- Gold remains supported after Friday’s NFP.

- Delta virus strain and declining US treasuries yields are keeping the gold underpinned.

- However, any rise in the Dollar will hamper the rise in gold.

Towards the end of the week, XAU/USD were supported by a decline in the yield of 10-year US bonds to 1.45%, as well as a weakening of the American currency, which had previously jumped to a 3-month high.

Also, bumpy statistics from the US labor market, published on Friday, became fertile ground for the growth of the yellow asset.

According to the latest data, the number of new jobs outside agriculture rose to 850k last month. The figure exceeded the predicted value of 700k.

At the same time, the unemployment rate turned out to be higher than forecasted. Analysts had predicted it would fall to 5.6% from 5.8% in May. However, the indicator fell short of expectations and jumped to 5.9%.

Another powerful catalyst for the growth of gold these days is the tense pandemic situation in the world. A new strain of the Delta coronavirus is actively spreading in several Asian countries. This slows down their economic activity but positively affects the value of safe-haven assets, which traditionally include the main precious metal.

With such fertile ground for growth, gold could return to its highs on June 23 Friday. The asset gained 0.4%, or $ 6.50. Its final price on the Comex New York Stock Exchange was $ 1,783.30.

The yellow metal gained 1.2% for three consecutive sessions. Its upward trend last week was the longest since May 26.

An excellent illustrative example was the situation on the precious metals market last summer. Then the yield on American bonds fell to 0.5%, which was a historical minimum for the indicator. At the same time, the price of gold, on the contrary, jumped to a record high of $2,063 per ounce.

Also, analysts predict the strengthening of the US dollar. In their opinion, the DXY greenback index could grow by 3% and approach 95. This will be facilitated by symptoms of an earlier rollback of the Fed’s loose monetary policy.

Of course, in this situation, gold will not be able to hold its current position. Moreover, higher yields on US bonds and a stronger dollar will put significant pressure on the yellow metal.

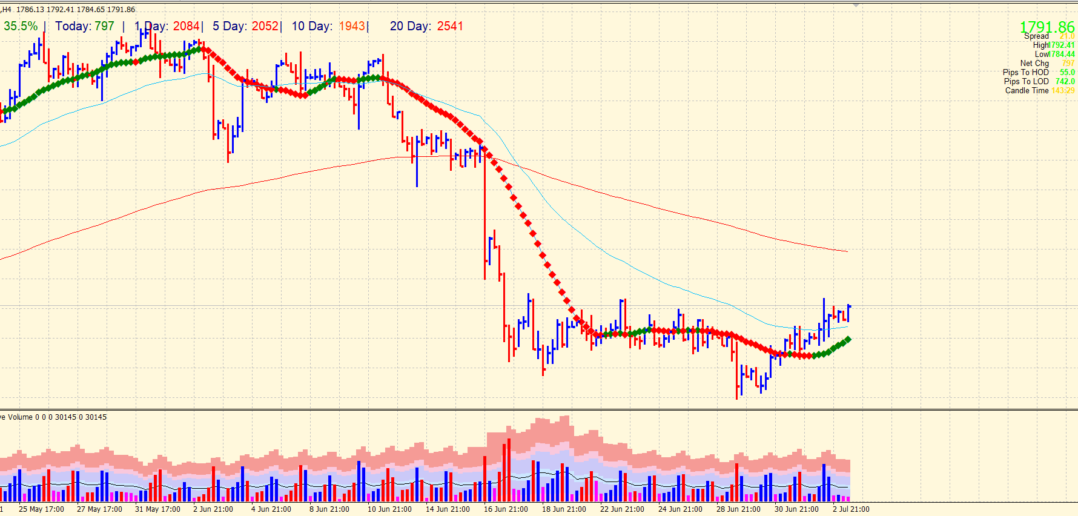

XAU/USD technical view: What’s in for the day?

Gold is positive on the day breaching above the 50-SMA on the 4-hour chart. The pair has already covered 35% ADR on the day. The immediate hurdle for the day is at $1800 ahead of $1816. We have higher odds of price to move towards the $1800 area. On the flip side, look for immediate support around $1773 ahead of $1750.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.