- Societe Generalewill launch a security token through Tezos.

- This is not the first security token issued by the French multinational investment bank.

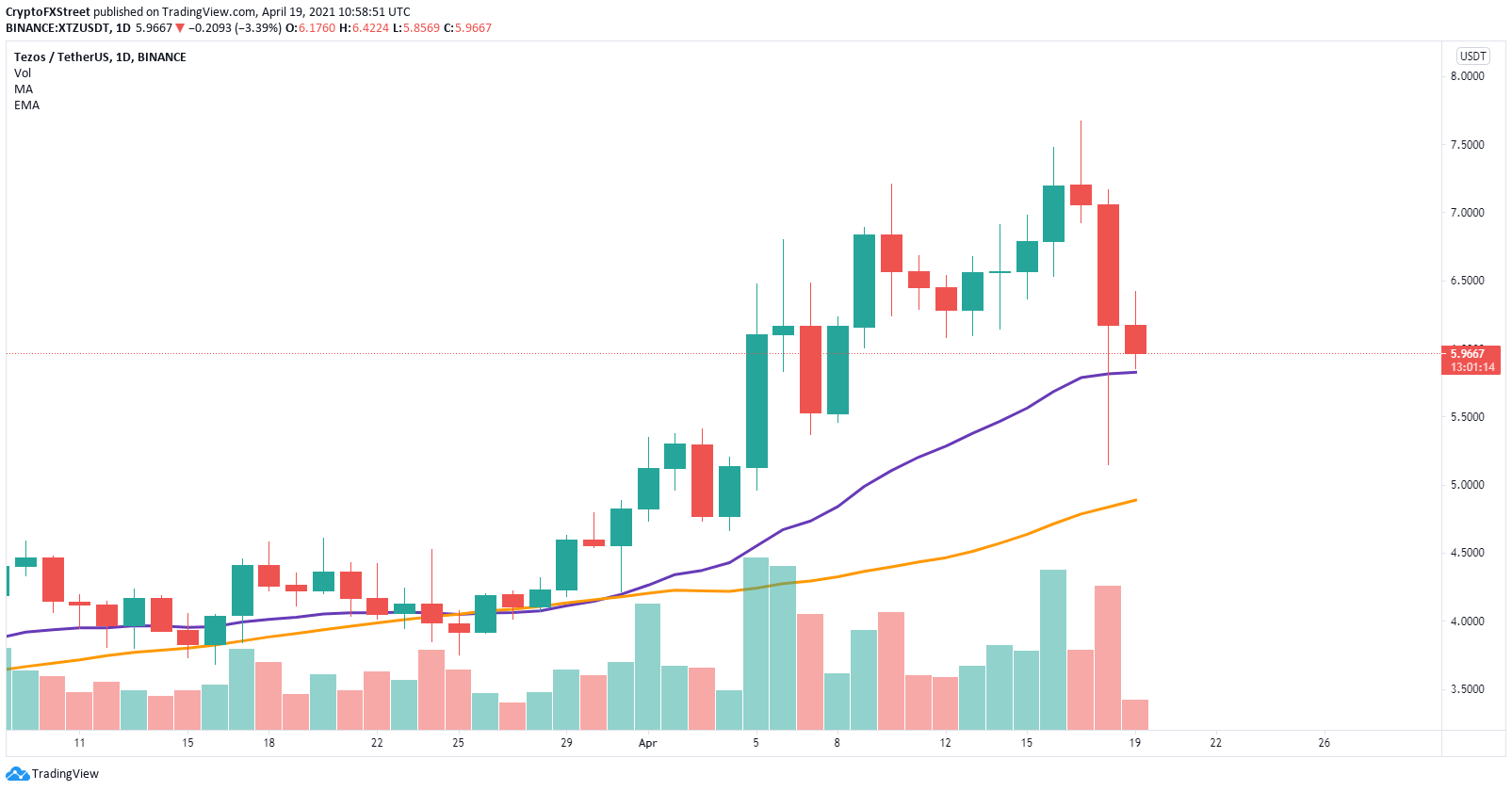

- Tezos price has defended a key support level.

Societe Generale announced its third security token offering on April 15th, this time through Tezos’ blockchain. The digital asset had a significant move after the announcement, gaining 8%, but has retraced in the past three days.

Tezos will launch a security token for Societe Generale

Societe Generale, also known as SocGen, is a French multinational investment bank that has already issued two security token offerings (STO) in the past.

The first STO was worth 100 million Euro on the Ethereum blockchain, and the second settled in the central bank digital currency (CBDC) issued by Banque de France.

This time around, Societe has chosen the Tezos blockchain to launch a new security token and stated that it will be part of the development process of the bank. The STO should go live by 2022.

This new experimentation, performed in accordance with best market practices, demonstrates the legal, regulatory and operational feasibility of issuing more complex financial instruments (structured products) on public blockchain.

Societe Generale has created Forge, which is a new operating model for STOs, intended to offer and issue cryptocurrency assets for professional clients.

Tezos price must stay above key support level

Tezos price has suffered a major 33% sell-off in the past three days but has managed to hold above the 26-EMA support level.

XTZ/USD daily chart

There isn’t a lot of resistance on the way up, which means a rebound from the 26-EMA could push Tezos price toward the previous high at $7.67 as there is weak resistance ahead.

However, a daily close below the 26-EMA would be significant and could drive XTZ down to the 50 SMA at $5.