- The long-term recovery in gold remains capped at $1815.

- Gold’s safe-haven appeal keeps the demand underpinned.

- Fed’s recovery hopes can raise demand for the US Dollar.

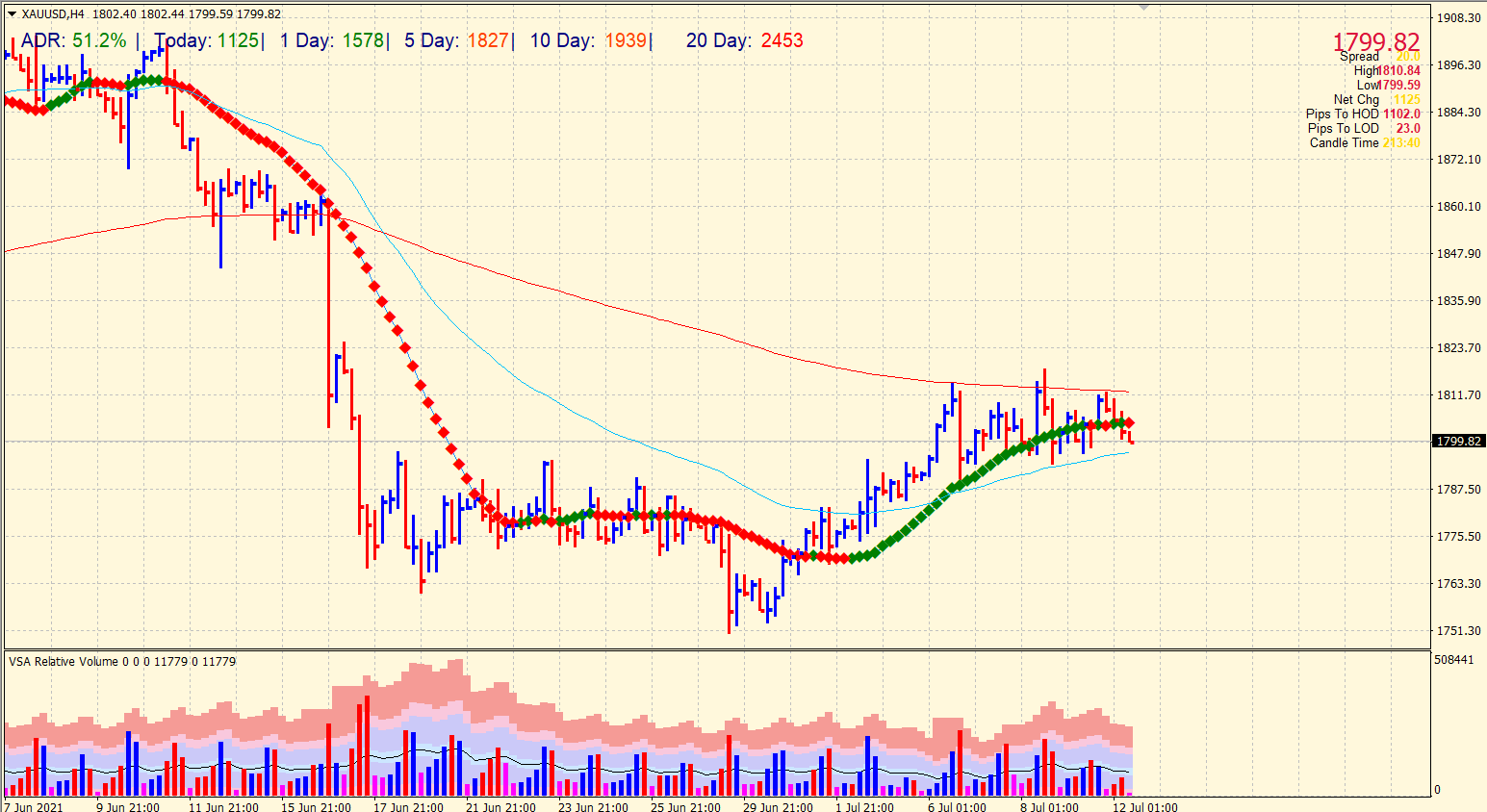

The uptrend in the gold price, which started with a double bottom at $1,677 in April, was stopped at the resistance at $1,920 and followed by an even steeper downward wave. This pushed the price of the precious metal back to the $1,755 mark before recovery began.

This countermovement has so far been slowed down several times at the resistance of $1,815. So far, the medium-term downtrend line has ended the recovery attempts on the part of the buyer.

Gold rebounded above the $1,800 mark and continued the previous day’s rise on Monday but failed to continue its uptrend. The recovery in US Treasuries from lower levels put pressure on the yellow metal.

-Are you looking for the best CFD broker? Check our detailed guide-

A hike in the US 10-year benchmark rate will support US Dollar demand. A higher rating in US Dollars makes gold expensive for owners of other currencies. Meanwhile, due to the highly contagious variant of Delta invested in gold, fears are renewed about rising coronavirus cases.

Gold prices rose due to its safe-haven appeal. Emotions continued to mount as the Fed’s minutes last week showed that significant further progress remains to be made in the economic recovery, but improvement is expected.

-Are you looking for automated trading? Check our detailed guide-

Gold price technical outlook: Key levels to watch

Moving below the interim support at $1,790 should currently lead to an attack on the support at $1,775. Below that, a small sell signal would be active, and another attack to $ 1,755 would result. Thus, a second recovery could begin here.

If, on the other hand, the $1,815 mark can still be exceeded sustainably, the gold price would have the space to climb directly to the next higher barrier at $1,848. However, the downward trend could nevertheless continue there. Therefore, the sell-off would only be neutralized above the mark, and a further increase to $1,920 would be possible in the medium term.

Gold price resistances: 1,815, 1,848, 1,875

Gold price supports: 1,755, 1,720, 1,670

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.