The bitcoin price is having a torrid time of late and despite some encouraging news flow emanating from El Salvador it has not been enough to act as a counterweight to the goings on in China.

In case anyone was in any doubt, China made it crystal clear today. The People’s Bank of China has instructed all banks to track down all crypto-related transactions and the accounts initiating those transactions.

The banks include the three main commercial banks Agricultural Bank of China, China Construction Bank and ICBC as well as non-bank payments giant Alipay and similar companies.

All the banking and payments institutions have been told to “investigate and identify” accounts involved in crypto transactions.

China banned crypto exchanges in 2017 but the over the counter market has remained active and by using virtual private networks, traders have been able to access offshore trading venues.

Bitcoin price: Crushing crypto to clear way for the digital yuan

The Chinese authorities are getting ready to launch the digital yuan central bank digital currency and want to be sure crypto has been crushed as a serious digital competitor before that happens.

Short of turning off the internet, crypto trading will likely be impossible extinguish entirely, such is the nature of decentralized systems, but the clampdown will certainly have the effect of draining liquidity from what remains of the market.

The troubles emanating from China don’t stop at what the government sees as wild speculation with the potential to undermine the financial system. Local government has been ordered to shutter bitcoin mining in their provinces and that too stepped up a gear these past few days.

China mining exit is ultimately bullish for bitcoin

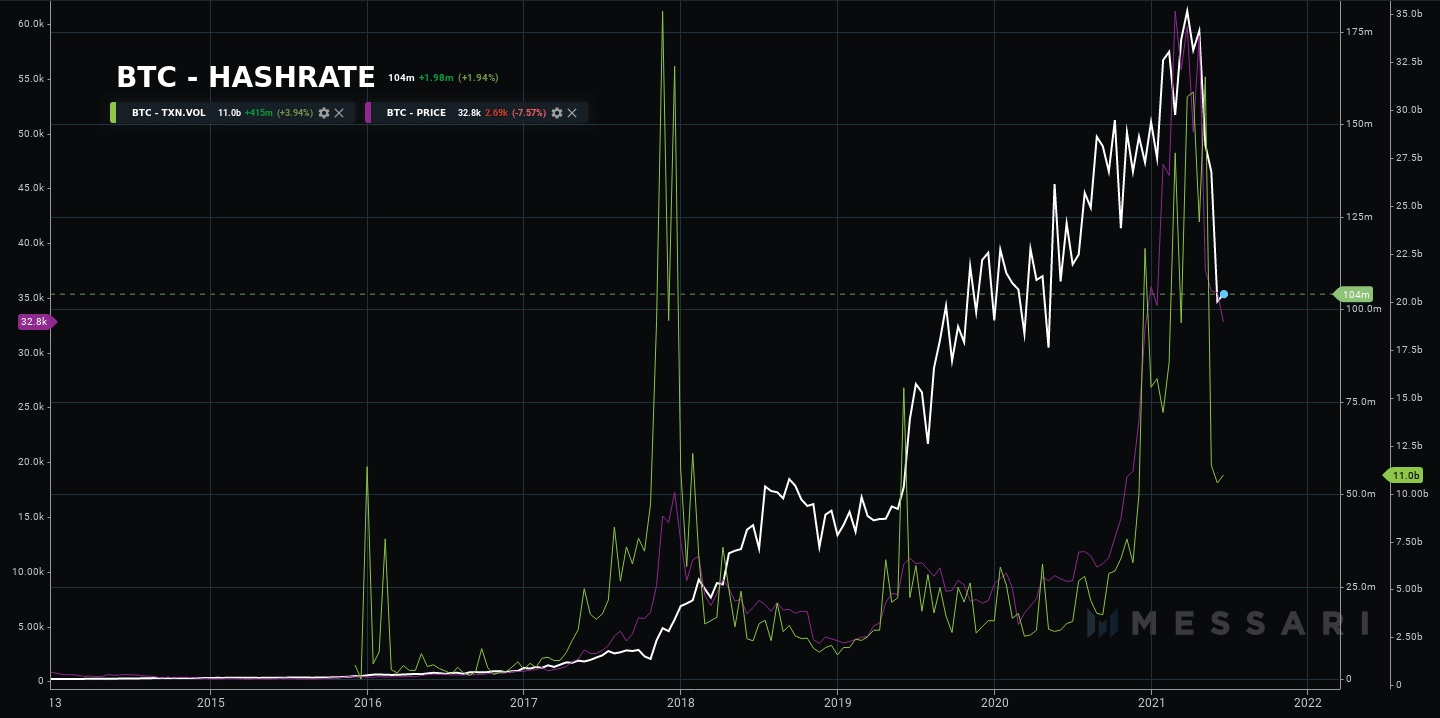

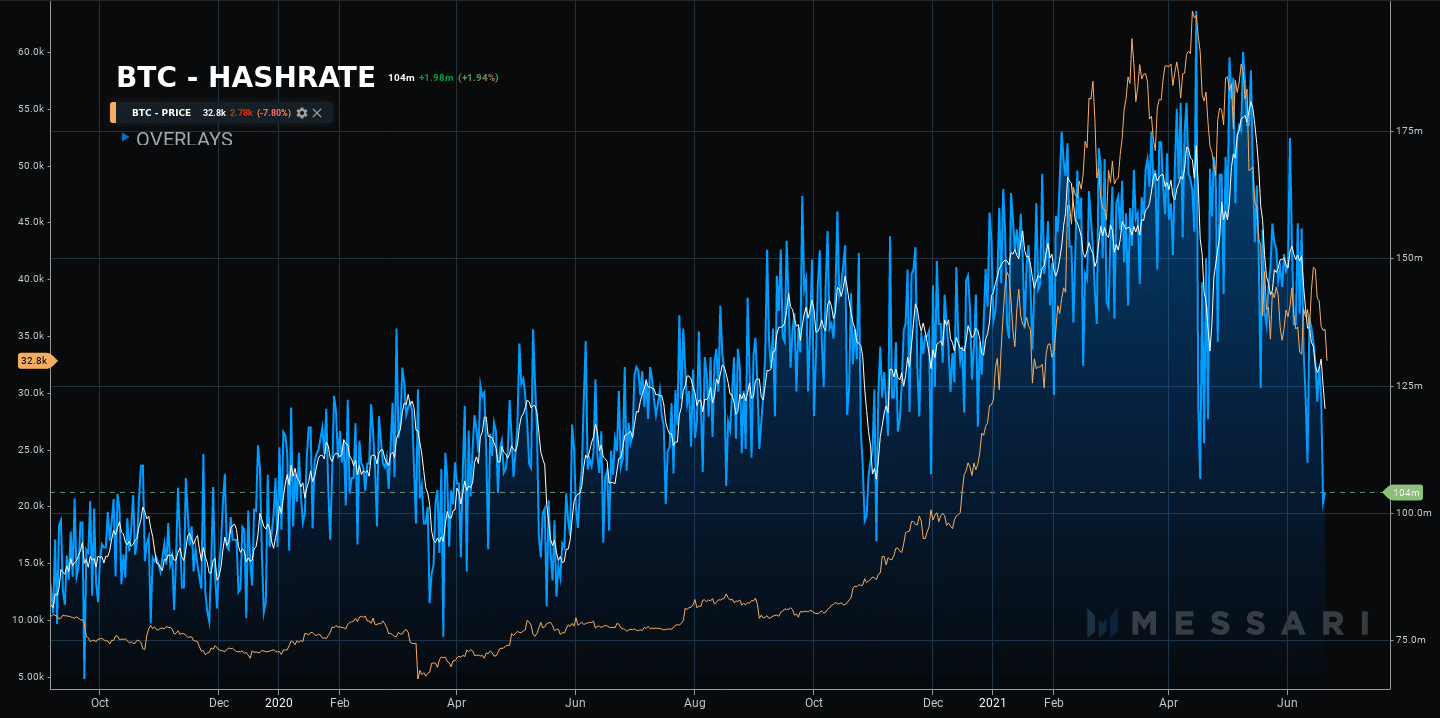

While China once accounted for as much as 75% of all mining globally, judging by the precipitous decline in the hashrate, the plug has now been pulled on most of the large mining farms, be they coal powered or hydro.

Sichuan province was home to the majority of hydropower-based miners and has now seen operations closed, with the same happening to miners in Xinjiang, Yunnan and Qinghai.

But the exit of China from the mining scene is a net positive for bitcoin. First, it means the network becomes less centralized and, secondly, it could become much greener in terms of its energy usage in the transaction verification process.

Also, when the hashrate falls the difficulty also drops to compensate, making it cheaper (less computing power required) to mine bitcoin.

Bitcoin hashrate plummets

Many miners had seen the writing on the wall and have been shipping equipment out of the country. Others are thought to have been selling their bitcoin in order to raise liquidity to set up operations elsewhere, pressuring the price of bitcoin lower.

Bitcoin transaction volumes drop

Bitcoin has also seen the steepest drop in transaction volume since 2018, when the last bear market kicked in.

BTC/USD Technical analysis

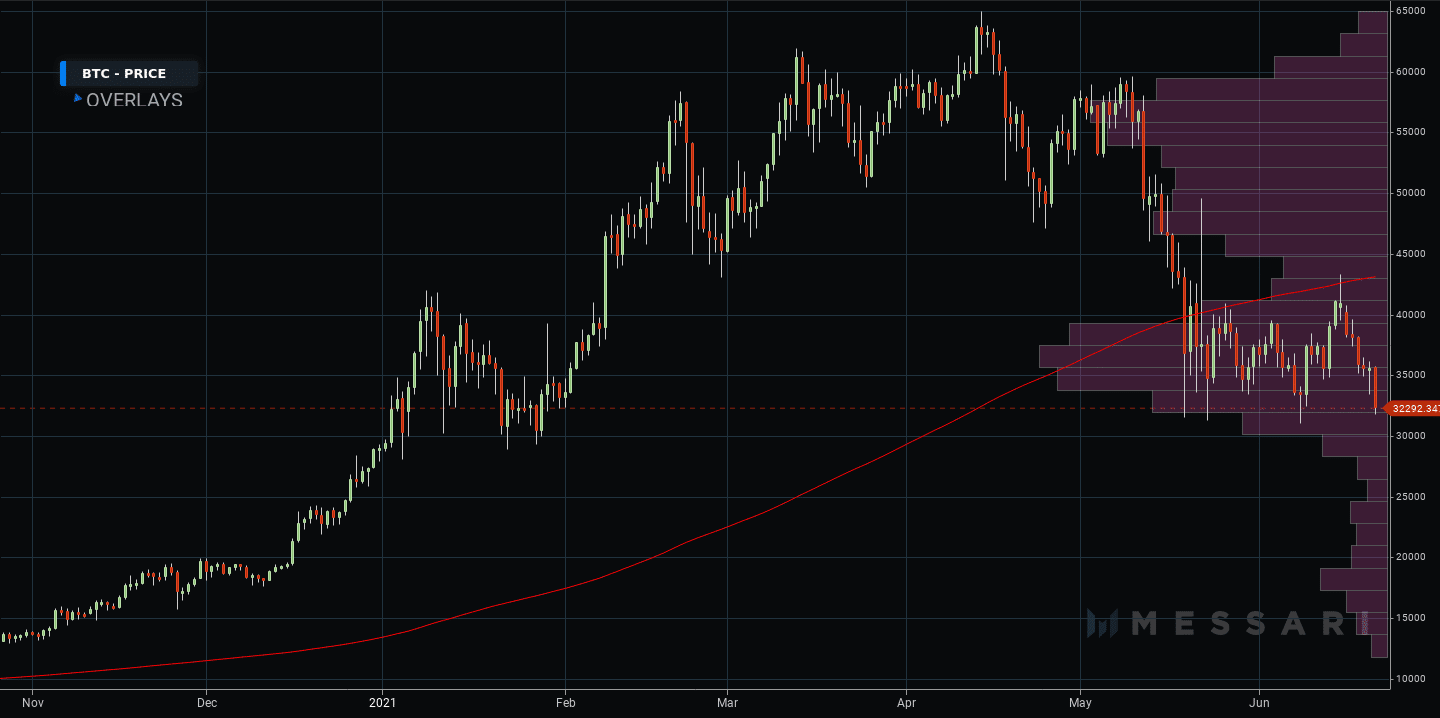

Bitcoin is currently trading at $32,292 with all eyes on the $30k level. The price has previously bounced off support in the low $30,000s but the longer the price languishes at the currently lowly levels the worse it is for bulls.

Volume profile, which unlike the normal transaction volumes that tell traders the volume at certain dates and times, this indicator provides data on trading volumes at certain price points, and tends to be favoured by pro traders.

On the volume profile below, the data shows less trading interest at current price levels and that could be indicative of the next move being a strong challenge of the $30k support.

But it would be remiss not to finish a look at the technicals without mentioning the death cross, where the 50-day moving average crosses below the 200 MA. This event could become a self fulfilling prophecy, with the technical event presumed to be signal for selling, which encourages selling.

However, bulls have better reason to hold by support at $30k, which was last successfully defended in February, and since then big cryptocurrency buyers in the shape of whales and institutions have tended to enter the market at those levels.

Get Free Bitcoin Signals – 82% Win Rate!

3 Free Bitcoin Signals Every Week – Full Technical Analysis