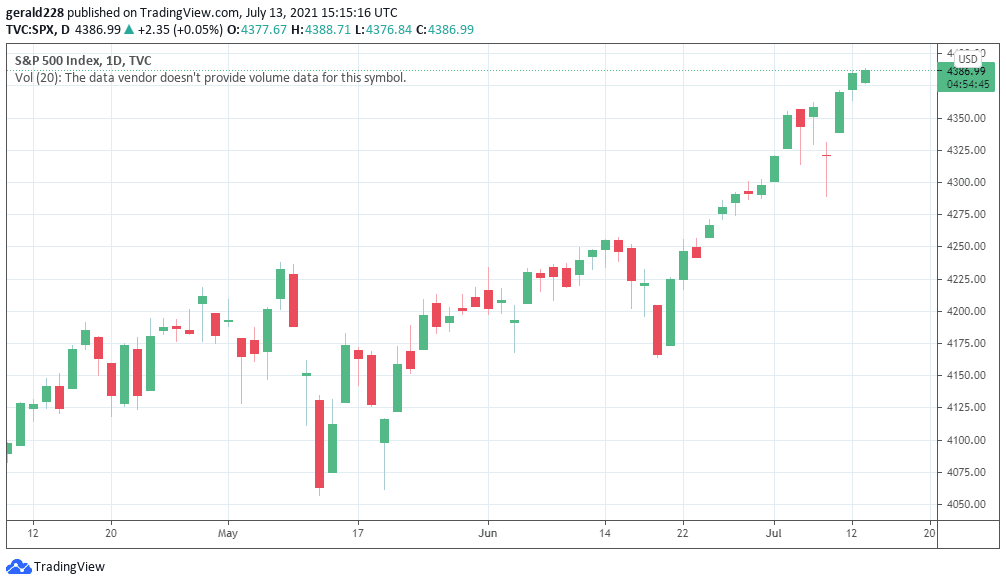

The S&P Index (SPX) continue to reach new highs as investor sentiment remains bullish. Latest figures announcing a rise in inflation will definitely give momentum to the bulls who are now in their element.

After closing at the $4366 level on 10 July, the S&P Index is on an upward trend having reached the $4388 level today. It is more than likely to start a move towards the $4400 mark sooner rather than later. If you’re interested in getting into the forex market have a look at these forex brokers for your trading

Short Term Forecast For S&P Index: Bullish and Positive

Activity over the past week is showing a rethink amongst those involved in the market. The global recovery could once again be held back by the large number of Covid19 cases sprouting everywhere. This could lead to economic activity continuing to be depressed and that will correspondingly have an effect on some share prices.

Central banks seem to be embarking on a policy normalization drive with the Bank of England now releasing dividends for shareholders. There have also been sizeable moves in the bond market but these have left equities relatively untouched.

There have been gains in the broader index which came from growth stocks. These benefit largely from lower yields so they were not affected by the plunge in bond yields. The S&P index is now once again outperforming value stocks for the first time since late February.

The outlook for the S&P index remains extremely bullish and very positive. The next barrier of resistance should be the $4390 level although the inflation results could put a slight damper on that. However there seems to be strength overall and that crucial level should be reached quite soon, possibly this week.

Major Events Affecting The SPX This Week

The most important event will be the US CPI which always remains and important focal point. The headline is expected to go down to 4.9% from 5%. We have also seen survey-based measures on inflation now showing signs that the peak has been reached. This should reinforce the view that the central bank’s assessment that inflation is transitory is a correct one.

However, if the headline CPI register on the downside, bond yields may be expected to renew a pullback. This will underpin growth stocks so this will remain a closely watched figure.

SPX investors will also be on the watch for the Fed Chair, Jerome Powell’s half yearly address. This should focus attention on the next signs as to when the Fed begins tapering asset purchases. Powell is expected to remain cautious with the view that the labour market still has room to grow.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.