- Monero is hard to trace primarily when it is used together with Tor.

- XMR/USD is moving inside the downside range, dominated by bearish sentiments.

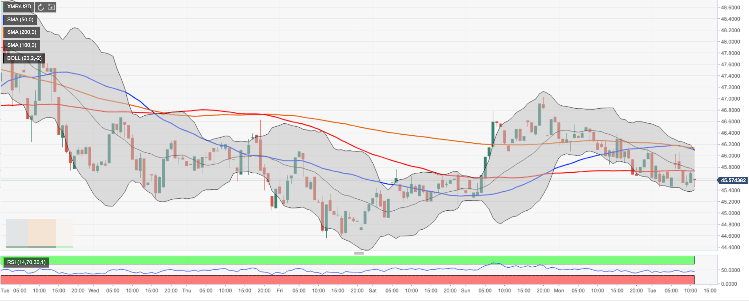

Monero recovered to $46.90 on December 29 and has been in retreat ever since. At the time of writing, the coin is changing hands at $45.45, down 1.3% in recent 24 hours. Monero’s market capitalization is registered at $797 million, while an average daily trading volume has settled at $56 million.

Monero + Tor = ultimate privacy

Monero (XMR) is a perfect tool for criminals and people engaged in illegal activities as it is practically untraceable when used together with web browser Tor, according to EUROPOL’s Strategic Analyst Jerek Jakubcek.

Speaking at the recent Blockchain Alliance webinar, the expert cited the results of the previous investigations and highlighted the difficulties related to Monero transaction traceability.

“Whatever happened on the Bitcoin blockchain was visible and that’s why we were able to get reasonably far. But with Monero blockchain, that’s where our investigation ended. This is a classic example of one of several cases where suspects decided to move funds from Bitcoin or Ethereum to Monero.”

Kevin O’Connor, Compliance and Enforcement Officer at FinCEN, came up to similar conclusions earlier this year. Notably, anonymity and enhanced privacy feature prompted some cryptocurrency exchanges to delist Monero along with several other privacy coins.

XMR/USD: technical picture

From the technical point of view, the local resistance is created by a combination of SMA100 (Simple Moving Average) and the middle line of the Bollinger Band on the one-hour chart at $45.70. Once it is out of the way, the upside is likely to gain traction with the next focus on $46.00/ This barrier is expected to slow down the recovery due to a confluence of SMA50, SMA200 and the upper line of 1-hour Bollinger Band located above this area. We will need to see a sustainable move above this handle for the upside to gain traction.

On the downside, the support awaits us on approach to the intraday low ($45.45). This area is reinforced by the lower lines of 1-hour and 4-hour Bollinger Bands. Once it is out of the way, the price will continue moving down towards December 27 low of $44.55 and $43.99 (the lowest level since December 18.