- Ripple price overcomes major hurdles at the 50, 100 and 200 SMA’s to chart the path towards $1.10.

- SEC v. Ripple case continues as the Regulator seeks access to Ripple’s Slack communication.

- Oversold RSI indicates a trend reversal could take place in the near term.

Ripple price prediction is significantly bullish as its trades 9% higher over the last 24 hours, bringing the 7-day gains to 25%, according to live data by Coinmarketcap. Ripple’s market capitalization currently sits at $41.6 billion. Ripple price attracted a $4.7 billion trading volume over the last 24 hours implying that investors are interested in the cross-border money transfer token even as it battles a case with SEC.

SEC Wants Millions of Ripple’s Slack Communication

The legal battle between the US Securities Exchange Commission (SEC) and Ripple labs continues with the former wanting to be granted access to the latter’s international communications.

James Filan, Ripple’s executive’s attorney said that SEC filed a motion on Monday asking Judge Sarah Netbrun to produce business messages on the Slack platform. Filan Tweeted:

The filing follows SEC’s belief that Ripple’s previous production of Slack messages was incomplete as Ripple may have only collected a small portion of its Slack messages and that a “massive quantity” of Slack data has not been collected or searched. The filing read:

“Ripple’s data error and refusal to produce most documents has already been highly prejudicial to the SEC. Among other things, the SEC has deposed 11 Ripple witnesses using incomplete records of their communications.”

Subsequently, Ripple filed a request to have more time to respond to SEC’s motion.

These events in the SEC v. Ripple case show that the settlement is far from over and investors on crypto

exchanges might have to wait longer for the verdict.

Meanwhile, Ripple price seems to snub all these events as it is on course towards $1.10.

Ripple Price V-shaped Recovery Far From Over

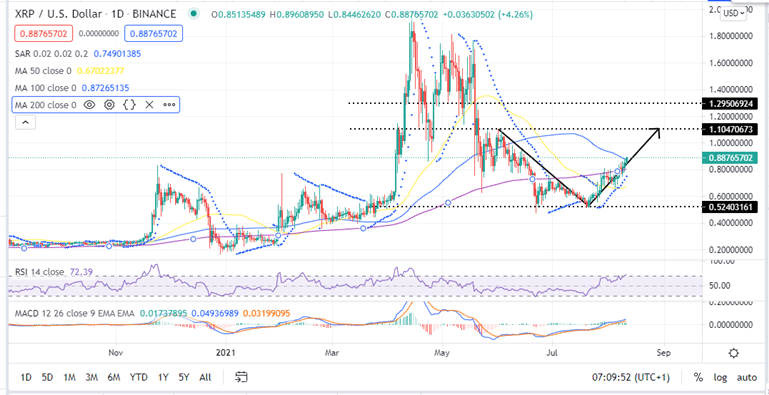

The daily chart illustrates a V-shaped recovery that came into the picture following the June and July sell-offs. A V-shaped recovery occurs when an asset experiences an extended dip but after securing robust support. Amid the oversold conditions, bulls find an opportunity to assert their pressure on the price. A sharp recovery emerges, as illustrated on XRP’s daily chart.

XRP/USD Daily Chart

The V-shaped recovery proceeds until the uptrend’s momentum gets exhausted or massive hurdles are met. Ripple’s rally that begun on July 21 has seen the asset turn major hurdles like the 50-, 100- and 200-day SMAs into support. These are currently providing the Ripple price with robust support that could bolster bulls to continue with the V-shaped recovery towards $1.10.

Realize the position of the Moving Average Convergence Divergence (MACD) above the signal line in the positive region and the entry of the Relative Strength Index into the overbought region validates this bullish narrative.

Looking Over The Fence

On the flipside, the RSI indicates that XRP is oversold at the moment and that the bullish momentum could be overheated in the near term triggering a trend reversal. If this happens, XRP could retreat to the 100-day SMA at the $0.80 support wall.

Looking to buy or trade Ripple now? Invest at eToro!

Capital at risk