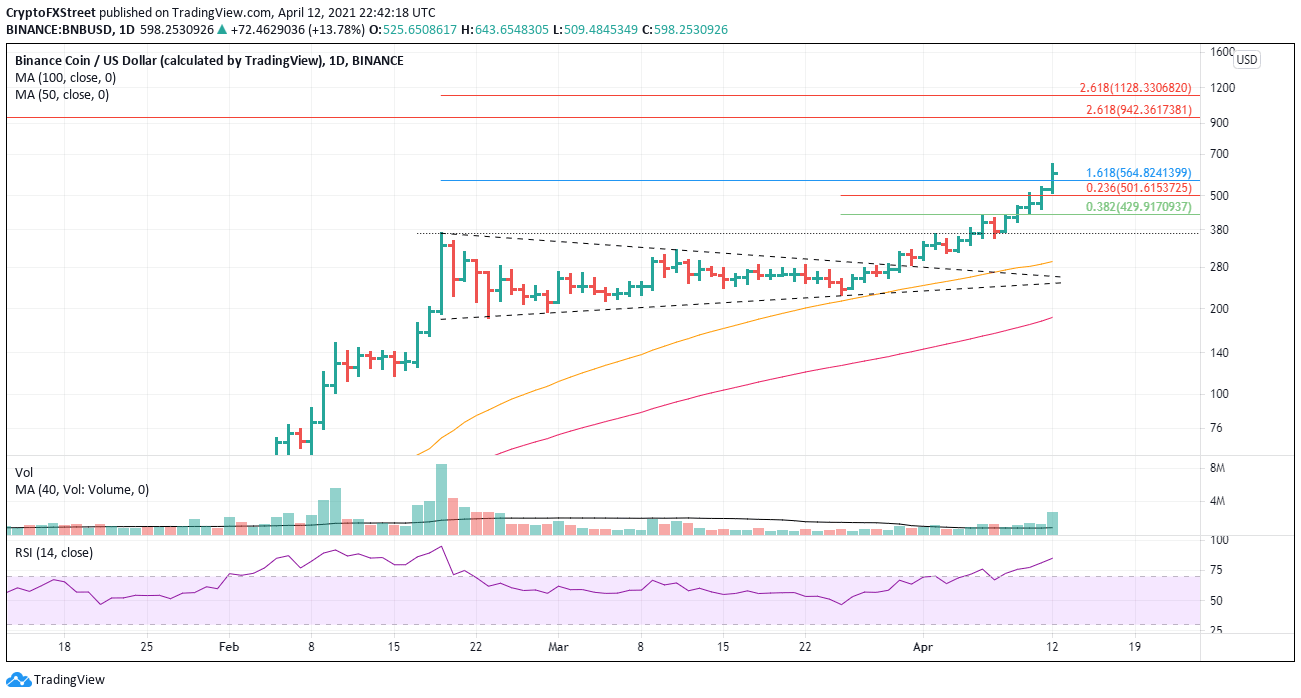

- Binance Coin price extending the symmetrical triangle breakout of March 30.

- New tokenized stock trading service allows users to buy fractions of companies’ shares.

- Largest daily volume since February 21.

Binance Coin price increase in 2021 reflects the rise of BNB from a simple utility token to something much more complex and useful for traders. The token’s momentum is slightly extended on an absolute basis, but relative to the February highs, there is still more upside potential, even for a blow-off move.

Binance Coin price betting BNB can facilitate billions of transactions per day

Today, the cryptocurrency exchange Binance allows users to buy fractions of Tesla shares on their website with no commissions. Users can buy as little as one-hundredth of a Tesla share, with prices settled in Binance USD as expected.

It is not the first tokenized stock play in the cryptocurrency world, as Mirror Protocol started this process in December 2020, as well as other platforms such as Terra and Synthetix. However, there is a big difference. Mirror uses synthetic stocks or tokenized representations of real stocks, while Binance is “backed by a depository portfolio of underlying securities,” which is managed directly by an investment company based in Germany.

Until the end of March, BNB was strongly correlated with Bitcoin, but it is now up almost 130% since the March 30 symmetrical triangle breakout, and BTC is more or less unchanged.

In an FXStreet article on April 6, we projected that the token would consolidate gains in time versus price before resuming the uptrend, and that has been the case. Today, Binance Coin price shredded the 161.8% Fibonacci extension of the brief February correction at $565 and looks positioned to continue the rally to the 261.8% extension of the 2019-2020 bear market at $942, and even to the 261.8% of the February correction at $1,128.

BNB/USD daily chart

A brief consolidation could emerge at any time for the latecomers. Still, based on the indicators and metrics, it should be relatively mild, taking BNB down to the 23.6% retracement of the rally from the March 25 low at $502. The 38.2% retracement at $430 should contain any further weakness