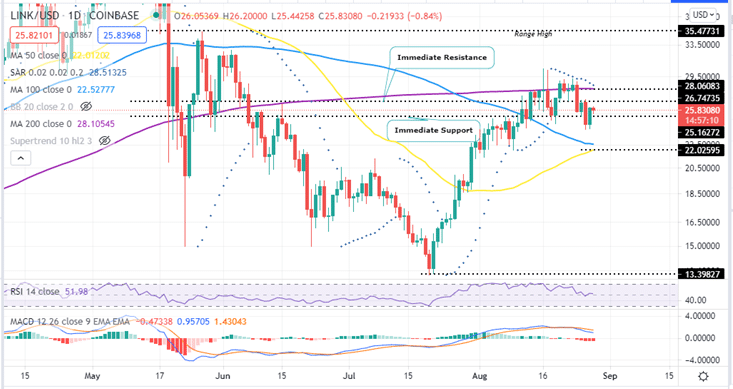

- Chainlink price lost the 200-day simple moving average (SMA) support to drop 15% August 22 and August 27.

- Breaking above the current immediate resistance at $26.74 will bolster the DeFi coin bulls to record higher highs.

- Chainlink’s continued partnerships with companies in the DApps and DeFi industry is expected to increase investors’ appetite in the long-term.

After rallying approximately 118% from a low of $13.31 on July 20 to close the week at $28.24 on Sunday August 22, the Chainlink price action was uneventful during the week with a mix of bullish and bearish sessions. Any recovery attempts were met by heavy resistance from the 200-day Simple Moving Average currently at $28.06. The LINK price tanked below the 200-day SMA on Tuesday August 24 and has remained so.

Chainlink Price, The Week That Was

LINK/USD price dropped by approximately 15% from Sunday August 22 price at $28.24 to Thursday’s intraweek low at $23.92. The previous week, Chainlink price was marked by indecision opening by a doji stick on Monday August 16 and closing the week by a doji stick on Sunday August 22 with a doji stick as well. The LINK price rose by less than 1% during that week. Chainlink closed Sunday August 22 at $28.24 as the bulls focused on overcoming the $200-day SMA.

Chainlink price started the week trading in green amidst market indecision characterised by continued sideways market movement. The asset recorded an intraweek high of $29.28 on Monday. Rejection from the $28.70 major resistance level saw LINK tank below the 200-day SMA at $28.06, as things turned bearish on Tuesday.

LINK has been trading in alternating bearish and bullish sessions between Monday and Friday while recording lower highs and lower lows finding support at the $24.40 support wall. This bolstered bulls who strived to push the Chainlink price from an intraweek low of $23.92 on Thursday to close the day around $26.74.

Friday’s bullish session saw the Chainlink price overcome the stubborn resistance at $25.50 psychological level to close the day at $26.06. At the time of writing, LINK is hovering at $25.83.

- Are you seeking to buy crypto? Read our guide on the best cryptocurrency to buy to get started.

During this week LINK lost 15% and flipped the 200-day SMA from support to resistance. This has been the week’s downside.

LINK/USD Daily Chart

LINK Price, The Week Ahead

Chainlink price forecast for the week ahead remains bearish as it has been struggling to maintain its bullish momentum.

Note if LINK closes the week on Sunday above immediate resistance at $26.74, the assetl could jump above the 200-day SMA at $28.06 after which a push to the May 27 range high around $35.47 would be the next logical move. This would represent almost a 37% gain from the current price.

Note that closing the week below the immediate support at $25.16, LINK price would slip below the $25 mark and revisit the 100-and 50-day SMAs at $22.25 and $22.0 respectively.

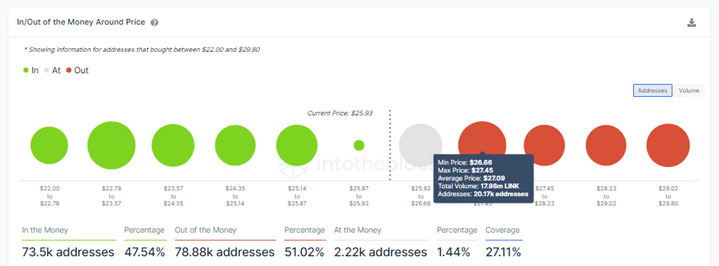

On-chain metrics from IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model reveals that LINK faces immense resistance upwards. The immediate resistance zone around the $26.74 zone is within the $26.60 and $27.45 investor cluster where around 17.98 million LINK were previously bought by about 20,170 addresses. These investors might want to break even curtailing any efforts to push Chainlink higher.

LINK IOMAP Chart

On the upside, a slip below the immediate support at $25.87, LINK will meet formidable support as shown by the IOMAP chart.

Can Chainlink Price Turn Bullish?

A part from the positive parabolic SAR and the upward movement of the RSI on the four-hour chart, the the position of the MACD above the zero line on the daily chart shows that Chainlink long-term price prediction appears bullish.

In addition, positive fundamentals are expected to bolster LINK in the long-term. For example, on August 18, Chainlink price feeds went live on the Fantom Opera mainnet, a scalable platform hosting Decentralised Finance applications (DeFi apps) and enterprise software. Cryptocurrency valued at approximately $380 million has been staked in Fantom. This new integration enables Chainlink developers to access real-time price data on cryptocurrencies and perform tasks such as settling futures and options contracts.

In addition, partnerships with such international companies is expected to push the LINK price even higher. For example, Swisscom, a Switzerland-based telecommunications company, is partnering with Chainlink on a pilot program that was started on August 05. 51% of the firm is government owned and has more than 6 million subscribers and 19,000 employees.

Another partnership is with the Bancor, an Ethereum-based decentralized exchange (DEX) and liquidity provider. In an announcement made on August 10, Bancor intends to integrate Chainlink Keepers to work as external triggers for smart contracts. This utility is expected to simplify the staking experience for liquidity providers and automates advanced trading features.

Chainlink is an oracle token designed for integrating real-world API into smart contracts execution. The recent partnerships are an illustration of how Chainlink’s oracle solutions are critical backbone to the DApps industry.

Where To Buy LINK?

If you wish to buy cryptocurrencies including Chainlink, exchanges such as eToro , Binance, Coinbase, Bittrex and Kraken are good places to visit.

Looking to buy or trade Chainlink now? Invest at eToro!

Capital at risk