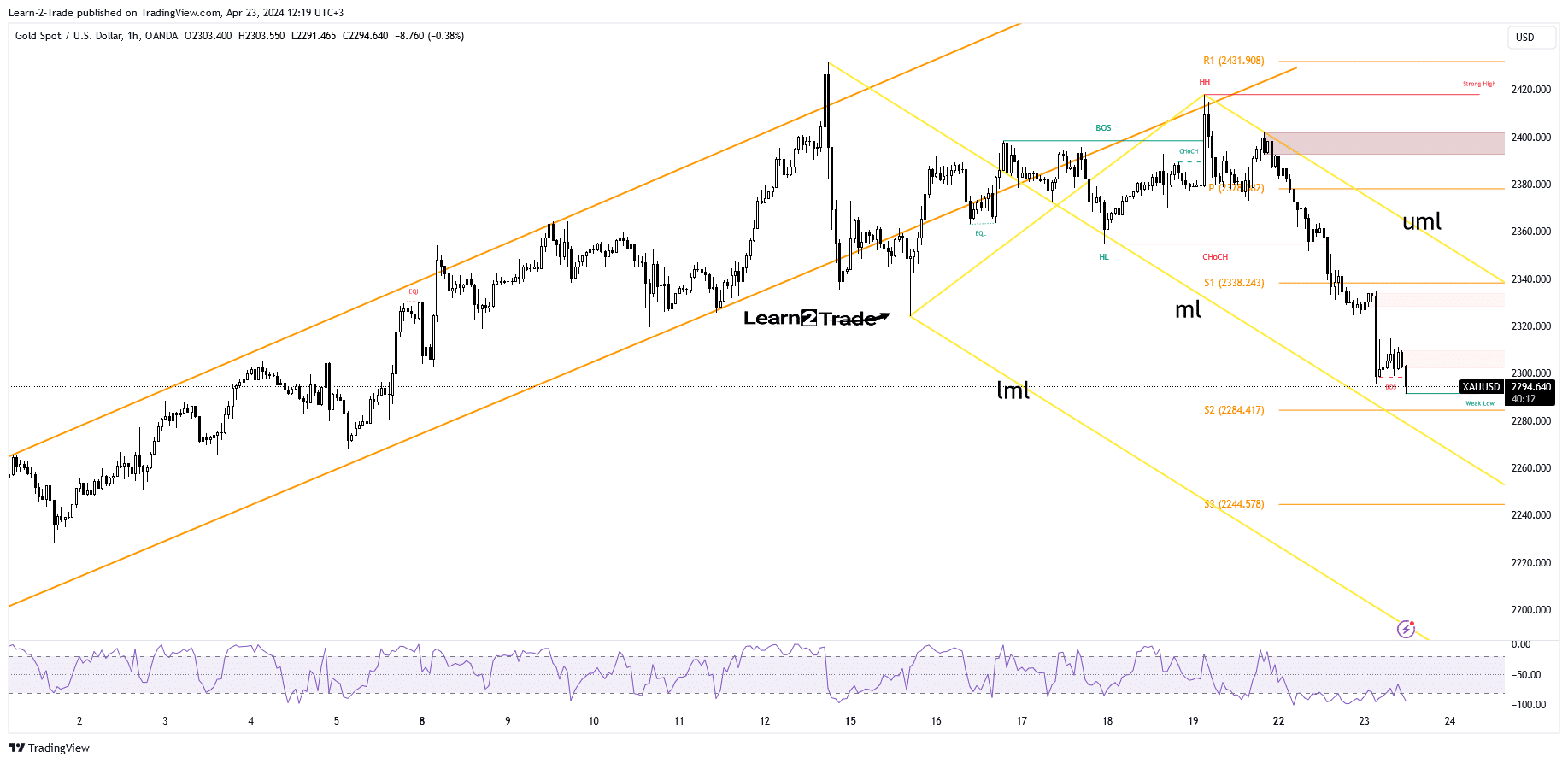

- Escaping from the up channel announced a potential leg down.

- Taking out the immediate downside obstacles opens the door for more declines.

- The US data could change sentiment in the short term.

The gold price tumbled after failing to retest the new all-time high of $2,431 and is now trading at $2,294 at the time of writing.

The bias has turned bearish in the short term. So, the XAU/USD could hit new lows despite a slightly weaker dollar.

–Are you interested in learning more about STP brokers? Check our detailed guide-

Today, the fundamentals should be decisive and may shift the sentiment. The French Flash Services PMI came in at 50.5 points above the 48.9 points expected versus 48.3 points in the previous reporting period, confirming expansion.

In comparison, German Flash Services PMI jumped from 50.1 points to 53.3 points, beating 50.6 estimates, announcing further expansion.

On the contrary, the French Flash Manufacturing PMI and German Flash Manufacturing PMI remained deep in the contraction territory.

Furthermore, the Eurozone and UK Flash Services PMI came in better than expected, while the Flash Manufacturing PMI came in worse than expected.

Later, the US data should move the markets. Flash Manufacturing PMI and Flash Services PMI indicators are expected to come in better than the previous reporting period.

In addition, the New Home Sales and Richmond Manufacturing Index data will be released as well. Only positive US figures could save the greenback from the downside.

Gold Price Technical Analysis: Aiming for Median Line

From a technical point of view, gold entered a corrective phase after retesting the major uptrend line. The price escaped from the up channel, confirming a potential leg down.

-Are you looking for automated trading? Check our detailed guide-

Taking out the weekly pivot point at $2,378 opened the door for a larger drop. Now, it has ignored the weekly S1 (2,338) and is almost to hit the weekly S2 (2,284) and the median line (ml). These represent important downside obstacles. Taking out these support levels validates more declines ahead.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money