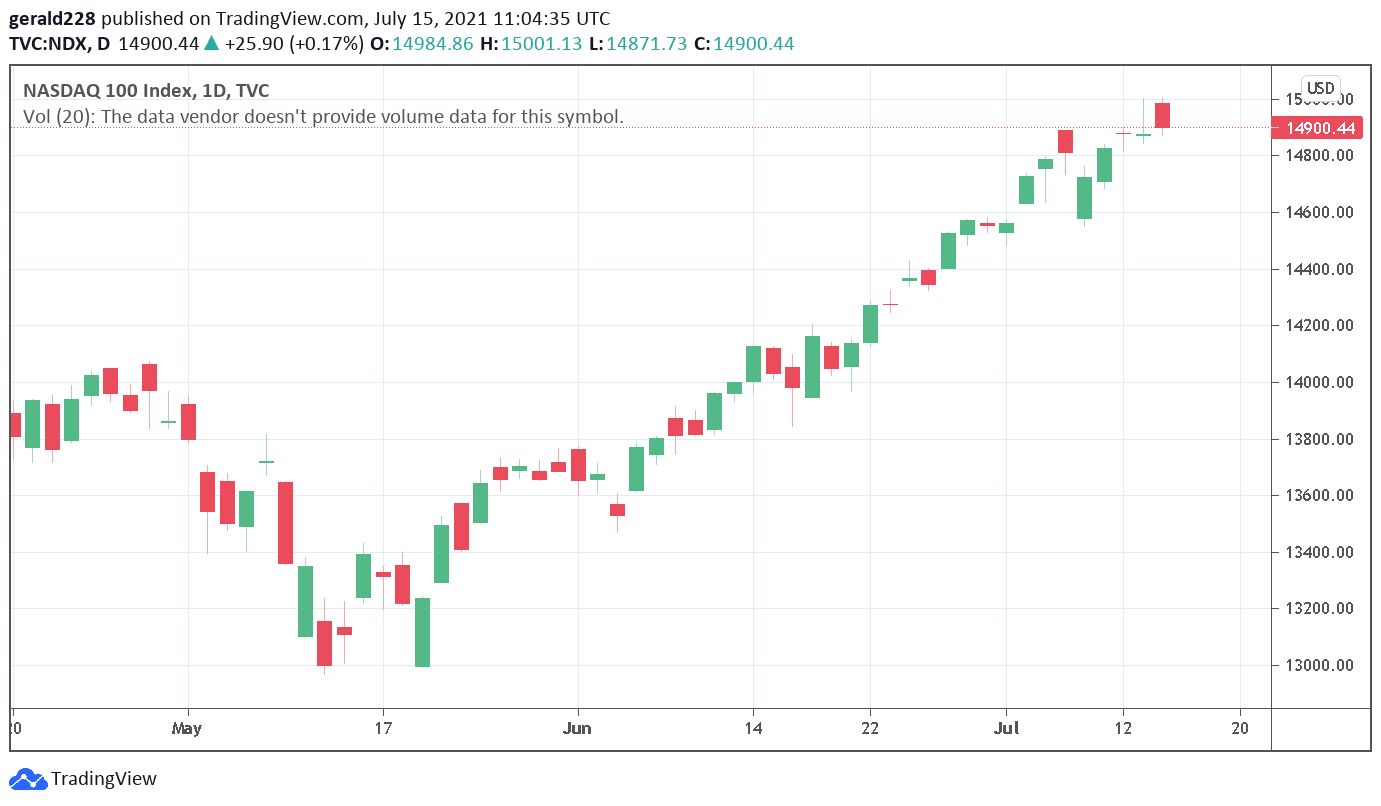

The NASDAQ price continues to reach new highs with the $14920 level attained over the past 24 hours. The NDX is expected to begin an assault on the $15000 price barrier sooner rather than later although the jump in inflation has had investors in jitters. If you want to take the plunge with trading why not take a look at some of the Forex brokers here?

Fed Chairman Jerome Powell’s dovish stance in his recent statement on the US economy has however added grist to the mill of aggressive investors. The NASDAQ has been on a consistent gain since June 4 where it was trading at the $13745 level. It has appreciated by some 9% over the past month or so and is looking to continue making gains.

NASDAQ Price Short Term Focus: No Pain, More Gain?

As the NASDAQ continues charging forward, it seems that very little will stop Big Tech shares from continuing their unassailable growth. It closed yesterday at the $14900 level and rose to the $14977 level overnight only to fall back to the $14900 level. A red candle is currently showing although the retraction is expected to be temporary.

If the $14900 level holds, then we can expect further gains and the $15000 level to be the next port of call for resistance. A bearish thesis would push the price back slightly to the $14800 level but this seems to be unlikely at this stage.

Moving Forward With NDX: What’s Next For Nasdaq?

The Nasdaq price finally managed to supersede the key resistance of $14000 at the end of June. This created further upside potential and a bullish trend that has been going on through the whole of July. The formation of higher highs and lows has continued to confirm this bullish thesis. There should also be major resistance at the $14960 level which in fact has already been met. So the next week will be interesting to observe.

AS one looks ahead, it seems that the upward trajectory for the Nasdaq price will continue. There may also be possible pullbacks in the third quarter if the Fed shifts its monetary policy stance to a more hawkish one. The very strong economic data announced recently, rising inflation and flush liquidity could warrant a scaling back of assistance in relation to the Covid19 pandemic. However, this should not theoretically cause a pullback in equities, so the outlook remains bullish.

With a huge 30% gain over the past 8 months, the Nasdaq price shows no signs of giving up its gains. The 4 and 10-week Simple Moving Averages are also on a higher trendline. Traders must be wary of possible short-term pullbacks as some profit-taking inevitably will happen. Overall, the trend remains bullish.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.