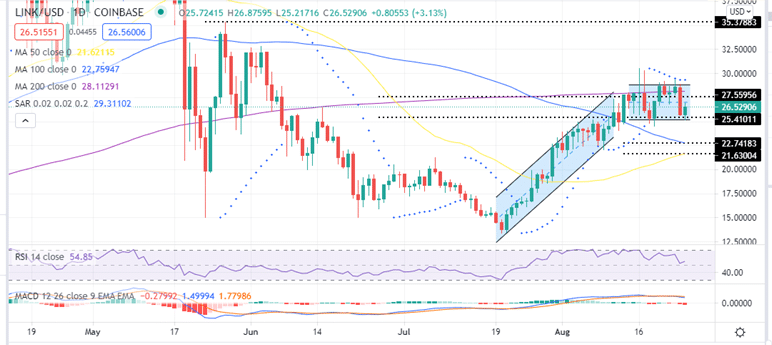

- Chainlink price must breakout above the upper tip of a ascending parallel channel to confirm a bullish breakout.

- LINK needs to flip 200 SMA into support to re-start the bullish leg.

- MACD and RSI technical indicators confirm Chainlink’s bullish narrative.

Crypto traders remain bullish as some altcoins continue to perform better than bigwigs like BTC and Ethereum over the past week. For altcoins like Chainlink which has displayed a sluggish price action over the last 12 days will need support from the wider market including the direction the Bitcoin price will take in the short term.

At the moment, the LINK/USD price appears to consolidating under $29 after recording less than 1% gains over the last 24 hours as it flipped the 200-day Simple Moving Average (SMA) from support resistance.

Chainlink Price Forms a Rectangle Pattern in a Horizontal Price Action

Since August 14, LINK has been trading sideways between the $25.18 and $28.81 price range. After falling below the $14 psychological level on July 20, recovery began that saw bulls regain control of the market flipping the 50, 100 and 200 Simple Moving Averages (SMA)s from resistance to support. This represents a 127% rally to the August 16 high around $30.50.

At the time of writing Chainlink teeters around $26.52 and appears to have formed a rectangle pattern on the daily chart. Note that the rectangle pattern does not have defined bullish or bearish breakout, but breaking above the upper boundary of the rectangle around $28.81 will predict a bullish move for LINK.

LINK seems to be battling immediate resistance around the $27.55 level. For a bullish move to be confirmed, LINK price must close the session above this level and go above the 200-day SMA at $28.07. This coincides with the upper tip of the ascending channel.

LINK/USD Four-Hour Chart

The $28.07 Mark Crucial For a Bullish Breakout

Note that a breakout above the $28.07 mark embraced by the 200-day SMA is crucial to Chainlink restarting the bullish leg. If this happens, Chainlink price will break above the upper boundary of the rectangle at $28.81. A decisive breakout will be achieved if LINK goes above the Aug 16 high at $30.30 to bring the May 27 range high at $35.37 into play.

The Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) indicators validate the bullish narrative. The MACD’s position above the zero line in the positive region and the upward movement of the RSI away from the oversold zone are all bullish crypto signals.

On the flipside, if LINK closes the day below the immediate resistance at $25.41 could see the bulls retreat to re-test the $22.74 and $21.63 support levels embraced by the 100 and 50 SMAs respectively.

Where To Buy LINK Now?

The top exchanges for trading in LTC currently are: eToro, FTX, Binance and Coinbase. You can find others listed on our crypto exchanges page.

Looking to buy or trade LINK now? Invest at eToro!

Capital at risk