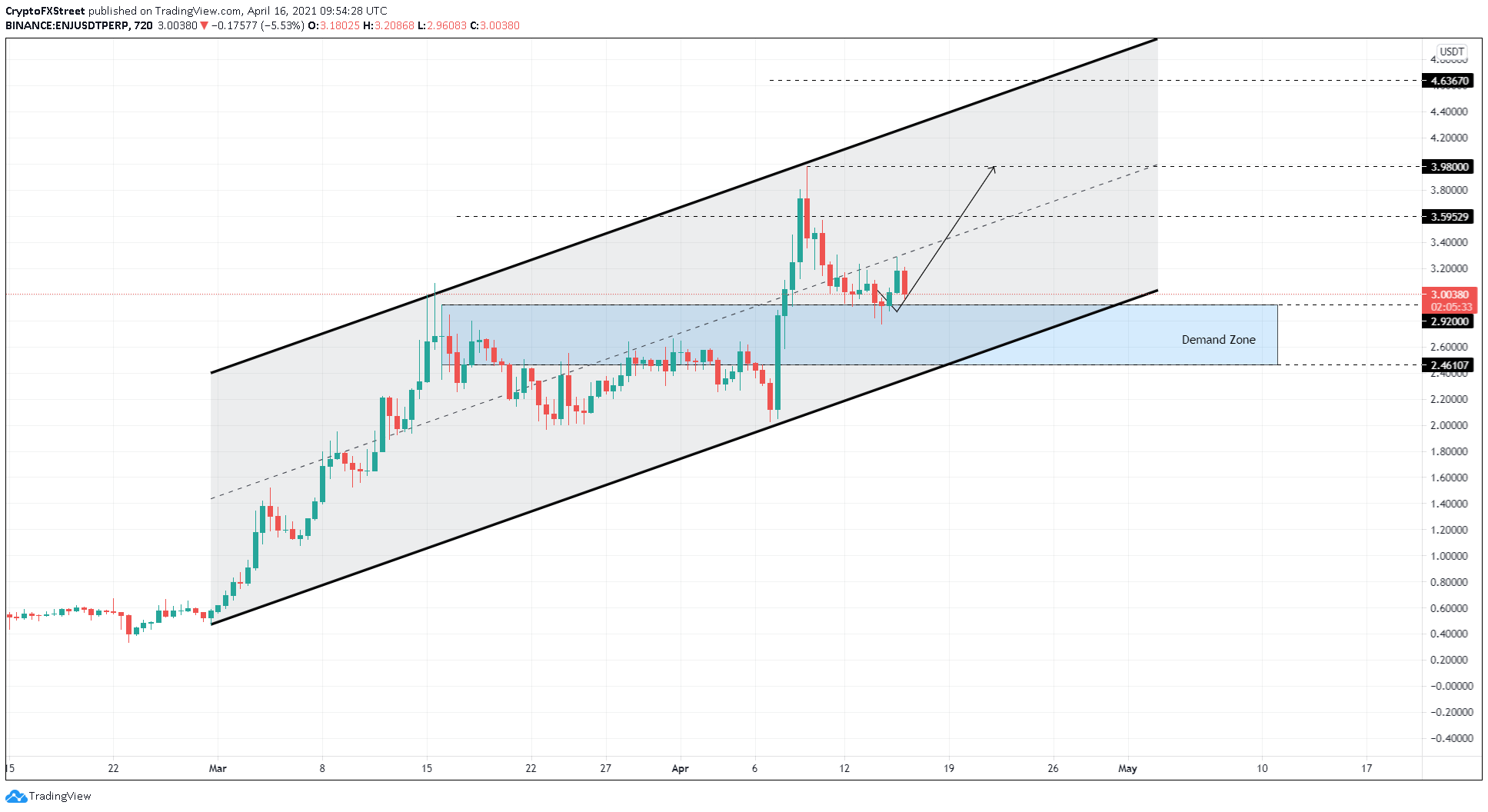

- Enjin Coin price is trading around the middle line of an ascending parallel channel.

- A bounce from the demand zone ranging from $2.92 to $2.46 signals a continuation of the upswing to $3.59.

- If ENJ slices through the supply barrier at $3.59, an additional 10% upswing will push it to $3.98.

Enjin Coin price is limping at the center of a technical pattern and could rally toward a crucial supply barrier if buyers pile up.

Enjin Coin to give upswing another try

Enjin Coin price has rallied nearly 535% since February 28 as it set up multiple higher highs and higher lows. When trend lines are drawn connecting these swing points, an ascending parallel channel is formed.

At the time of writing, ENJ is trading around $3.03, vying for an upswing toward the upper boundary. The supply zone ranging from $2.46 to $2.92 was recently flipped into the demand zone as Enjin Coin price surged nearly 100% from April 7 to April 9.

Investors can now expect a healthy retest of this area before heading higher. The immediate resistance level formed after the 96% upswing in price between April 7 and April 9 at $3.59 is the first level Enjin Coin price will most likely target. If the market participants refrain from booking profits here, ENJ might rise 10% to hit the recently formed top at $3.98.

Adding credence to the bullish narrative is the Momentum Reversal Indicator’s (MRI) reversal signal presented in the form of a green ‘one’ candlestick on the 12-hour chart. This technical formation indicates the exhaustion of a downtrend and the start of a new uptrend. The setup also forecasts a one-to-four candlestick upswing.

ENJ/USDT 12-hour chart

On the other hand, a potential spike in selling pressure that pushes ENJ price down to slice through the lower boundary of the demand zone at $2.46 will threaten the bullish thesis.

If Enjin Coin trades below this level for an extended period, a 15% crash to $2.11 seems likely.