- EUR/USD remains on the backfoot after upbeat US CPI.

- ECB shows flexibility on inflation targets beyond 2%.

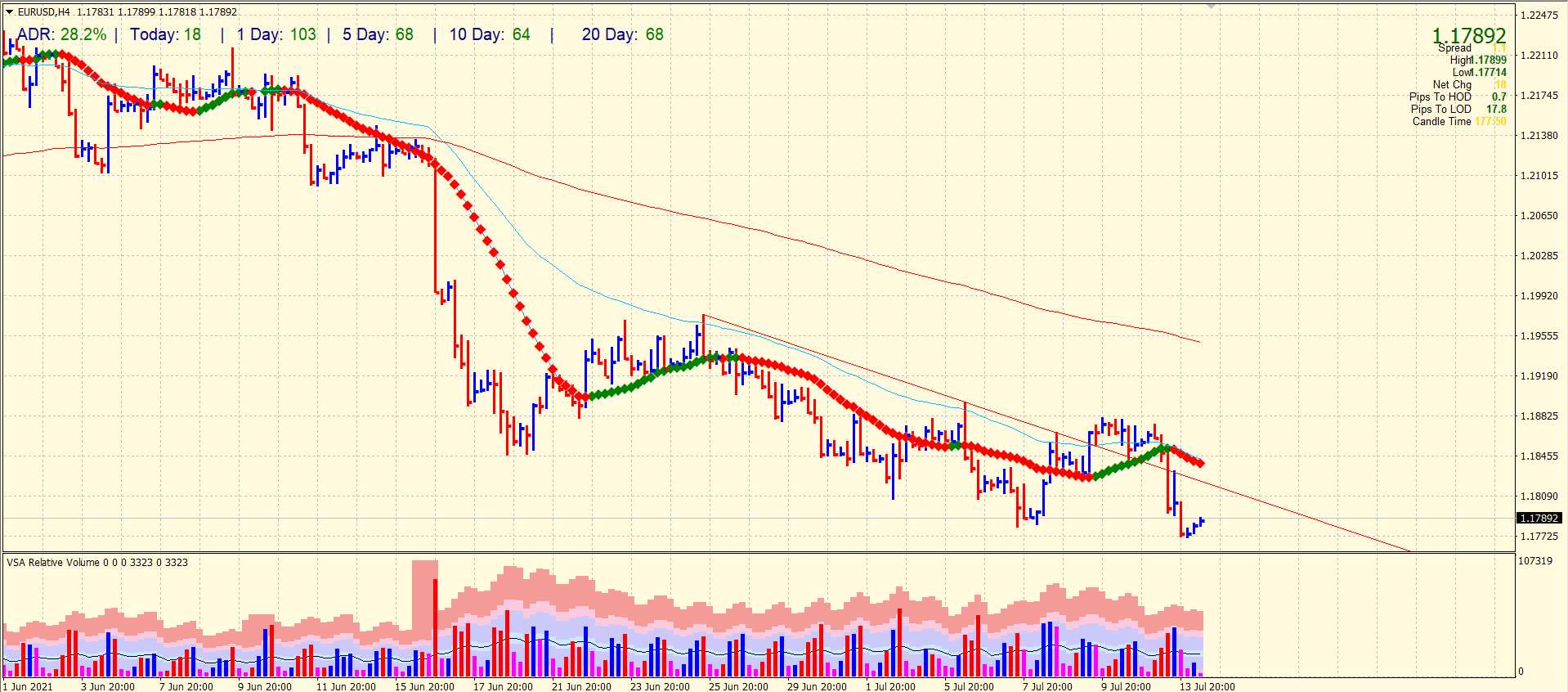

- Technically, the pair remains under the strong dominance of the bears.

The EUR/USD forecast reacted with a sharp decline after the upbeat US inflation data. The report was much better than economists’ forecasts, which further strengthened investor fears about an earlier curtailment of the bond-buying program and higher interest rates in the US. However, after some time, the market very quickly compensated for the entire fall, as traders began to realize that this report is unlikely to seriously affect the Federal Reserve System shortly.

-Are you looking for automated trading? Check our detailed guide-

According to the data, the US CPI rose 0.9% in June this year, while economists had forecast only 0.4% growth. The growth was due to a jump in spending to recover the American economy after the coronavirus pandemic. Over the past year, inflation has risen by 5.4%, which also significantly exceeded the economists’ forecasts, who believed in the growth of 4.9%. The underlying effect continues to grow after inflation started to rise in June last year.

But, of course, there is no denying that with the expansion of price pressures, questions continue to arise about when and to what extent inflation will eventually decline after the surge observed in recent months. If prices decline much worse than the central bank predicts, the committee will most likely be forced to act more aggressively to prevent the long-term inflation rate from going beyond 2.0%.

In the first half of the day, a report on changes in the volume of industrial production in the Eurozone is due to release, which may put additional pressure on the Euro. Therefore, the main task of the EUR/USD buyers will be to protect the support at 1.1773.

Now let’s talk a little about the European Central Bank and what changes are taking place there since the revision of its inflation mandate at the end of last week. First, let me remind you that according to the latest statements by the President of the European Central Bank, Christine Lagarde, the new strategy allows the ECB to be more flexible about the inflation target, which is now 2%. Lagarde noted that 2% is not a ceiling and, most likely, prices will fluctuate around this level, sometimes even exceeding it, which is also allowed.

-If you are interested in forex day trading then have a read of our guide to getting started-

EUR/USD technical forecast: Vulnerable below 1.1808

The 4-hour chart of the EUR/USD is yelling for a sell. The price closed below the 20-period SMA with a widespread bar and ultra-high volume. The next bar was an up bar that closed near the lows with a very high volume. The support at 1.1783 was briefly broken. Collectively, these factors point to a further strong sell-off. Alternatively, any relief rally in the pair may remain capped by the falling trendline at 1.1808. But clearly, breaking above the level may trigger more buying.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.