Bitcoin miners are being squeezed from both directions right now. The pincer movement comes in the form of attacks on price and transaction fronts. Although miners’ defences may not be overwhelmed just yet, the ramparts are being assailed.

Instead of looking for the next cryptocurrency to explode, entering the mining industry had seemed like a surer investment. Those calculations may be changing now.

Revenue from mining activities on the Bitcoin and Ethereum networks dropped by 42% and 53% respectively last month, according to The Block’s Data Dashboard.

Bitcoin miners amassed revenue amounting to $839 million in May, down from $1.45 billion in May

According to The Block’s Data Dashboard, Bitcoin miners raked in $839 million in revenue during June, compared to $1.45 billion in May.

At the root of the problem for bitcoin miners is the falling transaction volumes. They have fallen from a year to date high of 392k in January to 210k yesterday (30 June 2021), which is a level last seen in August 2018. Less transactions means less fees for miners as well as less blocks to be mined overall and therefore less in block rewards too.

Bitcoin miners – transaction volume decline hurts

As tx volume and fees have fallen soo too has the hashrate as miners exit. But as crypto watchers will know, the by far the largest impact on the hashrate was the shutdown in China, as they authorities moved to squeeze crypto miners out of the demands profile for energy consumption in the country.

On 28 June the hashrate slumped to a YTD low of 58.98 to on 28 June to 76.1 yesterday (30 June). The hashrate topped out at an all-time high of 171.3E on 13 May – a 55.5% relapse.

The next difficulty adjustment is not for another 23 days so this will also impact revenues negatively until the difficulty is reduced to compensate for the fall in hashing power on the network.

The drop in tx volumes has pressured lower the proportion of revenue miners receive in fees as opposed to block rewards, which is now at 5% (9% in June)

Ethereum miners revenue sliding too

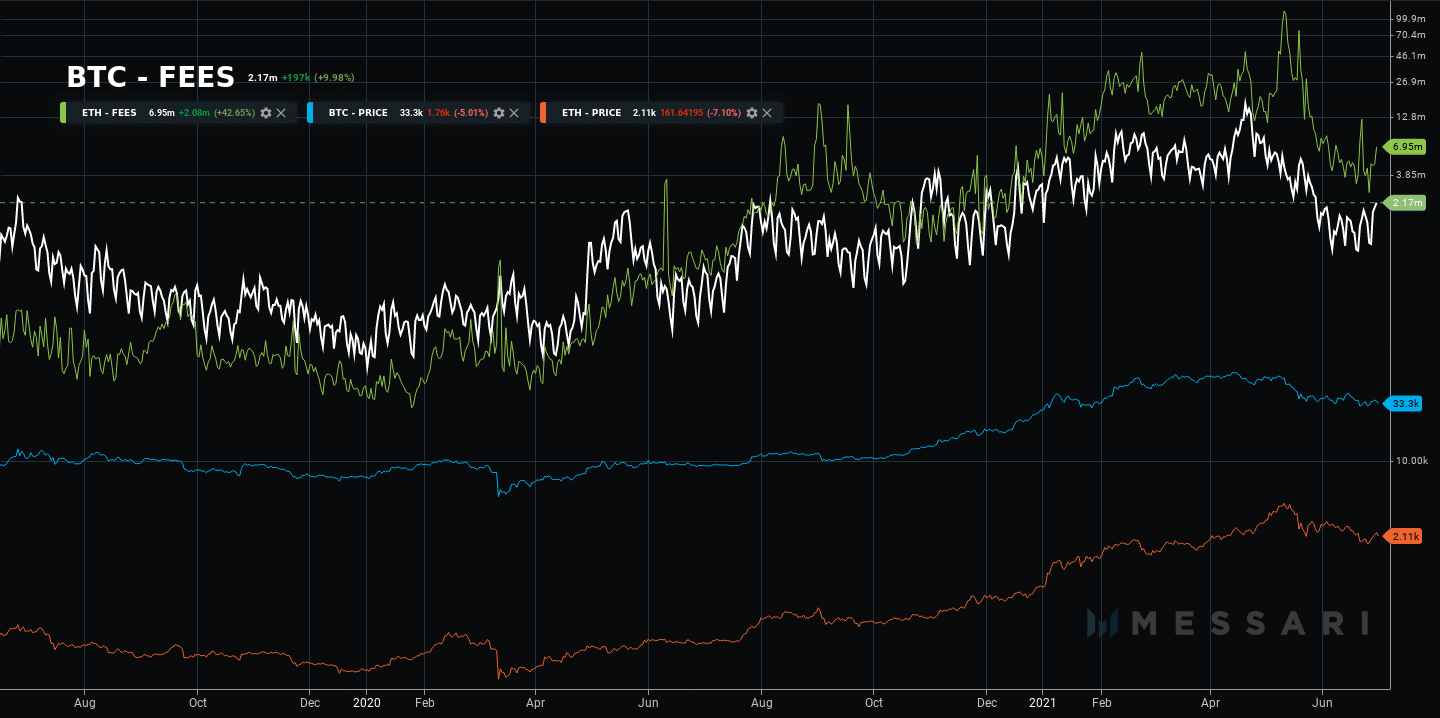

Ethereum miners have had a good year, up to now. Ethereum fell as much as 8% today, and that will further undermine miner revenues, but throughout the whole of this year Ethereum miner fee revenues have exceeded those of Bitcoin. As you can see in chart below, this is the first time this has happened. However, the yawning gap opened up in May is now closing as the spread on mining fees between the top two cryptocurrencies narrows.

The all-time high in revenues topped out at $2.35 billion as transaction volume boomed as a result of the popularity of DeFi and NFTs. But in June earnings fell by more than a half to $1.1 billion, with the pincer of waning token price and shrinking tx volumes crimping revenue. Block subsidy payments accounted for $940 million, with gas fees making up just 15% of the total at $166 million in the month of June.

Mining economics are set to worsen in August when the EIP 1559 update goes through, which will lower the cost of transactions on the network through the introduction of a base fee and an inclusion fee – the latter effectively being a tip paid to miners.

To give some context to the relative collapse in mining revenues, it should be borne in mind that current levels are still higher than they were in December last year.

Also despite the price reversal suffered by Dogecoin, it has come from nowhere in the mining game to third place by revenue, bringing in $3.6 million on the daily data today.

With the numbers looking to buy cryptocurrency in decline, the miners could have more hard times to come, but the sensible ones will have built up their cash reserves.

Cryptoassets daily mining revenue, sorted by highest amount, 1 July 2021

| Cryptoasset | price ($) | % Change 24Hr | Algorithm | HashRate | Mining Revenue ($) |

|---|---|---|---|---|---|

| Ethereum | 2118 | -0.79 | Ethash | 455 TH/s | 31,573,040 |

| Bitcoin | 33416 | -3.83 | SHA-256 | 92652 PH/s | 13,509,295 |

| Dogecoin | 0.255 | 1.62 | Scrypt | 208 TH/s | 3,649,272 |

| Ethereum Classic | 53.30 | -9.45 | Ethash | 874,702 | |

| Litecoin | 135.9 | -3.50 | Scrypt | 197 TH/s | 734,451 |

| Bitcoin Cash | 492 | -3.95 | SHA-256 | 1915 PH/s | 392,007 |

| Zcash | 120 | -4.14 | Equihash | 5 GH/s | 307,347 |

| Decred | 135 | -4.15 | BLAKE-256 | 77 PH/s | 267,369 |

| Dash | 135 | -2.57 | X11 | 3 PH/s | 185,829 |

| Monero | 208 | -4.66 | RandomX | 149,874 | |

| Bitcoin SV | 139 | -5.78 | SHA-256 | 574 PH/s | 127,545 |

| DigiByte | 0.045 | -3.45 | Scrypt, SHA256, Qubit, Skein, Groestl | 6 TH/s | 124,856 |

| Grin | Cuckoo Cycle | 55,833 | |||

| Bitcoin Gold | 52.2 | -3.20 | Equihash-BTG | 2 MH/s | 36,296 |

| Vertcoin | 0.560 | -4.51 | Lyra2RE | 7,837 | |

| Verge | 0.022 | -4.81 | Scrypt, Myr-Groestl, ZPool, Lyra2Rev2, Blake2s, x17 | 4 TH/s | 4,210 |

However, there could be a silver lining for miners in the shape of the restructuring set in train by the shutting down of mining in the cheap energy regions of China. Chinese miners have been shipping hardware out of the country to set up elsewhere or simply selling equipment on to third parties. But as can be seen in the chart, hash rate has moved back up since the shock.

And with less miners contributing hash power on the network, the difficulty mechanism will kick in to make it more cost-effective to mine bitcoin.

The next adjustment is in 16 days’ time on 17 July and she see a reduction of about 10%.

Looking to buy or trade Bitcoin and Ethereum now? Invest at eToro!

Capital at risk