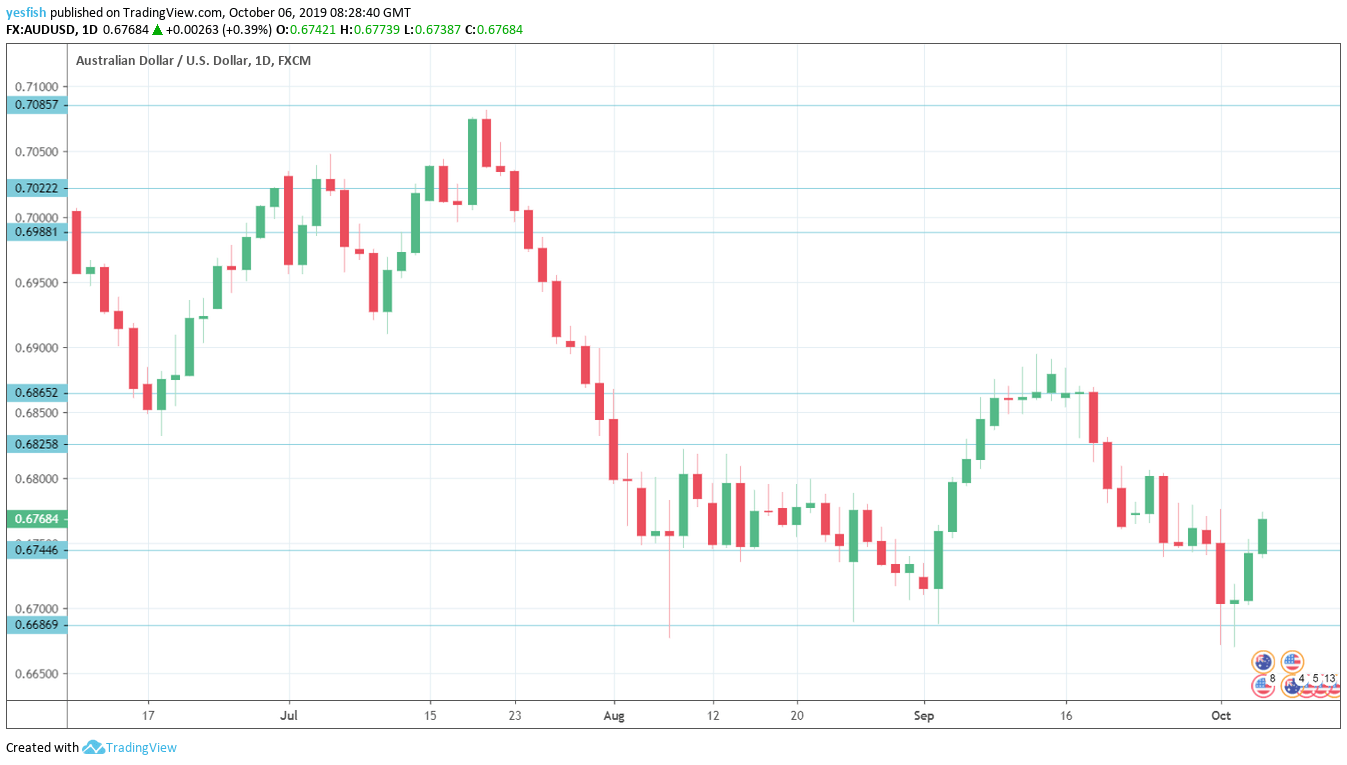

Technical lines from top to bottom:

We start with resistance at 0.7165. This line has held firm since early April.

0.7085 was a low point in September. 0.7022 is next.

0.6988 marked the low point in April.

0.6865 was active in mid-September and has some breathing room in resistance.

0.6825 (mentioned last week) is next.

0.6744 switched to a support role after AUD/USD recorded gains late in the week.

0.6686 was a cap back in January 2000.

0.6627 has held in support since March 2009. 0.6532 is next.

0.6456 is the final support level for now.

I am bearish on AUD/USD

The RBA has lowered rates three times in the past four months, in a desperate attempt to shore up economic activity. Weak global demand has hampered the manufacturing and export sectors, and there could be further headwinds for the Aussie.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!