- Dash climbs above key resistance levels including $120 and $124 but leaves $130 unconquered.

- The bulls are still in control despite the hurdle at $130.

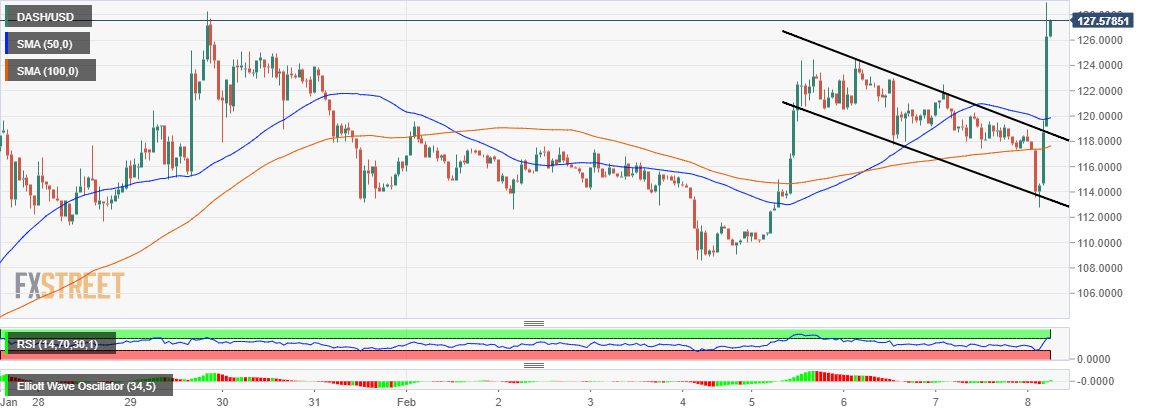

Dash is leading the weekend bullish action following the blast above descending channel resistance. The surge witnessed in January saw Dash rise confidently above the hurdles at $100 and $120. Unfortunately, the uptrend failed to break above the key resistance at $130. Instead, Dash spiraled towards $100. Support at $180 put a stop to the declines allowing for recovery main in the first week of February.

A second attempt on $130 fizzled out at $124 as the momentum tuned bearish. Dash corrected within the confines of a short term descending channel. However, the breakout on Saturday has seen another shot a launched at $130.

At the time of writing, Dash is teetering at $127.44 amid a strong bullish momentum and trend. The RSI clearly shows that the buyers have the throttle at maximum and desire nothing less than seeing the price above $130.

If a reversal occurs (which is likely) a higher support is anticipated at $124. If declines progress, the 50 SMA on the 1-hour at $120 will function as a key support zone. Other vital levels to keep in mind include $112, $108 and $100.