- Bitcoin price has suffered a mild sell-off in the past 24 hours but managed to recover.

- Bitcoin could be on the verge of a massive pullback because of the increased selling pressure from Mt. Gox.

Mt.Gox was the biggest cryptocurrency exchange back in 2014 but got hacked and lost more than 150,000 BTC total. There is a rehabilitation plan set by December 15 which could potentially release the entire stack. This possibility might have been the cause of the recent sell-off, however, this plan will most likely not come to fruition until months later.

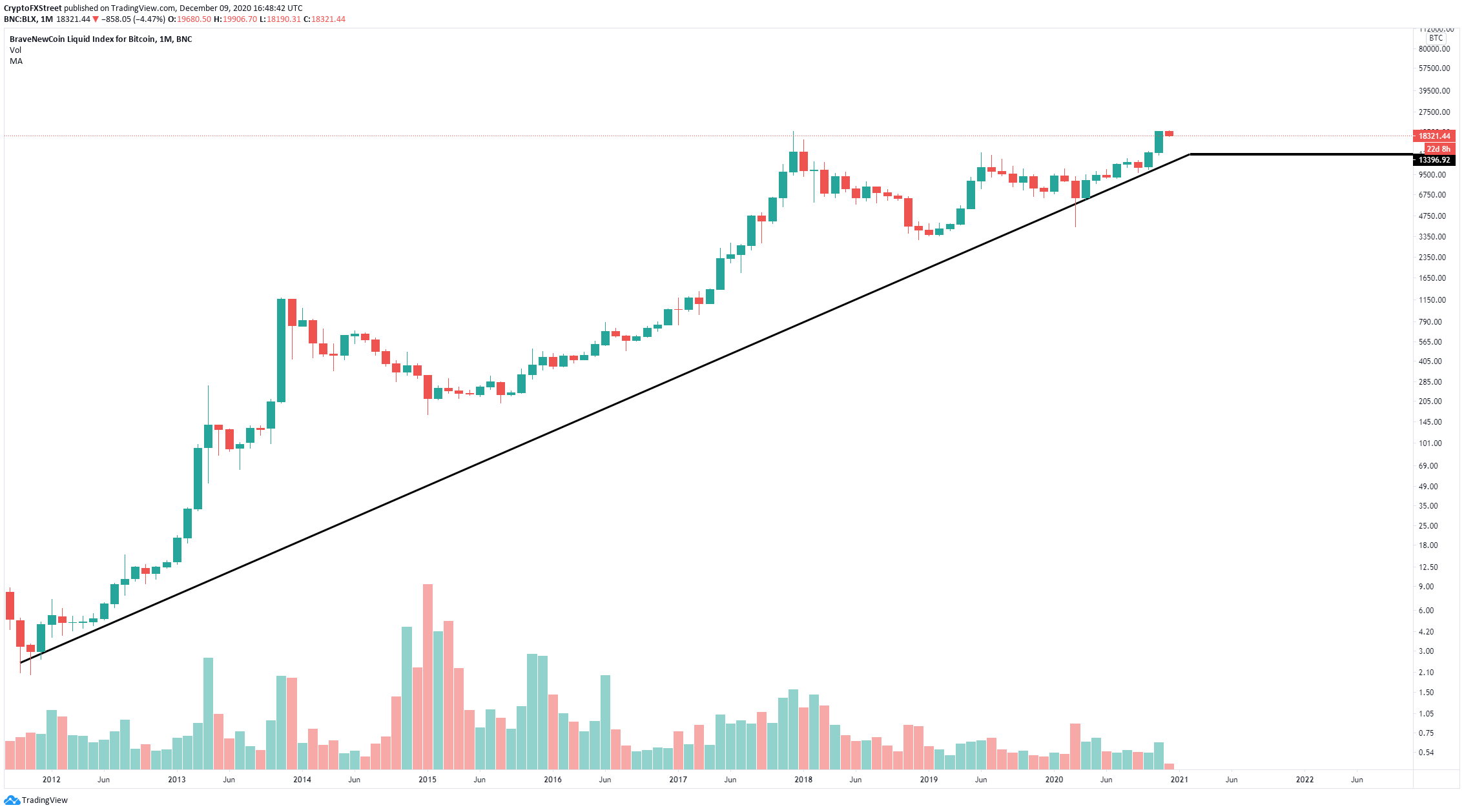

Bitcoin price could target $13,000 before resuming long-term uptrend

On the monthly chart, Bitcoin has established a long-term trendline support that is currently located at around $13,000 in case of a sell-off. Many analysts have stated that this level could be a potential target for the flagship cryptocurrency after topping out at the last all-time high.

BTC/USD monthly chart

The most recent weekly report by Glassnode also states that Bitcoin may need to see a correction before a sustained move above $20,000. BTC bears seem to be generating a lot of selling pressure in the short-term as Bitcoin established a potential double top on the monthly chart.

Additionally, it seems that the number of older coins moving is increasing which generally indicates that investors are looking to sell and realize profits. This is yet another factor in favor of BTC bears in the short-term.

However, Willy Woo, a popular analyst on Twitter, still believes Bitcoin is poised to hit $200,000 by the end of 2021 and up to $300,000, stating that his initial prediction might be conservative and that the current market has paid around $7,456 on average per coin.

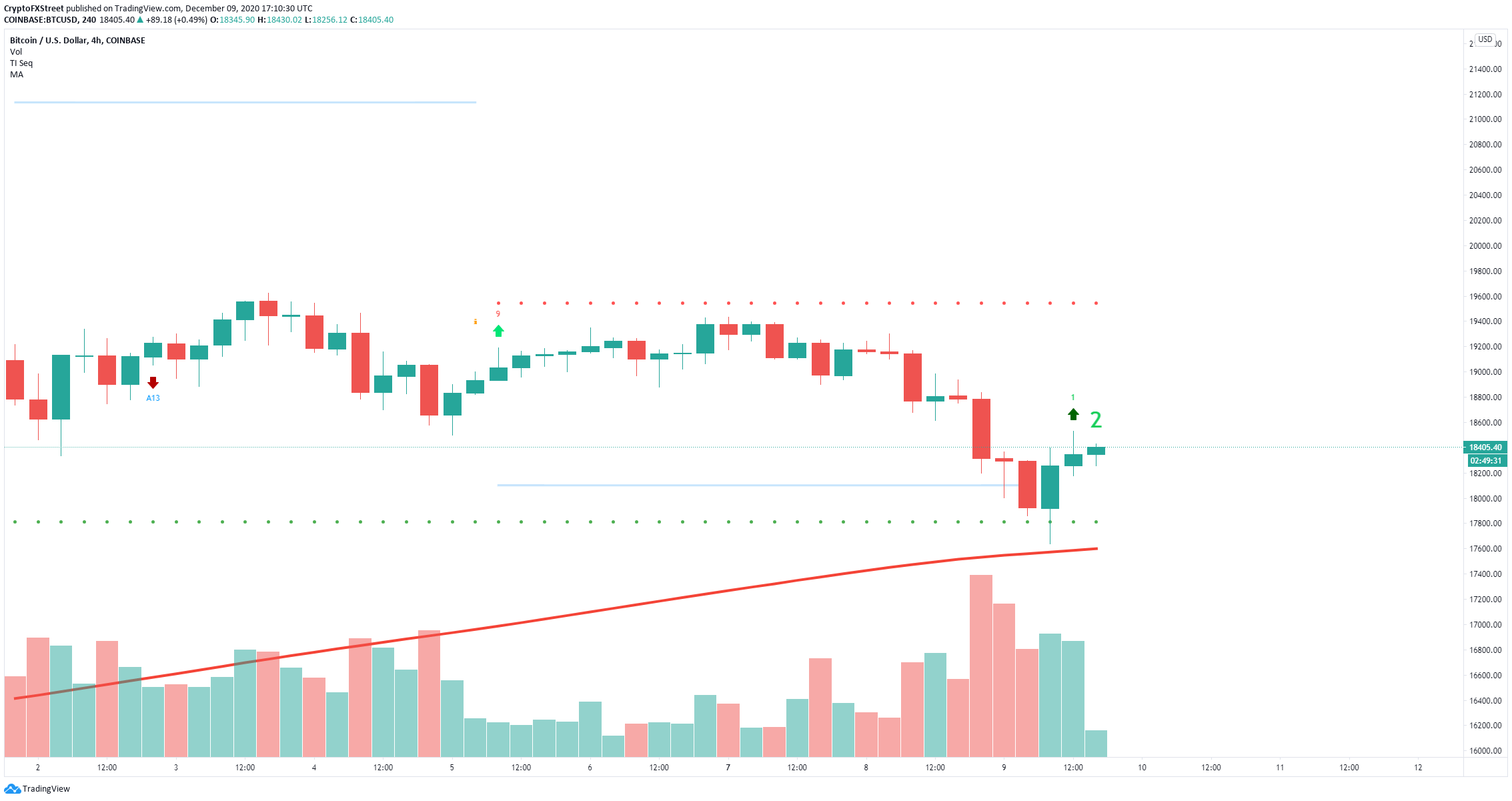

BTC/USD 4-hour chart

On a shorter time frame like the 4-hour chart, the TD Sequential indicator has just presented a buy signal that seems to be getting bullish continuation after defending the 200-SMA as a support level. Bitcoin bulls aim for $19,000 as a rebound price.