- XLM price has erected an ascending parallel channel on the 4-hour chart.

- A bounce from the setup’s lower trend line, although logical, seems unlikely.

- Stellar’s bear flag pattern on the 1-hour chart adds weight to the bearish outlook.

XLM price has slid into consolidation after a brief upswing. Technicals present a bearish outlook for the coin due to mounting pressure from overhead barriers.

XLM price at an inflection point

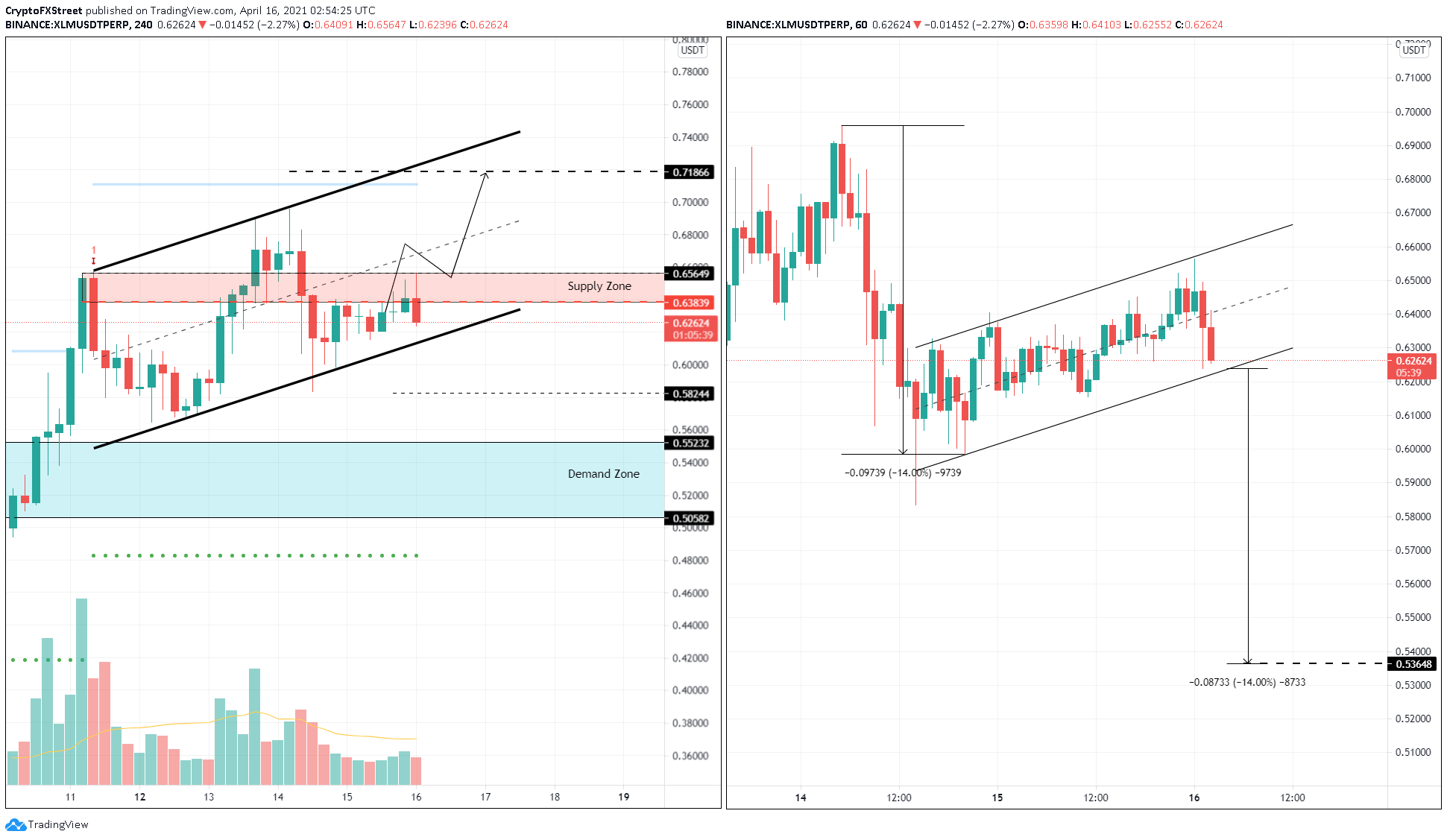

XLM price surged nearly 36% between April 10 and 11, resulting in a local top at $0.65. Since reaching this point, Stellar has created higher highs and higher lows, which results in an ascending parallel channel when the swing points are connected using trend lines.

Since April 14, XLM price has been trading close to the channel’s lower boundary at $0.62. Any attempts from the bulls aiming to head toward the upper trend line have failed due to the supply zone ranging from $0.63 to $0.65. Therefore, an exhaustion of the buying pressure will be fatal for the remittance token.

If this price swing slices through the lower trend line at $0.61, it will kickstart a new downtrend. Supporting this bearish move is the formation of a bear flag on the 1-hour chart.

This setup is a continuation pattern that contains a large crash in XLM’s market value, known as a flagpole, followed by a consolidation called the flag.

A breakdown of the lower trend line of the flag at $0.62 will signal the start of a 14% downtrend, which is obtained by adding the flagpole’s height to the breakout point.

This move places XLM price at $0.53, deep within the demand zone, extending from $0.55 to $0.50.

While the bearish scenario seems logical due to the multi-timeframe analysis, a potential spike in buying pressure due to an unforeseen event could breach the supply zone. Such a move would invalidate the bearish scenario and trigger the buyers to make a move.

Under such circumstances, XLM price could rise 9.5% to tap the channel’s upper trend line at $0.71, which coincides with the Momentum Reversal Indicator’s breakout line.