- Binance Coin has rallied 97% from July 20 to its current price above $480.

- KYC verification requirements, failed $100-million fund drive among other news underpin bearish Binance coin price over the weekend.

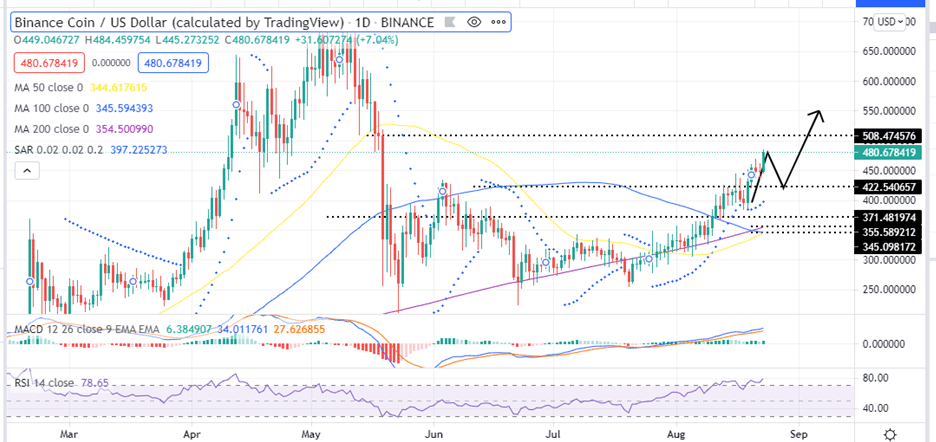

- BNB needs to remain above the $480 mark to increase the odds of getting to the range high about $550.

Binance Coin price is currently bullish as bulls focus on 0vercoing the crucial resistance level at $480. A breakout above this barrier will propel it to another significant level and might trigger a new uptrend. Here we answer the question on how to buy BNB as it remains bullish above $480.

Binance Cubject’s Users To KYC Verification

In an attempt to remedy the many problems with regulators across the globe, Binance has announced that all its users will be subjected to new Know Your Customer (KYC) requirements.

In a statement published on their website on Friday August 20, the largest crypto exchange indicated that they were making the improvements “light of evolving global compliance standards”, to improve user protections and provide a safer trading environment.

“Effective immediately, all new users are required to complete Intermediate Verification to access Binance products and service offerings, including cryptocurrency deposits, trades and withdrawals,” the statement read.

Following the announcement, the daily withdrawal limit for unverified Binance users dropped to 0.06 Bitcoin (BTC) from the previous limit of 2 BTC.

Following these news, BNB traded in the red over the weekend.

Binance Operating Illegally, says Dutch Centrals Bank

Two days prior to the KYC requirements announcement, the Dutch Central Bank had issued a warning to investors claiming that Binance operations in the country are illegal. In an August 18 statement, De Nederlandsche Bank claimed the crypto exchange was not operating in compliance with the Anti-Money Laundering and Anti-Terrorist Financing laws of the country.

Following these news, BNB continued the bearish leg that had been started on August 17 before turning bullish on August 19.

Failed $100-million fund underpinned weekend Binance Coin Price

Another reason why the BNB price traded in the red over the weekend was the news on investors backing out of Binance’s $100-million funding round. The investors are said to have backed out anxieties regarding ongoing investigations from U.S. authorities that are purportedly investigating Binance over money laundering and tax issues

This is said to have prompted Binance US CEO Brian Brooks to step down after serving as its executive for just three months.

Binance Coin price targets range high at $637

Binance Coin price has rallied roughly 90% since July 21 and swept the June 3 swing high at $433. If the buying pressure continues to build up, Binance Coin price will shatter $508 resistance and attempt to retest the range high at $637.

A clear breakout above this resistance zone will indicate a bullish outlook and the presence of buyers. This development will likely set the stage for a leg-up that will retest the $550 psychological level representing a 14% rise from the current price at $480.

- Read this guide if you want to know the best cryptocurrency to buy.

Crypto market participants should note that BNB might pull back towards the $422 or $371 support levels before the climb to $550.

BNB/USD Daily Chart

This bullish narrative is accentuated by the upward movement of the Relative Strength Index (RSI) in the overbought region, currently at 80, showing that buyers are in control of the cryptocurrency.

In addition, the upward movement of the Moving Average Convergence Divergence indicator (MACD) above the signal line in the positive region accentuates this bullish outlook. Also it is important to note that the MACD has just sent a bullish signal on the four-hour chart. This happened when the 12-day exponential moving average (EMA) (blue line) crossed above the 26-day EMA (orange line) indicating that the bulls are currently in control of BNB.

Furthermore, BNB is about to turn massively bullish after in near-term. This will happen when the 50 SMA moves above the 100 SMA as seen on the daily chart. If this happens BNB could surge massively towards areas beyond $550.

Note that things could go awry for the Binance coin price if it fails to slice through to remain above the $480 psychological level. If this happens, it would be an indication that there is a weakness among the buyers and sellers may take control of the market.

Such a development would potentially trigger a crash to towards the 100-day simple moving average (SMA) at $371 or where 50- and 200-day SMAs coincide at $355.

This bearish thesis is validated by the parabolic SAR which remains negative since August 19. Also realise that the RSI shows that the Binance coin is massively overbought. This could mean that bullish momentum could be overheated in near term signaling a reversal to a bearish momentum.

How to buy BNB?

If you wish to buy cryptocurrencies including Binance Coin, you can do so on such exchanges such as eToro , and Binance.

Looking to buy or trade Binance Coin now? Invest at eToro!

Capital at risk