- Bitcoin is the main entrance door to the crypto world.

- ETH/BTC price action will be dictated by Bitcoin halving and Ethereum’s Serenity update.

- The downward channel formation in ETH/BTC indicates bearish bias in 2020.

Many of the biggest exchanges in the world, like Binance, are pure crypto-to-crypto, meaning you can buy and sell crypto by using other cryptos. The most popular base currency is either USDT or Bitcoin. USDT (Tether) is a stable coin, while Bitcoin is the biggest coin in the market. In this article, we will see the advantages of using BTC as a base coin and then check out how ETH/BTC is expected to perform in 2020.

Advantages of using Bitcoin as a base currency

- There are more trading pairs available with BTC since it is extremely popular.

- Bitcoin is the leader of the crypto market and often predicts the price direction of other coins. So, if BTC drops, the negative percentage of your open positions won’t vary by much.

- If ETH/USD is going up, but ETH/BTC is going down, then that means that BTC is doing better than ETH against USD. If this is the case, then it might make sense not to trade ETH and just hold on to your BTC. Studying the ETH/BTC chart can help you make some smart decisions.

What controls the price of ETH/BTC?

Contrary to fiat currency pairs, both sides of ETH/BTC are sensitive to the same factors. Cryptocurrencies, in general, are sensitive to the following factors:

- Mainstream sentiment: Bitcoin is the most widely accepted cryptocurrency. As such, its price is often dependent on external factors like mainstream acceptance. If more retail stores, merchants and supermarket chains start taking and using Bitcoin, then its price is going to reflect it. Conversely, negative regulation news might also adversely affect the price.

- Blockchain and DApps adoption: As an investor, you must always keep in mind that Ethereum is not just a means of payment. It is a platform where developers from all over the world can create their applications. If one of these decentralized applications (DApps) gains mainstream acceptance and attracts more users, then that will increase activity on the Ethereum platform, boosting the price of the Ether tokens.

These factors aside, two more specific issues are going to be huge price drivers in 2020.

- Bitcoin Halving: Halving is the process by which the block reward given to miners gets halved. This is done to reduce the supply circulating around in the marketplace. Currently, the block reward for miners is 12.5 BTC, which will reduce to 6.25 following the halving event. The halving is expected to take place on 14 May 2020. Usually, this is a bullish event, however, as notable crypto analyst and influencer Willy Woo points out, things are a little different this time around, which might disappoint a lot of traders:

NEVER gone into a halvening in BEARISH price action, miners already capitulating adding sell volume. Historically we front run with a BULLISH setup, miner capitulating only after halvening when revenues are slashed. This is a unique setup. Quite bearish leading up to the event.

- Path to Serenity: 2020 will set everything in motion for Ethereum to begin its final phase – Serenity. Earlier in December, Ethereum finished its latest update called “Istanbul.” The first sub-upgrade of Serenity is the “Shard Chain” update. Sharding is the process by which a transaction set is broken into shards, which is then parallelly processed. This should increase the speed of the chain exponentially. Having said that, this will initially be a test run before the final thing is implemented. It will probably take a couple of years for Serenity to be completely implemented.

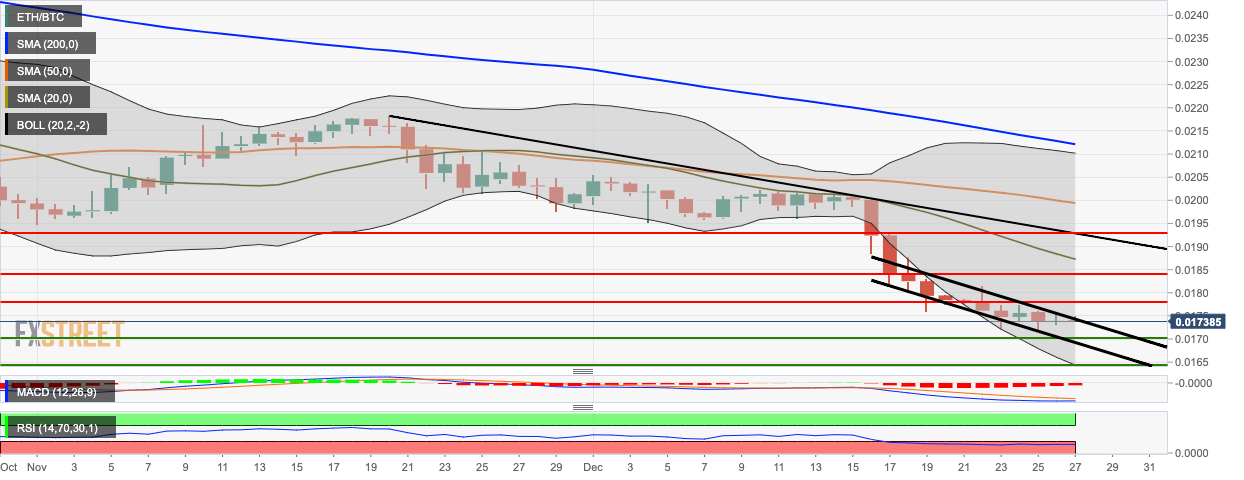

ETH/BTC daily chart

The ETH/BTC daily chart shows us that the BTC has consistently managed to trend in a downward channel formation. The 0.0169 support line ensures that ETH/BTC will continue to trend within the channel and inside the 20-day Bollinger Band. The Relative Strength Index (RSI) indicator has been stuck inside the oversold zone since December 16th. This should indicate that a bullish correction is around the corner following a lengthy sell-off period for ETH.

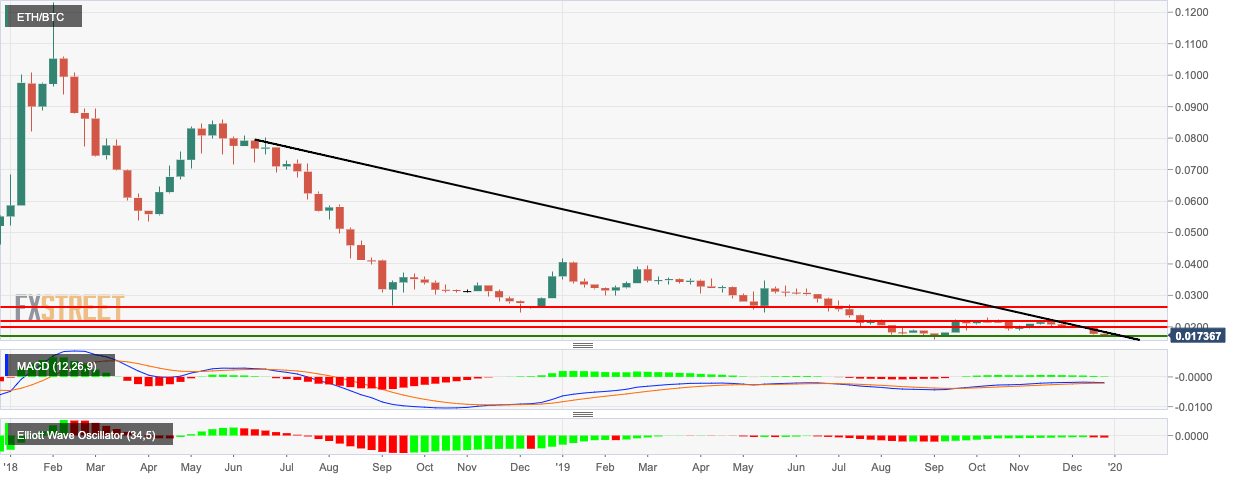

ETH/BTC weekly chart

ETH/BTC has had five bearish weeks out of the last six. After encountering resistance at the 0.021 level, the price eventually fell to 0.0173. ETH/BTC may drop to 0.017, where it will bounce up from the strong support and go back up. The Elliott Oscillator has had two red sessions after 14 straight green ones.

Conclusion

Currently, we can imagine that ETH/BTC may drop a little more, so it may make sense to short it for now and hold on to your Bitcoins to enjoy the “halving boost.” However, be on the lookout for the Serenity hard forks and invest in some Ethereum to collect some profits as well.